SANTANDER 2023 EARNINGS

Santander reports attributable profit of €11,076 million for 2023, meets all 2023 targets

LAST UPDATE: 31/01/2024 - 15:54

FY´23 Attributable Profit (+15%)

EPS

FY´23 Revenue (+11%)

RoTE (+169pb)

FL CET1 (+0,2pp)

FY´23 Attributable Profit (+15%)

EPS

FY´23 Revenue (+11%)

RoTE (+169pb)

FL CET1 (+0,2pp)

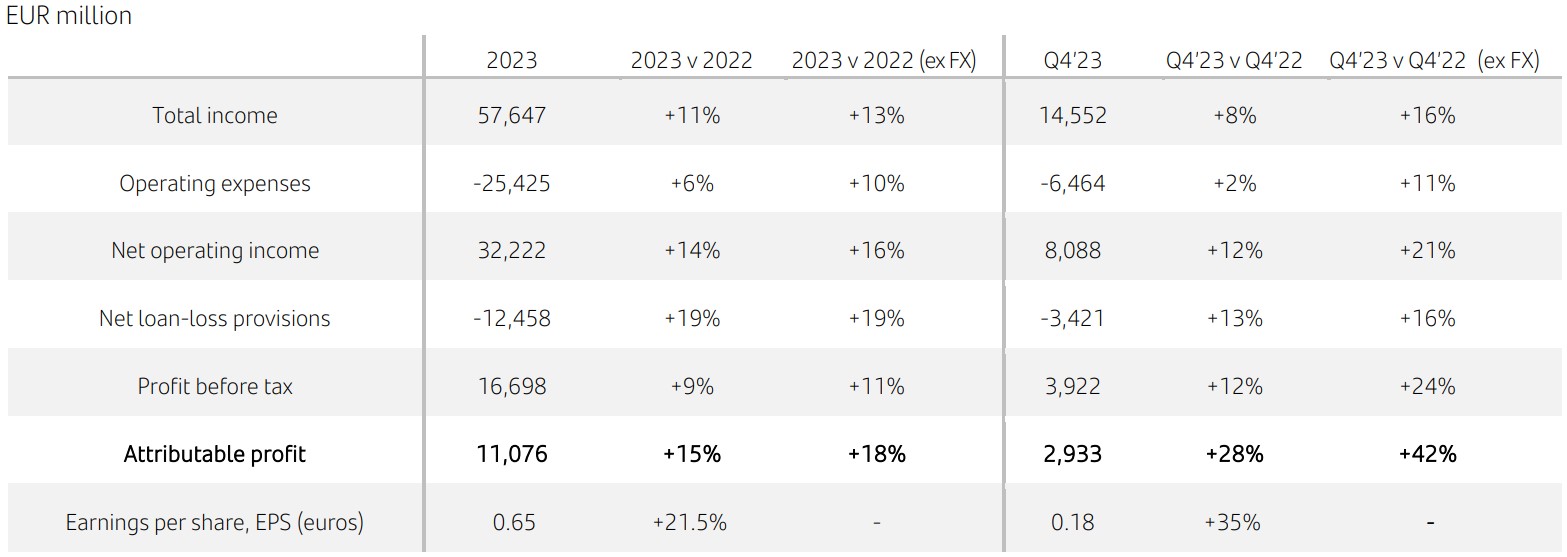

Santander achieved an attributable profit of €11,076 million in 2023, up 15% in current euros versus 2022, as strong growth in revenues, particularly in Europe, growth in customers and good cost control more than offset the expected year-on-year growth in provisions. In the fourth quarter, attributable profit increased 42% (+28% in current euros) versus the fourth quarter of 2022 to €2,933 million.

Don't miss these key takeways

• Earnings per share: up 21.5% year-on-year

• TNAV plus cash dividend per share: up 15% year-on-year

• Return on tangible equity (RoTE): 15.1%

• Fully-loaded CET1: 12.3% after cash dividend and share buyback accruals [1]

• Net interest income increased 16%, reflecting growth in customer activity in 2023, with positive contributions from all regions [2] , notably Europe.

• Net fee income increased 5%, with good performance in the Americas, CIB and Payments[3] .

