Everything you need to know about bitcoin

A type of financial asset, the technology underpinned by a technology with great potential, that increases security, traceability and transparency in data networks and systems.

Digitalisation has become increasingly important in many aspects of our lives. It has also is having an impact on money. It is important to differentiate digital money from electronic money which we trade with today in our day-to-day or see in our bank account. The latter is possible all thanks to the brokering of financial agents who cover credit risks. Digital money would ideally preserve the characteristics of cash (instant liquidation, it belongs to the holder, and no need for intermediaries in the exchange).

Recent decades have seen various attempts to create digital money, but they have all failed for one reason or another - or didn't garner the necessary traction. The most active groups of people in this innovation have been cypherpunks (online groups that value the ability to be anonymous online above all else) and neoliberal economists.

Building on these foundations, Satoshi Nakamoto (whose real identity remains unknown) published, in 2008, an article titled “Bitcoin: a peer-to-peer electronic cash system” in 2008 in which he presented both Bitcoin and the technology underpinning this cryptocurrency: blockchain. All transactions made in Bitcoin are recorded in a proprietary, public blockchain, giving Bitcoin the characteristics of blockchain: irreversibility, distribution and security.

What's more, Bitcoin seeks to be a decentralised means of payment, which means that no central body (e.g., a central bank) decides on its issuance or ensures how secure its transactions are. The algorithm governing Bitcoin dictates that a set number of bitcoins are issued every time a block of information joins its blockchain (this will be miners' remuneration), with this number decreasing over time.

When the first bitcoin transaction took place in 2009 and the first block of information was mined, 50 bitcoins were issued, although this number was halved when the network reached 200,000 blocks. It’s expected to continue to decrease, successively it will be halved, approximately every 4 years, until the expected 21 million bitcoins are issued in 2140. Due to the rigidity of Bitcoin protocol's monetary policy and its decentralisation, one of the most central narratives behind the cryptoasset is that it is “digital gold”.

