- Santander

-

Menu

- Search

- nuestro-modelo

- shares of stock

- Share

This share prices have a 15 minute delay and are shown in the local time of the market in which the quote is displayed.

OUR BUSINESS MODEL

Our customer focus, scale and diversification are the foundations for generating sustainable value for our shareholders

Please wait

Business model

We’re creating shareholder value by focusing on delivering profitable growth responsibly.

We want to be the best digital and open financial services platform by acting responsibly and earning the lasting loyalty of employees, customers, shareholders and broader society. Our purpose is to help people and businesses prosper. We strive to make sure that everything we do is Simple, Personal and Fair.

Three competitive advantages that make us unique

Customer focus

We have a multichannel offer of products and services to meet all our customers' financial needs.

Scale

Our global and in-market scale helps us improve our local banks' profitability, adding value and network benefits.

Diversification

- By customer: We serve a broad range of customers, from individuals to SMEs and large companies. And we offer a wide variety of products and services such as cards, loans, and wealth management.

- By geography: Our geographic footprint is well balanced between mature and emerging markets.

- By balance sheet: Santander has a solid, simple and diversified balance sheet, which consists mainly of collateralized loans with low market exposure and is largely funded by retail deposits.

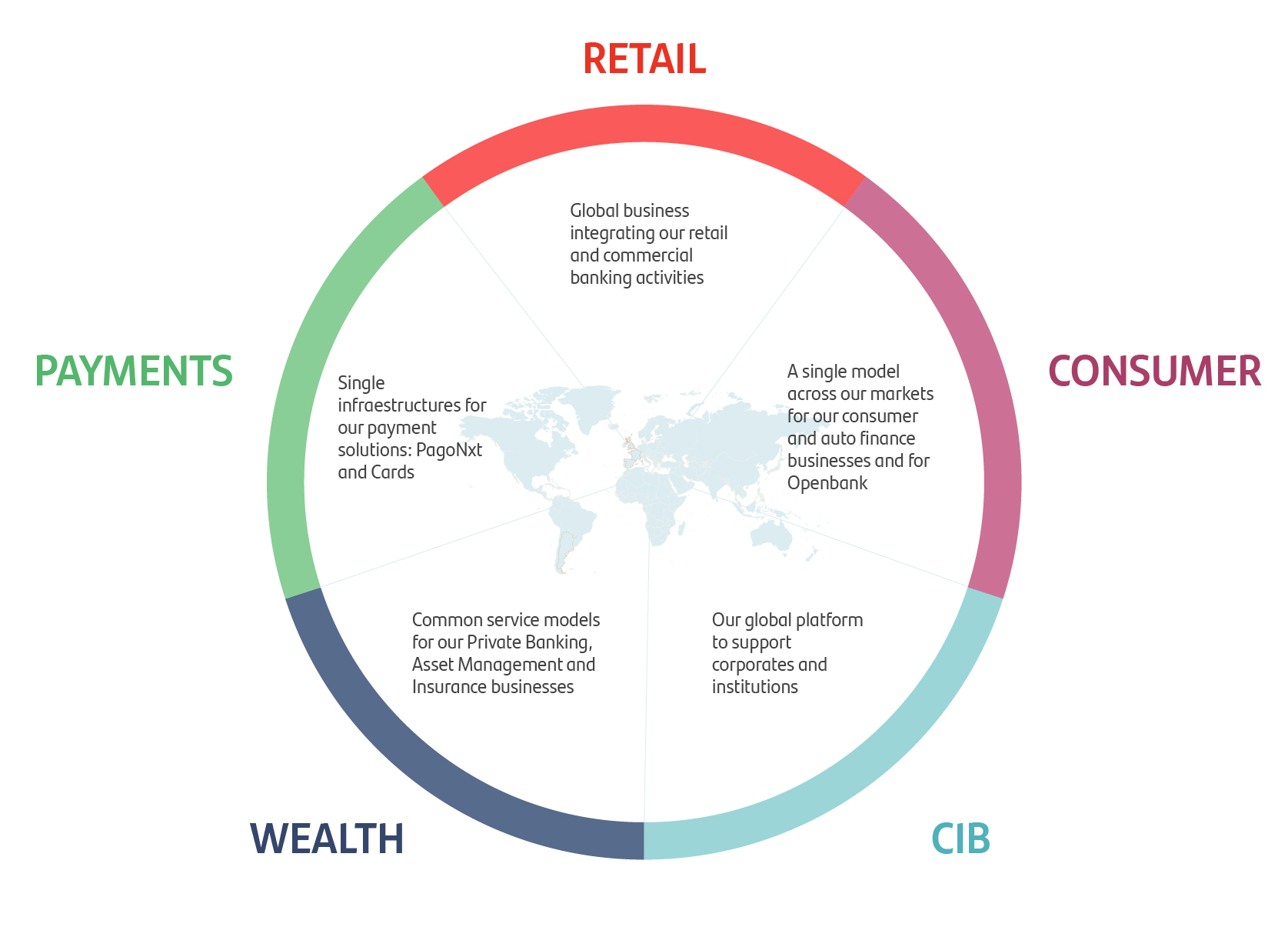

Global businesses

Founded in 1857, Santander is a bank headquartered in Spain. We are structured into five global businesses and operate in 10 core markets in Europe and the Americas.

We’re one of the world’s largest banks by market capitalization and are listed on stock exchanges in Mexico, Spain, the UK and the US. We offer banking and financial products and services to individuals and small and large enterprises through online channels and 8,011 branches.

We have 176 million customers, 204,330 employees, and close to 3.5 million shareholders worldwide. As a responsible bank, we focus on areas where our operations may have a positive impact on inclusive and sustainable economic growth.

