What is blockchain?

Blockchain is a new type of shared or distributed database where the information recorded is stored in blocks that are cryptographically linked together in a decentralised way, through a shared protocol. In other words, it's a new way of safely storing information with greater traceability and accessibility.

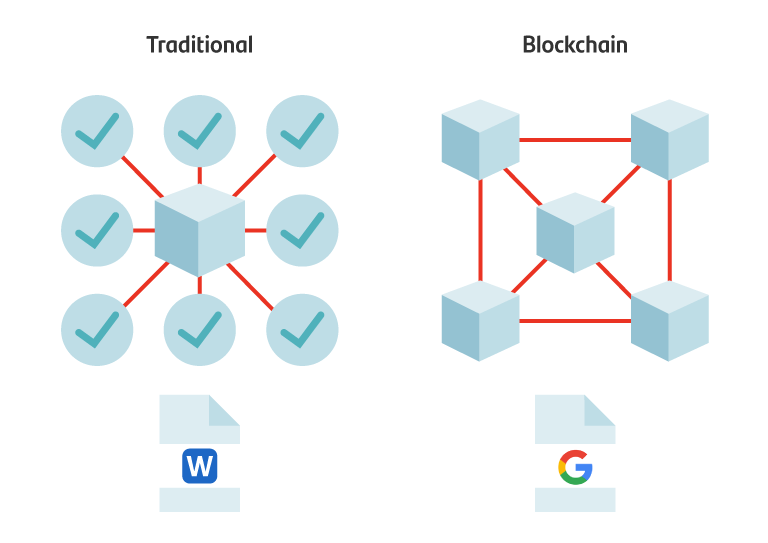

Blockchain differs from traditional databases in that the latter is based on a central data log. For example, if someone wants to buy a house, they must first access the land registry to verify the property details. In a shared database, there would be no central registry, as such, but rather each participant in the network would have a copy of that database at their disposal.

To gain a better understanding of the concepts of shared and decentralised databases, let's draw a comparison with word processors. A Microsoft Word document can only be opened by one person at a time, so if you're working as a group, several Word documents could then be generated, which someone would then need to group into a single ‘centralised‘ version later on.

With Google Docs, however, several people can work on one document at the same time, in a ‘shared‘ way. That way they can incorporate changes and see the amendments that other participants make to the document, all in real time.

In the first example, the final decision on the document to be saved is up to the person who groups their colleagues' changes together. The person responsible can choose which changes to either include or reject (‘centralised‘). In the second example, the final document is established by mutual agreement (‘decentralised‘).

Based on this example, we can deduce some of blockchain's characteristics:

- Shared. As mentioned earlier, blockchain is a shared database, meaning that each individual involved has a copy of the database that updates in real time.

- Irreversibility. The information blocks are cryptographically linked. Once a block has been created, it can't be modified unless the subsequent blocks are also changed. Those involved must agree to this operation, which means that, in practice, blockchain is irreversible.

- Security. Thanks to its shared and irreversible nature, we have a database that is, generally, more secure.

On the other hand, blockchain also comes with certain disadvantages:

- Efficiency. Traditional databases work perfectly well and, oftentimes, the cost of switching isn't worth the potential return that comes with blockchain's advantages.

- Accessibility. As was the case with the very first computers, blockchain's user experience is often not the most accessible. There's still a long way to come in this regard before everyone can work with this technology.

- Uncertainty. Several studies have found that a key challenge is the unknown risks that stem from this still-emerging technology.

In a series of upcoming articles we will cover how blockchain technology can be applied in real life. Beyond the latest developments in new payment systems and cryptoassets, this technology could improve efficiency in terms of transaction traceability or lower validation costs thanks to smart contracts, among other applications.

This article is for educational purposes only and does not reflect the opinion or strategy of Banco Santander, and in no way should be considered as financial advice.

Note: Cryptoassets are exposed to high risk of illiquidity and full loss or temporary unavailability of the capital invested, as they are highly speculative products that see highly volatile prices and huge fluctuations in value. Cryptoassets are unregulated and may not be suitable for retail investors. Their prices are set in the absence of mechanisms to ensure their correct formulation, such as those that exist in regulated stock markets. On a similar note, their high dependence on technology can give rise to operational faults, cyberthreats and risks arising from holding cryptoassets under the applicable legal framework, and credentials or passwords can be stolen or lost. Cryptoassets also entail the risk of fraud or money laundering. This means that cryptoassets may not fall under EU regulations and would therefore be unprotected, meaning that the capital invested may not be covered by the Deposit Guarantee Fund or the Investment Guarantee Fund. Any potential issues may, therefore, be rather costly to resolve.