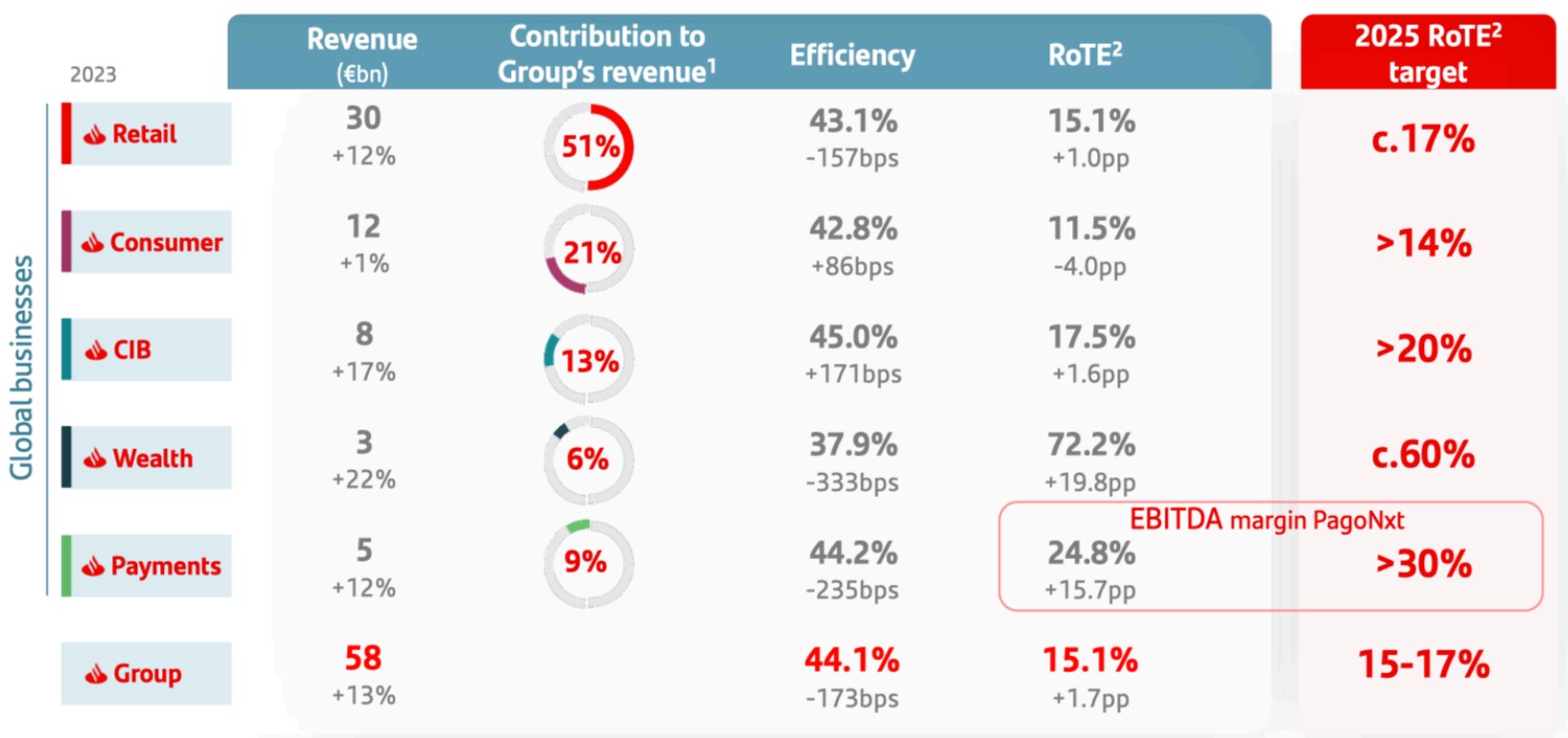

• Revenue up 13% supported by income growth in all regions and particularly strong growth in Wealth (+22%) and CIB (+17%).

• Efficiency ratio improved to 44.1% driven by our transformation towards a simpler, more digital and integrated model.

