Please wait

Price

Santander's shares are listed on five markets: on four exchanges in Spain, in the US (as an ADR), in the UK (as a CDI), in Mexico (Sistema Internacional de Cotizaciones) and in Poland.

Check the different SAN share prices in the various markets. The share prices shown have a 15 minute delay.

Shareholder remuneration

Charged to the results for the second half of 2025, the Board of Directors has approved:

- The implementation of a share buy-back programme for an approximate amount of €5,030 million, for which the Bank has already obtained the necessary regulatory authorization and is currently underway. In line with the Bank’s current shareholder remuneration policy, €1,830 million corresponds to an amount equivalent to approximately 25% of the Group’s net attributable profit (excluding non-cash, non-capital ratios impact items) for the second half of 2025. The remainder of the programme relates to an extraordinary share buy-back of €3,200 million, representing approximately 50% of the CET1 capital generated following the completion of the sale of 49% of Santander Bank Polska to Erste Group. You can find all the information about the share buyback program here.

- Submit to the 2026 Annual Shareholders’ Meeting, in application of the Bank’s shareholder remuneration policy, the approval of the payment against 2025 results of a final gross cash dividend of €12.50 cents per share entitled to receive dividends. Subject to the approval of the 2026 Annual Shareholders’ Meeting, the dividend would be payable from 5 May 2026. Thus, the last day to trade shares with a right to receive the dividend would be 29 April, the ex-dividend date would be 30 April and the record date would be 4 May.

Charged to the results for the first half of 2025, the Group carried out the following:

- A payment of an interim cash dividend of €11.50 cents per share, paid in November 2025, equivalent to c.25% of the Group’s net attributable profit in H1 2025 (excluding non-cash, non-capital ratios impact items), 15% higher than its 2024 equivalent.

- The first share buyback programme of €1.7 billion, carried out between 31 July 2025 and 23 December 2025.

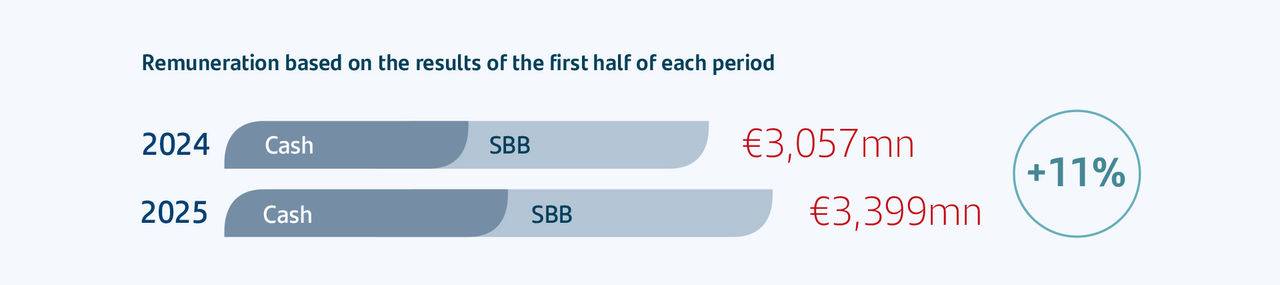

Total shareholder remuneration charged against H1 2025 results was €3,399 million, 11% higher than the remuneration charged against H1 2024 results. The amount is approximately 50% of H1 2025 net attributable profit (around 25% through cash dividend payments and around 25% through share buybacks).

Further information on shareholder remuneration can be found in the following sections of this website:

- Dividends

- Share buybacks and why they’re important to shareholders

- Prices of latest reinvestments (PDF 160 Kb) (Only available in Spanish)

- The most recent and historical dividend payments are shown in the table below.

| Date | 03-11-2025 |

|---|---|

| Gross | 0.1150 |

| Net | 0.0932 |

| Class | Ordinary |

| Type | Interim |

| Exercise | 2025 |

| Dividend Yield | 2.57% |

| Ex-dividend Date | 30-10-2025 |

| Date | 03-11-2025 |

|---|---|

| Gross | 0.1150 |

| Net | 0.0932 |

| Class | Ordinary |

| Type | Interim |

| Exercise | 2025 |

| Dividend Yield | 2.57% |

| Ex-dividend Date | 30-10-2025 |

No results found

Presence in indexes

Here are the most relevant indexes:

