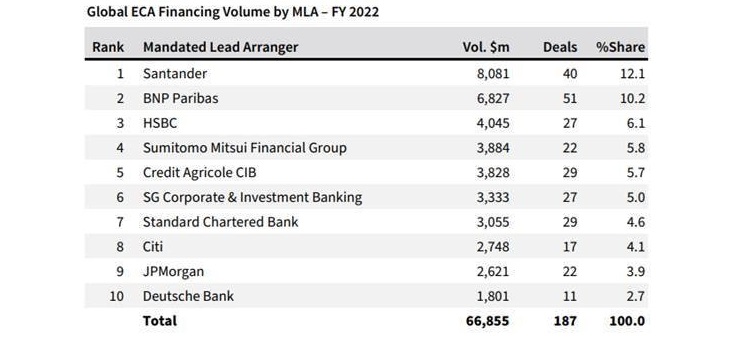

Santander, world leader in export finance in 2022

The Group topped the ranking with 40 transactions amounting to $8.081 billion, giving it an international market share of 12.1%.

The Bank's global capabilities, combined with local knowledge of all the sectors and markets where its clients operate, has enabled Santander to get ahead of the competition in a year marked by a significant increase in the volume of transactions.

Madrid, 25 January 2023.

Santander Corporate & Investment Banking (Santander CIB) ended 2022 as the global leader in export finance, with transactions amounting to $8.081 billion (€7.445 billion at current exchange rates), and a market share of 12.1%. Over the last financial year, Santander participated in 40 international transactions offering financing, through Export Credit Agencies (ECA) to support the international activity of medium-sized businesses and large multinationals.

Santander CIB has a strong relationship with all ECAs worldwide, which, as well as its in-depth knowledge of the markets and industries where its clients operate, has enabled the bank to top the list published by Dealogic, one of the most widely used tools for analysing the performance, trends, activity and market share of financial institutions in this market.

The macroeconomic and geopolitical context last year favoured greater market dynamism in regions such as the Middle East, Africa and Asia where Santander, together with its global customer base, was able to lead the market at regional level, in addition to its global leadership position.

José Luis Calderón, global head of Global Transaction Banking (GTB) at Santander CIB, said: ‘We are extremely happy to see Santander playing such a key role in this industry. We have been relentlessly investing in the business for the last two decades, getting closer to our clients, connecting sponsors, exporters, importers, ECAs and investors worldwide and innovating with the development of new products and structures with the main ECAs. We have been able to connect EMEA, the Americas and APAC to maximize our capacity to deliver the financial solutions our clients expect, not only for the big multinational companies but for mid-size enterprises as well.”

Credit insurance from ECAs and other multilateral institutions is one of the main public financial support instruments for company internationalisation, helping companies to obtain financing on competitive terms with specialised products tailored to their needs and mitigating the risks associated with cross-border activity. Last year saw strong activity from European agencies such as Euler Hermes (Germany) and UKEF (UK), as well as Asian agencies with Kexim (South Korea) playing a prominent role.

In recent years, Santander CIB has been developing its Export & Agency Finance (EAF) business focusing on import and export customers. As such, it has designed innovative products hand in hand with ECAs, with a combination of global and local origin and structuring capabilities which are the basis of the franchise's success.

Guillermo Hombravella, global head of Export & Agency Finance, said: "Obtaining results like this and leading global rankings in the export finance business is made possible thanks to our relationship with our customers, our ability to understand their needs and the profound knowledge of ECAs and their products that the team has on a global level."