• Loan-loss provisions rose 19%, as expected and in a context of higher interest rate environment and inflation, due to the ongoing normalization in the US and Mexico, as well as additional provisions for Swiss franc mortgages in Poland.

• Overall credit quality remained robust, with cost of risk in line with the target for the year at 1.18%.

• In the fourth quarter, attributable profit was €2,933 million, up 42% (+28% in current euros).

• The bank paid in November an interim cash dividend of 8.10 euro cents per share (+39% vs 2022) and has completed a share buyback against 2023 earnings [1]. Santander has repurchased approximately 9% of its shares since 2021.

• The targets for 2024 are mid-single digit revenue growth; an efficiency ratio below 43%; cost of risk of c.1.2%; RoTE of 16%; and fully-loaded CET1 above 12%.

[1] The bank’s shareholder remuneration policy is approximately 50% payout of the group net attributable profit (excluding the impacts that do not affect cash or capital ratios directly), split in approximately equal parts in cash dividends and share buybacks. Implementation of this policy is subject to future corporate and regulatory decisions and approvals.

[2] To allow a like-for-like comparison of underlying business performance, all variations are year-on-year and in constant euros (i.e., excluding currency movements) unless otherwise stated.

[3] New global business definitions as published on 20 December 2023 at CNMV and here.

Note: Reconciliation of underlying results to statutory results, available in the Alternative Performance Measures section (page 74) of the financial report at CNMV and here.

Santander increased profitability and shareholder value, with a return on tangible equity (RoTE) of 15.1% (+1.7 percentage points); earnings per share (EPS) of €0.65, up 21.5%, and tangible net asset value (TNAV) per share of €4.76 at year end. Including the cash dividend paid in May against 2022 earnings and the interim dividend against 2023 earnings paid in November, value creation (TNAV plus cash dividend per share) increased 15%. In 2023, the value created for shareholders is equivalent to €10.25 billion.

Santander met all its 2023 targets: revenues grew 13% (achieving the bank’s double-digit growth target), the efficiency ratio improved to 44.1% (versus a target of 44-45%); cost of risk was 1.18% (versus a target of lower than 1.2%); RoTE was 15.1% (versus a target of over 15%), and the fully-loaded CET1 capital ratio was 12.3% (versus a target of higher than 12%). For 2024, Santander is targeting mid-single digit revenue growth ; an efficiency ratio below 43%; cost of risk of c.1.2%; RoTE of 16%; and fully-loaded CET1 above 12%.

Underlying income statement*

(*) Reconciliation of underlying results to statutory results, available in the Alternative Performance Measures section (page 74) of the financial report at CNMV and here. Summary of statutory figures on page 6 of this press release.

The group’s geographic and business diversification continues to support consistent, profitable growth. Strong growth in Europe in 2023 more than offset the increase in provisions in North and South America. The global businesses1 had a solid year, demonstrating the value of the group’s global and cross border network. Revenue growth was particularly strong in Wealth Management & Insurance (+22%) and Corporate & Investment Banking (+17%).

In December 2023, Santander published adapted financial disclosures for the past two years to reflect the new operating model announced in September, under which the bank’s five global businesses will become the new primary reporting segments beginning in January 2024. Under the model, the bank’s activities are consolidated from this year into Retail & Commercial Banking (consolidating all the bank’s retail and business banking globally); Digital Consumer Bank (consumer finance activity worldwide); Payments (PagoNxt and Cards), and the existing global businesses of Corporate & Investment Banking (CIB) and Wealth Management & Insurance.

1 New global business definitions as published on 20 December 2023, available at CNMV and here.

The bank announced 2025 RoTE targets for the global businesses:

Note: YoY change in constant euros. New global business definitions as published on 20 December 2023. (1) As % of total operating units. (2) Global businesses’ RoTEs are adjusted based on Group’s deployed capital.

We are focused on delivering in the near-term while driving sustainable earnings growth for the future, and I am confident that 2024 will be even better for Santander, with strong momentum across our global businesses, despite heightened geopolitical risks and a slowing global economy. Our progress in executing our strategy, combined with the strength and diversification in our model, will allow us to continue to grow whilst further improving profitability, targeting a RoTE of 16% for 2024.

Ana Botín, Banco Santander executive chair