Bitcoin mining and consensus: How to reach an agreement for validating the blockchain?

The terms mining or validation are often used to describe the process of how a new block of transactions is added to a blockchain. Here, we discuss the main systems which are used to perform this task, within the world of blockchains.

Bitcoin

The oldest and most prominent Blockchain network is Bitcoin. In order to deliver a true "peer-to-peer electronic cash system", the origin of this network was providing a protocol to add entries to a distributed ledger. These entries indicate an amount of bitcoin (a digital token), where the user can assign some of their bitcoin to another user.

Blockchain is operated across distributed nodes, without a central authority of any kind for transferring the bitcoins or maintaining the ledger. The Bitcoin Blockchain created a whole new set of processes and leveraged certain existing ones: from implementation of the distributed ledger technology to the consensus algorithm.

Blocks

In Blockchain, the transactions are grouped into so called “blocks”, when there’s enough transactions to fill a block, or the time allocated for the block is reached, the blocks are proposed to be added to the chain. This is when the consensus mechanism comes into action. Consensus means finding a way for all nodes to agree on the validity of transactions without relying on a central authority.

Byzantine Generals problem

Imagine you are playing a children´s game and you need to agree on the rules to follow. Some of your friends might try to cheat or make up their own rules. The Byzantine Generals problem is similar to this scenario - it is a game theory used as an analogy to explain the problem of having Blockchain nodes which need to reach an agreement. This game theory shows that a group of Byzantine Generals are planning to attack the enemy, and they must do it on the same day at the same time. Otherwise, they will fail. The issue is that they do not trust each other. The Generals fear some of them may be traitors or may be sending contradictory messages. Should they attack or not?

The Blockchain nodes face the same issue. Should each of the nodes validate the transactions or not? The so-called consensus mechanism (or algorithm) is a way for them to reach an agreement.

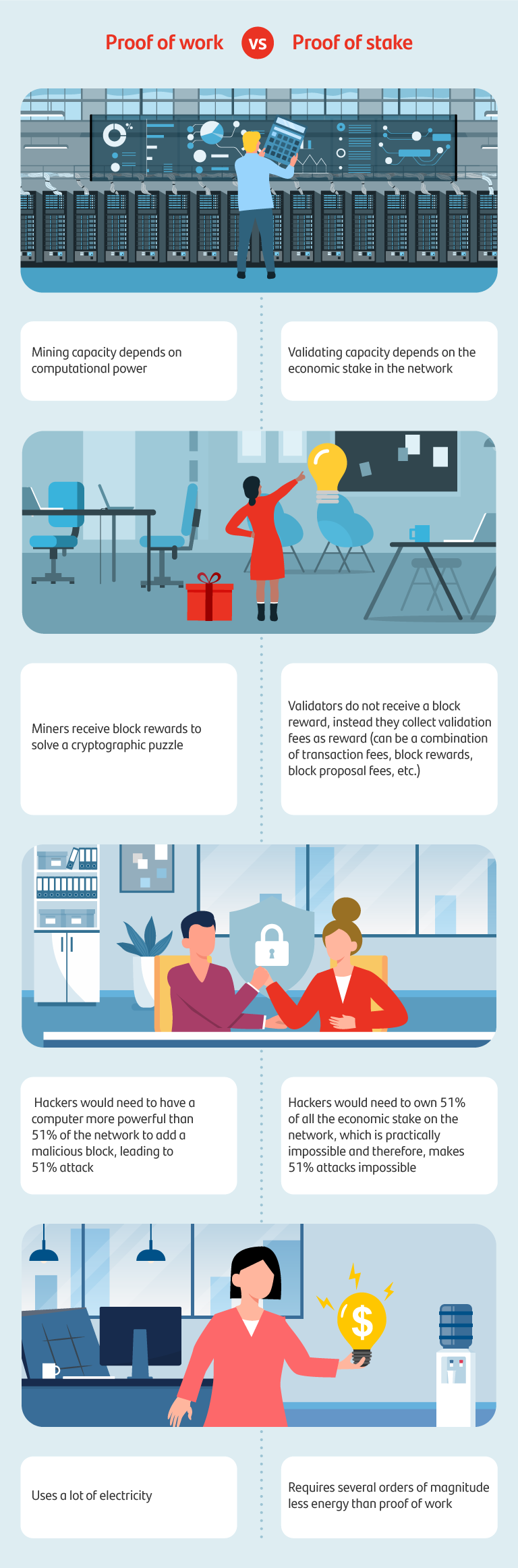

Proof of Work

The Bitcoin consensus algorithm is called Proof of Work (PoW). This is the way for Bitcoin to solve the Byzantine General’s problem. PoW is, like the name suggests, a proof of performing the work, which is a mathematical challenge to validate the block. After solving the challenge, the block is added to the network and there is a reward for the node which solves it. This challenge requires a lot of computer power.

