How housing can rebuild Spain

Ignacio de la Torre

Chief Economist at Arcano Partners

A Latin proverb says that prosperity shows the fortunate, adversity the great. In an environment in which the Spanish economy will suffer in 2020 the second largest contraction in the last two hundred years (only surpassed by the year in which the civil war began) it is time to constructively analyze adversity to come up with great ideas that help us to transform our adversity into new prosperity.

In my opinion, a fundamental axis on which to propose reconstruction measures is the reactivation of the housing market. As the tourism sector will face a severe crisis in 2020 that will translate into an increase of unemployment, it is essential to activate another highly labour intensive sector that can take over while the tourism situation returns to normal, a process that will be slow. Housing seems the most obvious candidate.

A fundamental axis on which to propose reconstruction measures is the reactivation of the housing market. As the tourism sector will face a severe crisis in 2020 that will translate into an increase of unemployment, it is essential to activate another highly labour intensive sector.

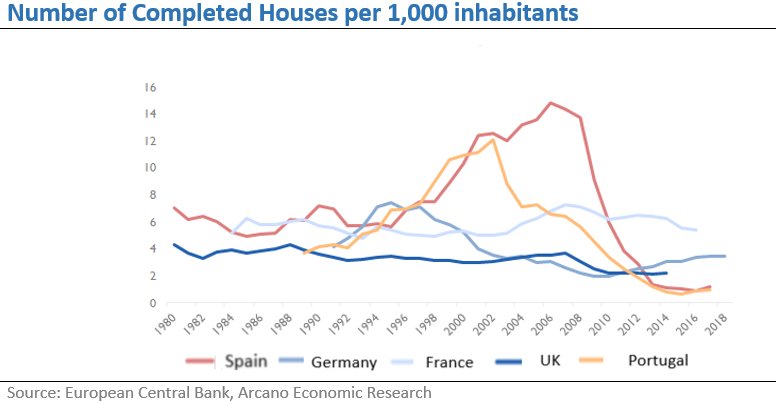

Spain has built an average of 220,000 houses a year during the last twenty years. The year 2006 was exceptional, when more than 600,000 houses were completed. And given that we are a country of excesses, the “new built housing properties” market fell dramatically - 94% - between that year and 2012, as a real estate crisis resonated in the financial sector and, therefore, in the economy in general. Despite the fact that the Spanish economy has been growing for six years since 2013, the number of completed houses in 2019 was barely half of the historical average, not covering household formation demand -135,000 new households- nor the replacement demand (tear-downs to build new homes; if we assume that a house is "replaced" every 100 years and Spain has 20 million houses, this normalized demand could reach 200,000 units).

In other words, the sector is far from being in a normal situation when measured against its history or for comparable countries (figure 1).

On the other hand, Spain has one of the oldest housing stocks in Europe, which translates into enormous energy inefficiency. Regarding prices, all the metrics show that house prices in Spain are not in bubble territory. Therefore, we have scope to promote the sector to return to normal (225,000 houses per year), which would translate into intense growth in employment (about half a million new jobs).

We have scope to promote the sector to return to normal (225,000 houses per year), which would translate into intense growth in employment (about half a million new jobs).

How can it be achieved?

First, by promoting the demand for affordable housing through a “help to buy” program, in which the buyer, who can afford mortgage monthly instalments but does not have enough savings to buy (on average 20% of appraised value), could be eligible to obtain a mortgage for the 95% of the appraised value (instead of the usual 80%). This would be thanks to a government guaranteed loan for up to a 15% of appraised value. The guarantee would not count towards government deficit and it would generate great housing development and therefore jobs that would contribute to reducing the public deficit.

Promoting the demand for affordable housing through a “help to buy” program, in which the buyer, who can afford mortgage monthly instalments but does not have enough savings to buy (on average 20% of appraised value), could be eligible to obtain a mortgage.

Second, by deferring the payment of taxes on the purchase of affordable housing, so that they are paid over a number of years, which facilitates access to housing. In addition, to boost demand, affected by the covid confidence crisis, one could study implementing super-reduced value-added tax on housing purchases during the country's reconstruction (2020-2021).

Third, promoting the new-build housing for the rental market by optimizing taxation (inefficient in its current form) to achieve attractive returns, encouraging investments to increase the supply of new rental housing.

Fourth, reforming the administrative procedures to reduce the build-and-deliver period in Spain from three years to two, the case in almost all European countries. This would make housing cheaper, facilitating access for those who cannot afford it today.

Fifth, removing spanners from the wheels of the sector with supply policies. Spain is the second largest country in Western Europe and has a low population density, making it absurd that there is a shortage of land to develop housing. Politicians must understand that facilitating access to housing is not from the Left or the Right in politics, it begins by facilitating the supply of land, and ends by speeding up the tortuous procedures that are still required today, which increase housing prices by about €13,000 per unit.

Sixth, fostering a national housing rehabilitation plan that allows homeowners to renovate their homes to improve their energy efficiency. An original way to finance these works would be a state-backed asset securitization fund, which would be issued in the capital markets, and using the funds raised to finance the works, so that the owners make monthly payments to the fund.

In June 2020, we will have left behind the biggest contraction in our GDP in our recent history, and we will see the first green shoots of recovery. It is time to strengthen the recovery, depending on whether the measures are better or worse designed, we will face a more or less intense recovery.

The employment intensity of the developer/construction sector is such that fiscal multipliers become much more intense, so they have a special impact on GDP.

In my opinion, the measures proposed in this article would help add fuel to the recovery. First, because the employment intensity of the developer/construction sector is such that fiscal multipliers become much more intense, so they have a special impact on GDP. Second, because most of these measures hardly cost money for the State: the guarantee does not increase deficit, the improvements in the supply side by speeding up procedures does not cost money either, and although the payment of some tax could be delayed, we shouldn’t forget that the day of our life when we pay the most taxes is precisely when we buy a house, so the administration can do good business with these measures. Third, because intensifying the recovery will help in reducing income inequality (the main factor that explains the different levels of inequality is the unemployment rate). Fourth, because if we facilitate access to housing by young people, perhaps we will also help improve our birth rate, which is among the lowest in the world, building a future on a current reality that seems more like the present and the past.

Hopefully, we will live up to the task, and the next generation will see with pride our efforts to rebuild Spain in such tragic times, affirming: "they were great", like the Latin proverb says.

The opinions expressed in this article belong exclusively to its author and do not represent the position of Banco Santander. For further information please visit our “Legal Notice” section