Santander Results 2021

Banco Santander reports attributable profit of €8,124 million for 2021

+65% constant euros

+7% constant euros

+65% constant euros

+7% constant euros

Banco Santander achieved an attributable profit of €8,124 million in 2021, which compares to an attributable loss of €8,771 billion in 2020, when the bank made a non-cash adjustment to the valuation of goodwill and deferred tax assets (DTAs). The 2021 attributable profit is 25% higher in current euros than in 2019, before covid. Excluding net charges of €530 million for restructuring costs already announced in Q1 2021, underlying profit for 2021 was €8,654 million, up 78% versus the previous year. In the fourth quarter alone, the bank achieved an attributable and underlying profit of €2,275 million, up 5% versus the previous quarter and the highest underlying profit in a single quarter in the last 12 years.

The bank’s strong performance was driven by an activity rebound, with loans and deposits growing 4% and 6% respectively, which led to a solid growth in net interest income and net fee income. There was also an improvement in credit quality, which enabled a normalisation of the level of loan-loss provisions, down 37%. That was partly due to a release of overlay provisions due to the pandemic of c.€750 million, reflecting a general improvement in the economies in which Santander operates and the positive performance of portfolios. Across the group, businesses continued to focus on supporting customers, driving revenue growth, effective net interest income management and cost control.

Don't miss these key takeways

• The group earned €46.4 billion in total revenue in 2021, up 7% year-on-year in constant euros, driven by strong growth in customers (+5 million) and activity across the group’s regions and businesses.

• Net operating income increased by 9% year-on-year in constant euros to €25.0 billion, as both lending (+4%) and deposits (+6%) grew strongly.

• Underlying profit in Europe and North America was more than double that of same period last year, increasing by 110% and 109% respectively in constant euros, while in South America underlying profit increased by 24%.

• The strong growth in digital adoption (76% of all transactions in core banks were through digital channels in 2021 versus 55% in 2019) helped drive improvements in efficiency and customer satisfaction, with the group’s cost-to-income ratio among the best of its peer group at 46.2%, and eight of the group’s markets achieving a top-three net promoter score (NPS).

• The bank’s fintech subsidiaries showed significant growth, with Openbank reaching 1.7 million customers across five markets (+80% year-on-year growth outside Spain), doubling the number of granted mortgages and achieving the highest NPS in Spain. PagoNxt increased revenues by 47% in constant euros in 2021 and expects to grow revenues by 50% in 2022.

• Provisions were down 37% in constant euros as the group released c.€750 million of the overlay provisions made in 2020. The cost of credit improved further to 0.77% compared to 1.28% in 2020.

• These results led to an underlying return on tangible equity (RoTE) of 12.7%, above cost of capital, and a tangible net asset value (TNAV) per share of €4.12, up €0.33 in the year.

• The group's fully-loaded CET1 capital was 12.12%. The bank aims to maintain a fully-loaded CET1 of around 12% going forward.

• In September, the bank announced an interim distribution from 2021 earnings of c.€1.7 billion, split between a cash dividend of €4.85 cents per share and a €841 million share buyback. This interim distribution is now complete and a final shareholder remuneration from 2021 earnings will be announced in the coming weeks.

• In 2022, the bank is targeting mid-single digit growth in revenues, a cost-to-income ratio of around 45%, a RoTE above 13% and a payout ratio of 40% of underlying profit.

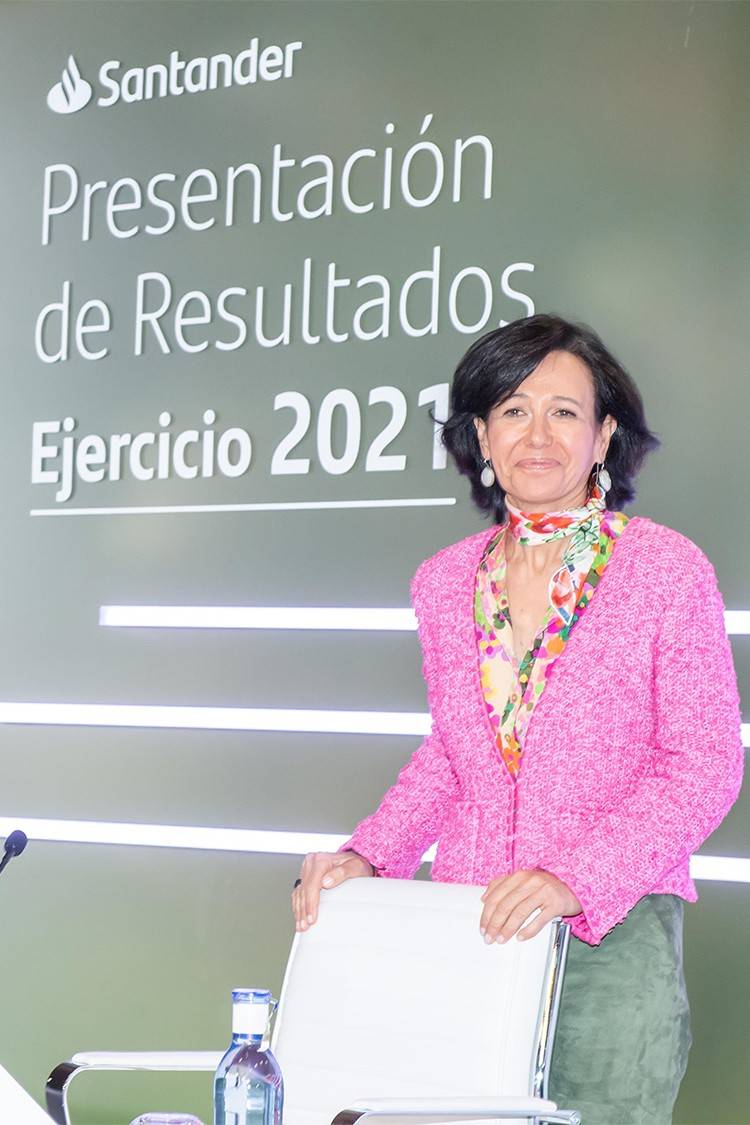

Media Gallery: Financial Results

View and download high-resolution photos from the financial results here.