An analogy can be drawn to the process of mining for precious metals, like gold. When people mine for gold, they have to put in a lot of effort and use specialized tools to extract the precious metal from the ground. Similarly, within the Bitcoin Blockchain, computers put in effort to “extract” a quantity of new bitcoin (the cryptocurrency) from the digital "mines."

That is why the process is known as mining and the reward for that work is the cryptocurrency of the network. The bitcoin reward in this case, is a constant number, which decreases every four years. Another part of the reward for miners are the fees that the issuers have paid in order to get their transactions included in the block.

Other Blockchain networks may also use PoW or alternative types of algorithms. The need for other consensus algorithms arose in response to energy and environmental considerations. The community realized that PoW was performing the same calculation millions of times by thousands of machines to return only one result, spending a lot of energy in wasted calculations.

There were also inefficiencies in the number of transactions per second which the network supported. It was at this point when a new consensus mechanism, proof of stake (PoS) was created (explained below). Ethereum, the second biggest Blockchain by market capitalization after Bitcoin, switched its protocol from PoW to Proof of Stake (PoS). Ethereum´s transition to PoS was finalised in September 2022 in an event referred to as “The Merge”. The PoS reward in the Ethereum network remains as ETH but is performed using PoS now instead of PoW.

What is Proof of Stake?

Proof of Stake is a consensus algorithm which selects a validator (which is similar to a miner) based on the staking of a certain volume of tokens. In Ethereum the amount of ETH to stake for a single validator is 32 ETH, staking any more ETH does not affect the probability of a node being selected as a validator, but other networks may take into account the volume of staked tokens, such as the Cardano network. PoS does not require solving the computational problem required in PoW, and this results in large power savings for the validators and the whole network itself.

The trust put in validators comes from the fact that if there’s a malicious activity a validator´s stake may be at risk in the form of deductions, and may be removed from the validator pool.

Other common consensus algorithms include Proof of Authority and Proof of Capacity.

Proof of Authority

Proof of Authority (PoA) is a Blockchain consensus algorithm in which the validators do not stake the compute power they use (PoW) nor funds locked in the network (PoS) but instead the validators´ reputation/identity is used. This consensus algorithm is more commonly used in private networks where all the participants are known, as reputation works very well in reduced environments. This can also be used in public networks where it is directly related to reputation: validators are trusted entities and do not want to have their identities attached to a negative reputation. The validators are also a small subset of all the nodes so there’s form of centralization in this case, but the benefit is to have a more efficient network (versus PoW) and higher number of transactions per second.

Proof of Capacity

Proof of Capacity (PoC) it is not based in compute power, token staking, nor reputation but is instead based on the storage capacity of the validator. The validators store the list of possible solutions to the puzzle in their disks. So the largest storage capacity is dedicated a higher possibility of having the solution and receiving a reward.

These are just some of the most common consensus algorithms, however there are other alternatives like Proof of Burn or Proof of Elapsed time that will be explored in future articles.

This article is for educational purposes only and does not reflect the opinion or strategy of Banco Santander, and in no way should be considered as financial advice.

Note: Cryptoassets are exposed to high risk of illiquidity and full loss or temporary unavailability of the capital invested, as they are highly speculative products that see highly volatile prices and huge fluctuations in value. Cryptoassets are unregulated and may not be suitable for retail investors. Their prices are set in the absence of mechanisms to ensure their correct formulation, such as those that exist in regulated stock markets. On a similar note, their high dependence on technology can give rise to operational faults, cyberthreats and risks arising from holding cryptoassets under the applicable legal framework, and credentials or passwords can be stolen or lost. Cryptoassets also entail the risk of fraud or money laundering. This means that cryptoassets may not fall under EU regulations and would therefore be unprotected, meaning that the capital invested may not be covered by the Deposit Guarantee Fund or the Investment Guarantee Fund. Any potential issues may, therefore, be rather costly to resolve.