*Data as of June 2025

Our strategy

Three pillars

We are in a phase of value creation, driven by higher profitability and underpinned by three tenets:

- We want to become the leading bank across our footprint and to maximize shareholder value.

- We want to be our customer’s bank of choice.

- We’re building ONE Santander to harness our unique combination of global strength and local leadership.

- THINK VALUE

- THINK CUSTOMER

- THINK GLOBAL

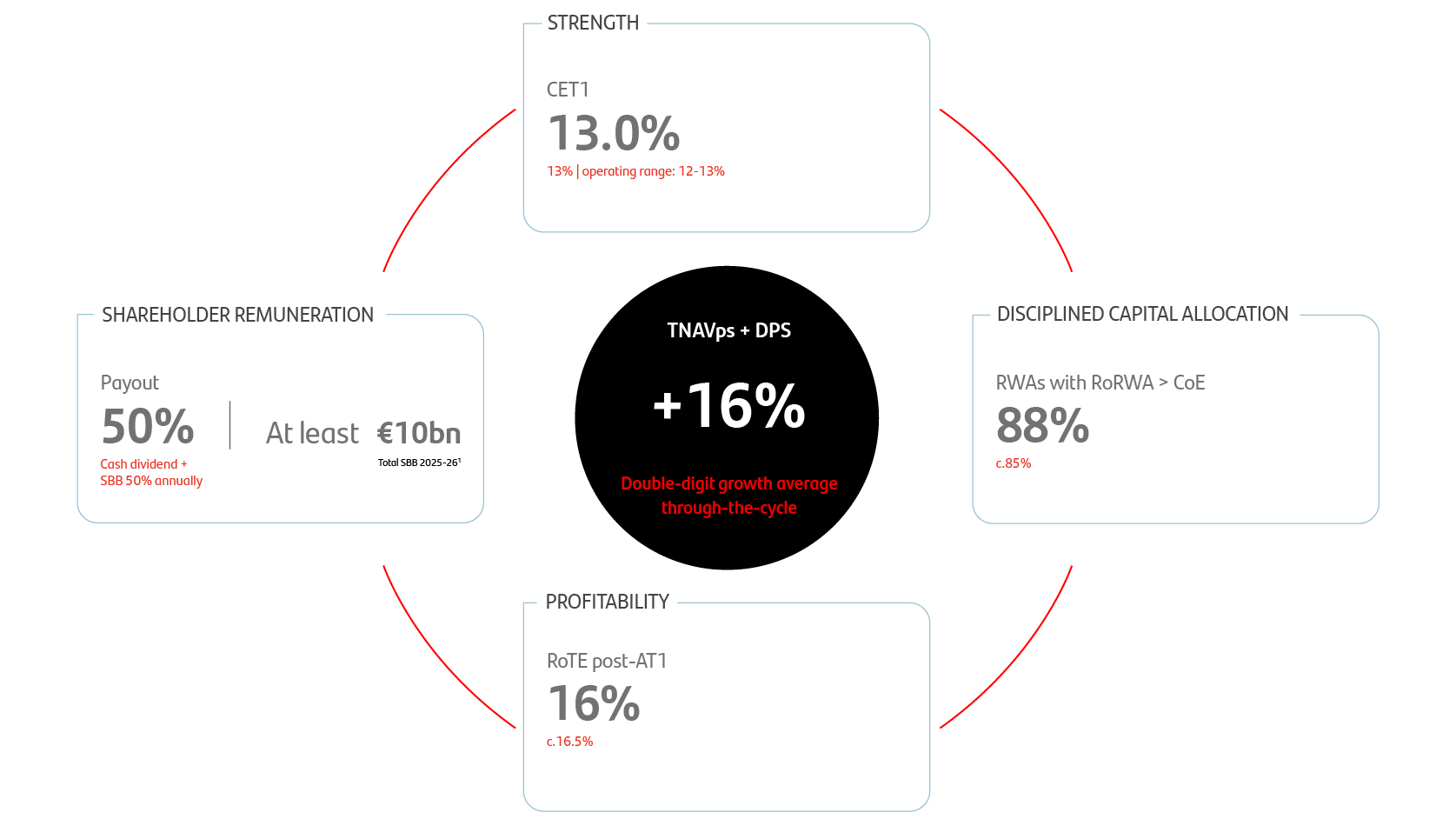

Well ahead on all our strengthened Investor Day 2025 targets.

H1’25 vs. 2025 ID targets (incl. upgrades in Q4’24)

Note: our current ordinary shareholder remuneration policy is to distribute approximately 50% of Group reported profit (excluding non-cash, non-capital ratios impact items), distributed approximately 50% in cash dividend and 50% in share buybacks. Execution of the shareholder remuneration policy is subject to future corporate and regulatory decisions and approvals. (1) Share buyback target against 2025-26 results as well as to the expected excess capital. This share buyback target includes: i) the buybacks resulting from the application of our existing shareholder remuneration policy plus ii) additional buybacks to distribute excesses of our CET1 (including 50% of the capital released from the disposal of its 49% stake in Santander Bank Polska S.A). The execution of share buybacks is subject to future corporate and regulatory decisions and approvals. For more information, see notes 1 and 2 on slide 57 of the H1’25 Group earnings presentation.

We want to be our customers’ bank of choice.

Our plan

To build a digital bank with branches

Our approach

To promote a customer-centric model

To harness our scale in product proposition

To embed technology (especially AI) in everything we do

Our goals

The best customer experience

With the best products

At the best prices

Leveraging global and in-market scale, network and tech to deliver world class-services and accelerate profitable growth

Our transformation and five global businesses deliver higher revenue with lower costs structurally, supporting our ambition to become the most profitable bank in every market where we operate

Our five global businesses

2024 Digital Annual Review

Results, strategy and messages to shareholders from the Executive Chair and CEO