| Name | Weight to 31/12/2025 | Geographic Area | Index type |

|---|---|---|---|

| Ibex 35 | 17.02% | Spain | General |

| EURO STOXX Banks | 13.55% | Europe | Financial |

| STOXX Europe 600 Banks | 8.44% | Europe | Financial |

Coverage

| December 2025 | |

| Recommendation | |

| % BUY | 69% |

| % HOLD | 24% |

| % SELL | 7% |

| Source | Bloomberg |

| Date | 31/12/2025 |

| Target price | |

| Average target price | 9.81 € |

| Source | Bloomberg |

| Date | 31/12/2025 |

| * Note: 12 month target price based on updates provided by Analysts within the last 3 months. |

| December 2025 | ||

| Organization | Recommendation | Target price |

| Alantra Equities | Buy | 10.30 |

| AlphaValue/Baader Europe | Sell | 7.27 |

| Autonomous Research | Buy | 10.70 |

| Banco Sabadell | Buy | 10.15 |

| Barclays | Buy | 10.10 |

| Bestinver Securities | Buy | 9.18 |

| BNP Paribas | Buy | 10.70 |

| CaixaBank BPI | Buy | 10.40 |

| Citi | Buy | 10.00 |

| Deutsche Bank | Buy | 9.80 |

| DZ Bank AG Research | Hold | 10.00 |

| Goldman Sachs | Buy | 11.10 |

| GVC Gaesco Valores (ESN) | Buy | 9.10 |

| Intesa Sanpaolo | Buy | 9.70 |

| Jefferies | Buy | 7.10 |

| JP Morgan | Hold | 9.10 |

| Keefe Bruyette & Woods | Buy | 10.79 |

| Kepler Cheuvreux | Hold | 8.81 |

| Landesbank Baden-Wuerttemberg | Buy | 11.00 |

| Mediobanca | Buy | 10.60 |

| Morgan Stanley | Buy | 11.00 |

| Morningstar | Sell | 7.18 |

| Oddo BHF | Buy | 9.90 |

| RBC Capital | Hold | 8.50 |

| Renta 4 SAB | Hold | 9.70 |

| UBS | Buy | 10.55 |

Analysts consensus

Capital transactions

Listed below are the increases/reductions in capital which Banco Santander has developed over the periods described.

BORME announcement of capital reduction December/2025 (PDF 188 kb) (Only available in Spanish)

BORME announcement of capital reduction June/2025 (PDF 189 kb) (Only available in Spanish)

| Date | 23/12/2025 |

|---|---|

| Shares | 14,689,319,502 |

| Nominal | 0.50 |

| Share Capital | 7,344,659,751 |

| Currency | EURO |

| Type | Capital reduction by cancellation of treasury stock |

| Characteristics | Capital reduction by the cancellation of 196,005,870 own shares under the share repurchase program |

| Date | 02/06/2025 |

|---|---|

| Shares | 14,885,325,372 |

| Nominal | 0.50 |

| Share Capital | 7,442,662,686 |

| Currency | EURO |

| Type | Capital reduction by cancellation of treasury stock |

| Characteristics | Capital reduction by the cancellation of 267,166,950 own shares under the share repurchase program |

BORME announcement of capital reduction December/2024 (PDF 189 kb) (Only available in Spanish)

BORME announcement of capital reduction June/2024 (PDF 136 kb) (Only available in Spanish)

BORME announcement of capital reduction February/2024 (PDF 137 kb) (Only available in Spanish)

| Date | 17/12/2024 |

|---|---|

| Shares | 15,152,492,322 |

| Nominal | 0.50 |

| Share Capital | 7,576,246,161 |

| Currency | EURO |

| Type | Capital reduction by cancellation of treasury stock |

| Characteristics | Capital reduction by the cancellation of 341,781,250 own shares under the share repurchase program |

| Date | 25/06/2024 |

|---|---|

| Shares | 15,494,273,572 |

| Nominal | 0.5 |

| Share Capital | 7,747,136,786 |

| Currency | EURO |

| Type | Capital reduction by cancellation of treasury stock |

| Characteristics | Capital reduction by the cancellation of 331,305,000 own shares under the share repurchase program |

| Date | 30/01/2024 |

|---|---|

| Shares | 15,825,578,572 |

| Nominal | 0.50 |

| Share Capital | 7,912,789,286 |

| Currency | EURO |

| Type | Capital reduction by cancellation of treasury stock |

| Characteristics | Capital reduction by the cancellation of 358,567,487 own shares under the share repurchase program |

