Santander Consumer Finance launches ‘Simplifi’, a platform aimed at promoting financial education in Spain

'Simplifi’ brings together various learning and information tools aimed at facilitating financial decision-making and better control of financial resources.

With this fully digital initiative aimed at customers and others, Santander Consumer Finance shows its commitment to Banco Santander’s responsible banking strategy on financial inclusion.

The Group’s aim is to financially empower 10 million people between 2019 and 2025 and it has already achieved 60% of this target.

Madrid, 22 October 2021 – PRESS RELEASE

Santander Consumer Finance, Banco Santander’s specialised consumer finance unit with a presence in 16 European countries, Canada and China, has created ‘Simplifi’, an initiative that was conceived with the aim of contributing to the promotion of financial education in Spain and which will reinforce Banco Santander’s digital leadership and its firm commitment to the financial empowerment of people.

Simplifi is a free, fully digital platform that brings together various tools with the aim of simplifying people’s financial lives. This initiative, aimed at Santander Consumer Finance customers and others, will help people to improve control of their financial resources and make better-informed financial decisions in the current context of change and increasing digitalisation.

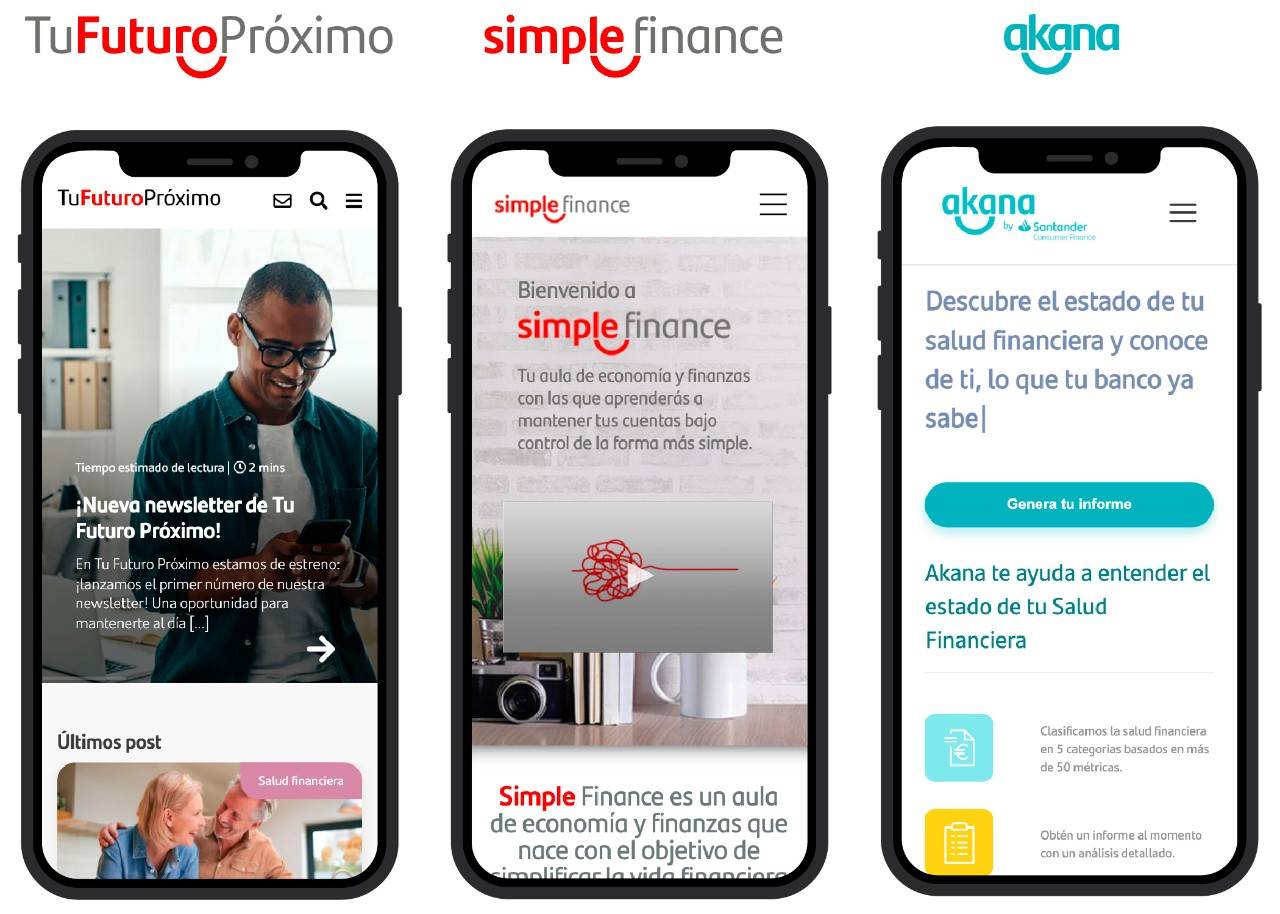

Simplifi includes various online tools, such as Akana, Tu Futuro Próximo, and now also Simple Finance, which offer users free courses on personal finance and tips on savings and responsible consumption.

- Akana is a service that makes it easy to quickly know the situation of your accounts using objective data extracted from the movements thanks to the European Payment Services Directive (PSD2). After analysing more than 50 parameters, the result is presented to the user in a simple, highly visual way, providing a personalised analysis that can be understood at a glance. It also includes numerous metrics and tips related to the user’s financial situation so that they can apply them in their daily lives.

- Simple Finance is a virtual economy and finance classroom offering free courses on essential topics of personal finance, which help people to learn concepts that are useful to keep their finances under control, know what they do with their money and avoid making financial commitments they cannot afford. The courses are highly educational, with explanatory videos and downloadable materials, which teach each subject simply and accessibly.

- TuFuturoPróximo is a blog that uses a simple, accessible language to keep users up to date with the latest financial developments. It includes content and tips on trends, financial health, savings and responsible consumption. Readers are invited to subscribe to a monthly newsletter containing the best articles on trends.

The creation of ‘Simplifi’ aligns Santander Consumer Finance’s commitment with the Group’s responsible banking strategy on financial inclusion. It joins other initiatives promoted by the bank in Spain such as the ‘Finance for Mortals’ programme, the Spanish Banking Association’s ‘Your Finance, Your Future’ initiative, and the ‘Financial Education in the Schools of Catalonia’ programme (EFEC). The goal of Banco Santander – recently recognised by Euromoney magazine as the best bank in the world in financial inclusion – is to financially empower 10 million people between 2019 and 2025 in all the countries in which it operates, and to date it has already achieved 60% of this target.

Santander Consumer Finance (SCF) is a leading consumer finance bank with a presence in 16 European countries, Canada and China. A team of more than 14,700 offers the best products and services to 18 million customers and 130,000 associated points of sale. SCF has a wide range of financial and banking solutions that it offers through points of sale (automotive dealers and retail outlets) and direct consumer channels (branches, telephone platforms and the internet). It is part of Santander, one of the most important financial groups in the world.

#Financial Education

Through financial education, we provide people with the skills they need to manage their finances