What is blockchain used for?

Blockchain, the technology behind bitcon, has become popular thanks to cryptocurrencies, but its uses go far beyond that.

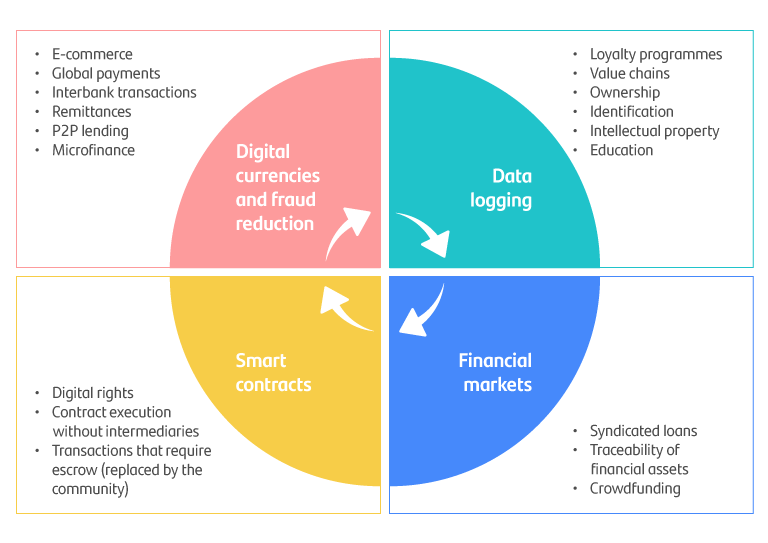

Blockchain is a database that allows information to be stored in an innovative way and its applications vary greatly. Many such uses are still being discovered and developed. Here are some of the most advanced applications.

- Payments. Blockchain became widely known as bitcoin emerged, so discussing how this technology applies to payments is a no-brainer. Blockchain allows cryptoassets to be transferred quickly and securely. Blockchain-based protocols can be automated and decentralised, thus enabling the creation of cryptoassets without the need for controlling, supervisory or centralised bodies.

- Less fraud, financing of terrorism and money laundering. All transactions that occur on a blockchain leave a record. This means that this technology has the potential to reduce fraud, the financing of terrorism and money laundering thanks to transaction traceability, provided that anonymity is prohibited. The first few years of blockchain technology did indeed see a number of cryptoassets used for illicit purposes, as the authorities were not yet using blockchain's traceability to pursue these crimes. Nowadays, only 0.15% of cryptocurrency transactions are used for illicit purposes, according to Chainalysis.

- Data log. In data-intensive industries or processes, blockchain offers a comparative advantage over traditional databases. For example, foreign trade transactions require numerous documents to be processed and signed in a process so cumbersome that, oftentimes, a cargo shipment can arrive at its destination before all the relevant documents are in order, thus preventing the goods from being dispatched. Recording all documents in blockchain not only allows such documents to be signed electronically, but it also enables the perfect traceability of a large part of the processes involved in a company's foreign trade operations.

- Intellectual property. Similar to the data log, blockchain's intellectual property log can easily and securely protect the authorship of original works. The latest developments in this regard revolve around NFTs – unique tokens that, when applied to art, can guarantee paid royalties. For example, nowadays, if an artist paints a picture, they only earn however much the painting first sells for. The lack of traceability in subsequent transactions stops the artist from profiting from any subsequent sales at a higher price. NFTs resolve this problem: NFTs can be treated as a unique digital copy of that painting and, because this is recorded and transferred through a blockchain, you can find out the exact moment of sale and its price, so that the author of the work can benefit from the revaluation of their work.

- Education. Recently, business schools, universities and even certifying associations are issuing course certificates and education certificates through blockchain. This application prevents fraud in job candidates' CVs and can be verified quickly and easily.

- Financial markets. Applications in financial markets are yet to be explored. The German stock market has trialled the use of blockchain technology to issue bonds from different issuers, thus offering full traceability of the debtors of the bondholders. Beyond this, future applications in this sector could see the potential replacement of clearing houses or improved efficiency in reconciliation processes.

- Smart contracts. They are one of the applications that, together with means of payment, originated in blockchain. The Ethereum network is the foundation for smart contracts that aim to simplify processes based on ITTT (if this... then that...) clause programs. Smart contracts are already used in microinsurance, crowdfunding systems or transactions that require a notary public.

This article is for educational purposes only and does not reflect the opinion or strategy of Banco Santander, and in no way should be considered as financial advice.

Note: Cryptoassets are exposed to high risk of illiquidity and full loss or temporary unavailability of the capital invested, as they are highly speculative products that see highly volatile prices and huge fluctuations in value. Cryptoassets are unregulated and may not be suitable for retail investors. Their prices are set in the absence of mechanisms to ensure their correct formulation, such as those that exist in regulated stock markets. On a similar note, their high dependence on technology can give rise to operational faults, cyberthreats and risks arising from holding cryptoassets under the applicable legal framework, and credentials or passwords can be stolen or lost. Cryptoassets also entail the risk of fraud or money laundering. This means that cryptoassets may not fall under EU regulations and would therefore be unprotected, meaning that the capital invested may not be covered by the Deposit Guarantee Fund or the Investment Guarantee Fund. Any potential issues may, therefore, be rather costly to resolve.