Shareholder remuneration

Charged to the results for the second half of 2025, the Board of Directors has approved:

- The implementation of a share buy-back programme for an approximate amount of €5,030 million, for which the Bank has already obtained the necessary regulatory authorization and is currently underway. In line with the Bank’s current shareholder remuneration policy, €1,830 million corresponds to an amount equivalent to approximately 25% of the Group’s net attributable profit (excluding non-cash, non-capital ratios impact items) for the second half of 2025. The remainder of the programme relates to an extraordinary share buy-back of €3,200 million, representing approximately 50% of the CET1 capital generated following the completion of the sale of 49% of Santander Bank Polska to Erste Group. You can find all the information about the share buyback program here.

- Submit to the 2026 Annual Shareholders’ Meeting, in application of the Bank’s shareholder remuneration policy, the approval of the payment against 2025 results of a final gross cash dividend of €12.50 cents per share entitled to receive dividends. Subject to the approval of the 2026 Annual Shareholders’ Meeting, the dividend would be payable from 5 May 2026. Thus, the last day to trade shares with a right to receive the dividend would be 29 April, the ex-dividend date would be 30 April and the record date would be 4 May.

Charged to the results for the first half of 2025, the Group carried out the following:

- A payment of an interim cash dividend of €11.50 cents per share, paid in November 2025, equivalent to c.25% of the Group’s net attributable profit in H1 2025 (excluding non-cash, non-capital ratios impact items), 15% higher than its 2024 equivalent.

- The first share buyback programme of €1.7 billion, carried out between 31 July 2025 and 23 December 2025.

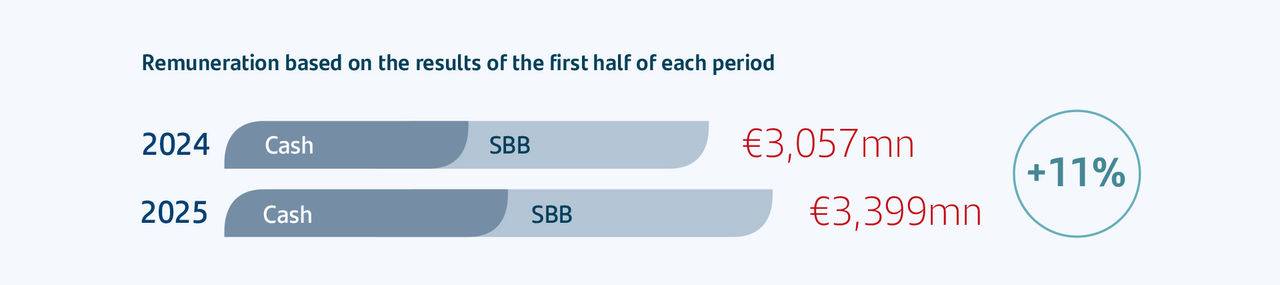

Total shareholder remuneration charged against H1 2025 results was €3,399 million, 11% higher than the remuneration charged against H1 2024 results. The amount is approximately 50% of H1 2025 net attributable profit (around 25% through cash dividend payments and around 25% through share buybacks).

Further information on shareholder remuneration can be found in the following sections of this website:

- Dividends

- Share buybacks and why they’re important to shareholders

- Prices of latest reinvestments (PDF 160 Kb) (Only available in Spanish)

- The most recent and historical dividend payments are shown in the table below.

| Date | 03-11-2025 |

|---|---|

| Gross | 0.1150 |

| Net | 0.0932 |

| Class | Ordinary |

| Type | Interim |

| Exercise | 2025 |

| Dividend Yield | 2.57% |

| Ex-dividend Date | 30-10-2025 |

| Date | 03-11-2025 |

|---|---|

| Gross | 0.1150 |

| Net | 0.0932 |

| Class | Ordinary |

| Type | Interim |

| Exercise | 2025 |

| Dividend Yield | 2.57% |

| Ex-dividend Date | 30-10-2025 |