BORME announcement of capital reduction June/2023 (PDF 140 kb) (Only available in Spanish)

BORME announcement of capital reduction March/2023 (PDF 137 kb) (Only available in Spanish)

| Date | 27/06/2023 |

|---|---|

| Shares | 16,184,146,059 |

| Nominal | 0.50 |

| Share Capital | 8,092,073,029.50 |

| Currency | EURO |

| Type | Capital reduction by cancellation of treasury stock |

| Characteristics | Capital reduction by the cancellation of 269,848,953 own shares under the share repurchase program |

| Date | 15/03/2023 |

|---|---|

| Shares | 16,453,995,012 |

| Nominal | 0.50 |

| Share Capital | 8,226,997,506 |

| Currency | EURO |

| Type | Capital reduction by cancellation of treasury stock |

| Characteristics | Capital reduction by the cancellation of 340,406,572 own shares under the share repurchase program |

BORME announcement of capital reduction June/2022 (PDF 136 kb) (Only available in Spanish)

BORME announcement of capital reduction April/2022 (PDF 135 kb) (Only available in Spanish)

| Date | 28/06/2022 |

|---|---|

| Shares | 16,794,401,584 |

| Nominal | 0.50 |

| Share Capital | 8,397,200,792.00 |

| Currency | EURO |

| Type | Capital reduction by cancellation of treasury stock |

| Characteristics | Capital reduction by the cancellation of 286,309,445 own shares under the share repurchase program |

| Date | 30/03/2022 |

|---|---|

| Shares | 17,080,711,029 |

| Nominal | 0.50 |

| Share Capital | 8,540,355,514.50 |

| Currency | EURO |

| Type | Capital reduction by cancellation of treasury stock |

| Characteristics | Capital reduction by the cancellation of 259,930,273 own shares under the share repurchase program |

| Date | 10/12/2020 |

| Shares | 17,340,641,302 |

| Nominal | 0,5 |

| Share Capital | 8,670,320,651 |

| Currency | EURO |

| Type | Capital increase against reserves |

| Characteristics | 722,526,720 shares issued as part of the capital increase |

| Date | 12/09/2019 |

|---|---|

| Shares | 16,618,114,582 |

| Nominal | 0,5 |

| Share Capital | 8,309,057,291 |

| Currency | EURO |

| Type | Capital increase |

| Characteristics | 381,540,640 shares issued as part of the offer to buy Banco Santander (Mexico) shares. |

| Date | 14/11/2018 |

|---|---|

| Shares | 16,236,573,942 |

| Nominal | 0,5 |

| Share Capital | 8,118,286,971 |

| Currency | EURO |

| Type | Capital increase |

| Characteristics | Issue of 100,420,360 shares under the framework of the Santander Scrip Dividend programme. |

| Date | 14/11/2017 |

|---|---|

| Shares | 16,236,573,942 |

| Nominal | 0.50 |

| Share Capital | 8,118,286,971 |

| Currency | EURO |

| Type | Capital increase |

| Characteristics | Issue of 100,420,360 shares under the framework of the Santander Scrip Dividend programme. |

| Date | 31/07/2017 |

|---|---|

| Shares | 16,040,573.446 |

| Nominal | 0.50 |

| Share Capital | 8,020,286.723.0 |

| Currency | EURO |

| Type | Capital increase |

| Characteristics | Issuance of 1,458.,232,745 new shares. |

| Date | 07/11/2016 |

|---|---|

| Shares | 14,582,340,701 |

| Nominal | 0,5 |

| Share Capital | 7,291,170,350.50 |

| Currency | EURO |

| Type | Capital increase |

| Characteristics | Issue of 147,848,122 shares under the framework of the Santander Scrip Dividend programme. |

| Date | 05/11/2015 |

|---|---|

| Shares | 14,434,492,579 |

| Nominal | 0.50 |

| Share Capital | 7,217,246,289.50 |

| Currency | EURO |

| Type | Capital increase |

| Characteristics | Issue of 117,859,774 shares under the framework of the Santander Scrip Dividend programme. |

| Date | 07/05/2015 |

|---|---|

| Shares | 14,316,632,805 |

| Nominal | 0.50 |

| Share Capital | 7,158,316,402.50 |

| Currency | EURO |

| Type | Capital increase |

| Characteristics | Issue of 256,046,919 shares under the framework of the Santander Scrip Dividend programme. |