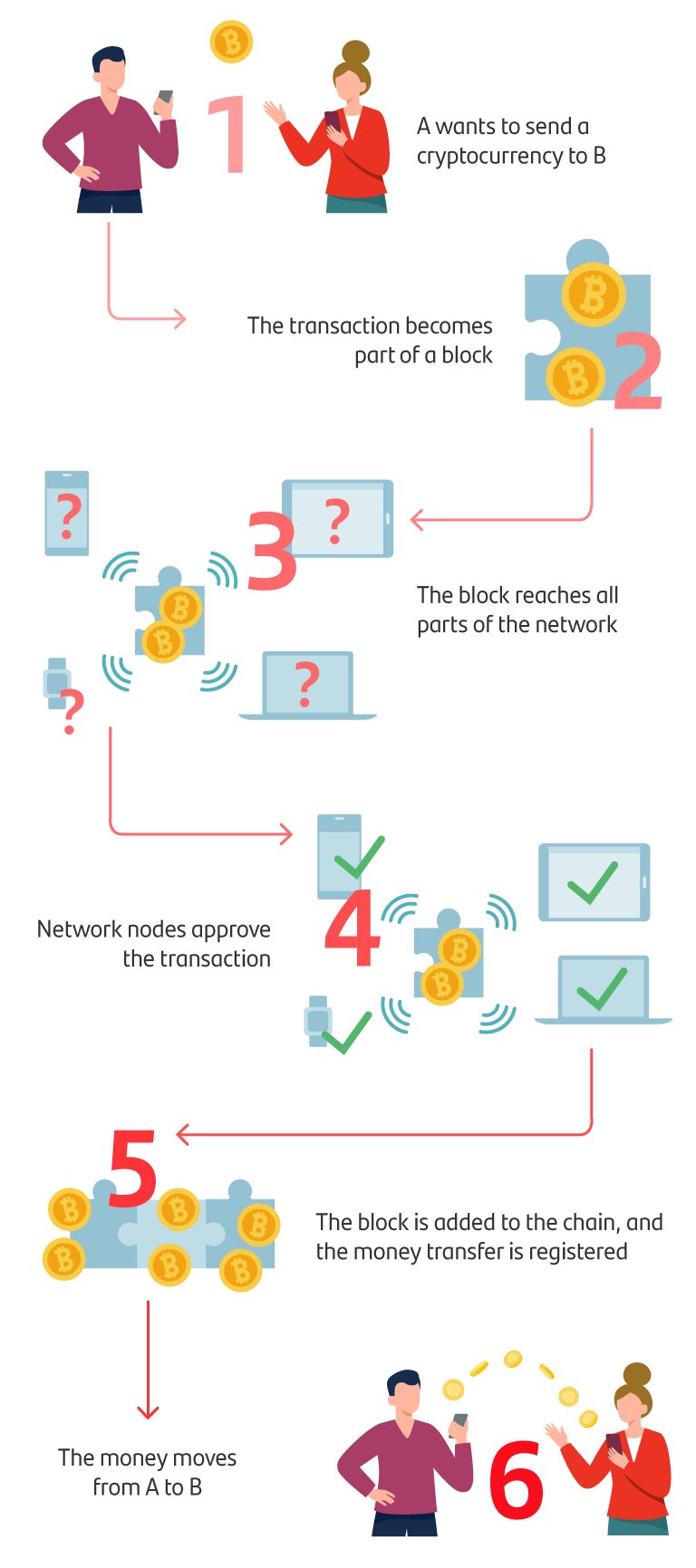

Bitcoin transactions work as follows: If A wants to send a bitcoin to B, A must convey this request to the system in an action similar to the way traditional bank transfers are sent. Once the network receives this order, it then goes on to form part of a block (a block of information, as mentioned earlier). The network will confirm the signature of the transaction (this means that A has really ordered this transaction using his Private Key A) and that A possesses the bitcoin they want to send to B. Once the nodes verify this information, the block of information is added to the chain, the transfer is recorded, and the money moves from one account to the other.

The challenges of Bitcoin

Bitcoin, like other cryptocurrencies, is not entirely risk-free. You can read more in the article “Bitcoins and other cryptocurrencies: everything you need to know”.

Money fulfils three functions, main characteristics, namely that of being used as a unit of account, a store of value and a means of exchange. Given Bitcoin's price volatility, in addition to the fact that it's a network in the process of being adopted, it could still be considered a work in progress.

Bitcoin and other cryptocurrencies use a “proof-of-work” mining process to ensure that the blockchain is established by consensus. This process is energy intensive. The debate on the Bitcoin protocol's energy consumption is highly nuanced: energy consumption is presented as an incentive system to prevent network corruption. In any case, alternatives to the proof-of-work process are currently under development, which we shall discuss in later articles.

One of Bitcoin's main criticisms is its low scalability. Compared to VISA, which executes over 20,000 transactions per second, Bitcoin is only capable of executing between 4 and 7 transactions in the same time frame. However, several companies are now developing solutions based on Lightning Networks to ensure that transactions on the Bitcoin network can be made not only immediately, but at a lower cost. Lightning Networks is a decentralized network using smart contract functionality in the blockchain to enable instant payments across a network of participants.

The lack of a legal security network is one of the biggest problems facing Bitcoin's growth. Although countries such as China have prohibited activities relating to Bitcoin, on a global level it is generally considered to be a non-legal asset, just like all other digital assets. In other words, there is no regulation. Europe is currently working on the MiCA regulation, which will aim to offer a standardised legal framework for Member States on issuing and trading digital assets.

This article is for educational purposes only and does not reflect the opinion or strategy of Banco Santander, and in no way should be considered as financial advice.

Note: Cryptoassets are exposed to high risk of illiquidity and full loss, or temporary unavailability of the capital invested, as they are highly speculative products that see highly volatile prices and huge fluctuations in value. Cryptoassets are unregulated and may not be suitable for retail investors. Their prices are set in the absence of mechanisms to ensure their correct formulation, such as those that exist on regulated stock markets. On a similar note, their high dependence on technology can give rise to operational faults, cyberthreats and risks arising from holding cryptoassets under the applicable legal framework, and credentials or passwords can be stolen or lost. Cryptoassets also entail the risk of fraud or money laundering. This means that cryptoassets may not fall under EU regulations and would therefore be unprotected, meaning that the capital invested may not be covered by the Deposit Guarantee Fund or the Investment Guarantee Fund. Any potential issues may, therefore, be rather costly to resolve.