| Date | 05/02/2015 |

|---|---|

| Shares | 14,060,585,886 |

| Nominal | 0.50 |

| Share Capital | 7,030,292,943.00 |

| Currency | EURO |

| Type | Capital increase |

| Characteristics | Issue of 262,578,993 shares under the framework of the Santander Scrip Dividend programme. |

| Date | 12/01/2015 |

|---|---|

| Shares | 13,798,006,893 |

| Nominal | 0.50 |

| Share Capital | 6,899,003,446.50 |

| Currency | EURO |

| Type | Capital increase |

| Characteristics | Issuance of 1.213.592.234 new shares. |

| Date | 06/11/2014 |

|---|---|

| Shares | 12,584,414,659 |

| Nominal | 0.50 |

| Share Capital | 6,292,207,329.50 |

| Currency | EURO |

| Type | Capital increase |

| Characteristics | Issue of 225,386,463 shares under the framework of the Santander Scrip Dividend programme. |

| Date | 05/11/2014 |

|---|---|

| Shares | 12,359,028,196 |

| Nominal | 0.50 |

| Share Capital | 6,179,514,098 |

| Currency | EURO |

| Type | Capital increase |

| Characteristics | 370,937,066 shares issued as part of the offer to buy Banco Santander (Brazil) shares. |

| Date | 31/07/2014 |

|---|---|

| Shares | 11,988,091,130 |

| Nominal | 0.50 |

| Share Capital | 5,994,045,565 |

| Currency | EURO |

| Type | Capital increase |

| Characteristics | Issue of 210,010,506 shares under the framework of the Santander Scrip Dividend programme. |

| Date | 30/04/2014 |

|---|---|

| Shares | 11,778,080,624 |

| Nominal | 0.50 |

| Share Capital | 5,889,040,312 |

| Currency | EURO |

| Type | Capital increase |

| Characteristics | Issue of 217,013,477 shares under the framework of the Santander Scrip Dividend programme. |

| Date | 31/01/2014 |

|---|---|

| Shares | 11,561,067,147 |

| Nominal | 0.50 |

| Share Capital | 5,780,533,573.50 |

| Currency | EURO |

| Type | Capital increase |

| Characteristics | Issue of 227,646,659 shares under the framework of the Santander Scrip Dividend programme. |

| Date | 04/11/2013 |

|---|---|

| Shares | 11,333,420,488 |

| Nominal | 0.50 |

| Share Capital | 5,666,710,244.00 |

| Currency | EURO |

| Type | Capital increase |

| Characteristics | Issue of 241,310,515 shares under the framework of the Santander Scrip Dividend programme. |

| Date | 01/08/2013 |

|---|---|

| Shares | 11,092,109,973 |

| Nominal | 0.50 |

| Share Capital | 5,546,054,986.50 |

| Currency | EURO |

| Type | Capital increase |

| Characteristics | Issue of 282,509,392 shares under the framework of the Santander Scrip Dividend programme. |

| Date | 02/05/2013 |

|---|---|

| Shares | 10,809,600,581 |

| Nominal | 0.50 |

| Share Capital | 5,404,800,290.50 |

| Currency | EURO |

| Type | Capital increase |

| Characteristics | Issue of 270,917,436 shares under the framework of the Santander Scrip Dividend programme. |

| Date | 31/01/2013 |

|---|---|

| Shares | 10,538,683,145 |

| Nominal | 0.50 |

| Share Capital | 5,269,341,572.50 |

| Currency | EURO |

| Type | Capital increase |

| Characteristics | Issue of 217,503,395 shares under the framework of the Santander Scrip Dividend programme. |

| Date | 05/11/2012 |

|---|---|

| Shares | 10,321,179,750 |

| Nominal | 0.50 |

| Share Capital | 5,160,589,875 |

| Currency | EURO |

| Type | Capital increase |

| Characteristics | Issue of 222,107,497 shares under the framework of the Santander Scrip Dividend programme. |

| Date | 09/10/2012 |

|---|---|

| Shares | 10,099,072,253 |

| Nominal | 0.50 |

| Share Capital | 5,049,536,126.50 |

| Currency | EURO |

| Type | Capital increase |

| Characteristics | Issue of 200,311,513 new shares to cover the redemption of Santander Securities. |

| Date | 07/09/2012 |

|---|---|

| Shares | 9,898,760,740 |

| Nominal | 0.50 |

| Share Capital | 4,949,380,370 |

| Currency | EURO |

| Type | Capital increase |

| Characteristics | Issue of 14,333,873 new shares to cover the redemption of Santander Securities. |

| Date | 08/08/2012 |

|---|---|

| Shares | 9,884,426,867 |

| Nominal | 0.50 |

| Share Capital | 4,942,213,343.50 |

| Currency | EURO |

| Type | Capital increase |

| Characteristics | Issue of 37,833,193 new shares to cover the redemption of Santander Securities. |

| Date | 01/08/2012 |

|---|---|

| Shares | 9,846,593,674 |

| Nominal | 0.50 |

| Share Capital | 4,923,296,837 |

| Currency | EURO |

| Type | Capital increase |

| Characteristics | Issue of 218,391,102 shares under the framework of the Santander Scrip Dividend programme. |

| Date | 06/07/2012 |

|---|---|

| Shares | 9,628,202,572 |

| Nominal | 0.50 |

| Share Capital | 4,814,101,286 |

| Currency | EURO |

| Type | Capital increase |

| Characteristics | Issue of 193,095,393 new shares to cover the redemption of Santander Securities. |

| Date | 08/06/2012 |

|---|---|

| Shares | 9,435,107,179 |

| Nominal | 0.50 |

| Share Capital | 4,717,553,589.50 |

| Currency | EURO |

| Type | Capital increase |

| Characteristics | Issue of 73,927,779 new shares to settle the conversion of 195.923 bonds (Compulsory Convertible Bonds 2007 Issue I). |

| Date | 03/05/2012 |

|---|---|

| Shares | 9,361,179,400 |

| Nominal | 0.50 |

| Share Capital | 4,680,589,700 |

| Currency | EURO |

| Type | Capital increase |

| Characteristics | Issuance of 284,326,000 shares under the Santander Scrip Dividend programme. |

Share capital distribution

As communicated by “other relevant information” registered with the Spanish National Securities Market Commission (Comisión Nacional del Mercado de Valores) on 23 December 2025 with registration number 38297, the board executive committee, in accordance with the delegations granted by the ordinary general shareholders’ meeting and the board of directors, has resolved on the Bank’s share capital reduction through a cancellation of own shares acquired in the share buy-back programme, the beginning and termination of which Banco Santander properly notified to the market through the notice of inside information published on 30 July 2025 with registration number 2844 and the aforementioned notice of other relevant information published on 23 December 2025 with registration number 38297, respectively.

Banco Santander’s share capital has been reduced by EUR 98,002,935 through the cancellation of 196,005,870 own shares. Consequently, the resulting Bank’s share capital has been set at EUR 7,344,659,751, represented by 14,689,319,502 shares with a nominal value of EUR 0.50 each, all of them of the same class and series.

The public deed recording the corporate resolutions on the capital reduction and the consequent amendment of Article 5 of the Bank’s By-laws has been registered in the Commercial Registry of Santander, on 30 December 2025. On January 5, took place the delisting of the 196,005,870 cancelled shares from the Spanish and foreign stock exchanges or stock markets on which the Bank’s shares are listed, and the cancellation of the book-entry records of the cancelled shares before the competent bodies will both be requested.

| 31 December 2025 | ||

| Shares | Capital stock % | |

| Board | 196,051,396 | 1.33% |

| Institutional | 9,476,867,931 | 64.52% |

| Retail | 5,016,400,175 | 34.15% |

| Total | 14,689,319,502 | 100.00% |

| 31 December 2025 | |

| Geographical area | Capital stock (%) |

| Europe | 70.38% |

| America | 28.29% |

| Rest | 1.33% |

| 31 December 2025 | |||

| Share holdings | Shareholders | Shares | Share capital % |

| 1 - 200 | 2,130,344 | 227,705,079 | 1.55% |

| 201 - 1.000 | 720,907 | 415,695,364 | 2.83% |

| 1.001 - 3.000 | 384,387 | 620,117,840 | 4.22% |

| 3.001 - 30.000 | 260,275 | 2,082,575,034 | 14.18% |

| 30.001 - 400.000 | 22,156 | 1,380,987,733 | 9.40% |

| More than 400.000 | 660 | 9,962,238,452 | 67.82% |

| Total | 3,518,729 | 14,689,319,502 | 100.00% |