We are creating value for our shareholders by focusing on delivering profitable growth in a responsible way.

We aim to be the best open financial services platform, by acting responsibly and earning the lasting loyalty of our people, customers, shareholders, and communities. Our purpose is to help people and businesses prosper. We strive to make all we do Simple, Personal and Fair.

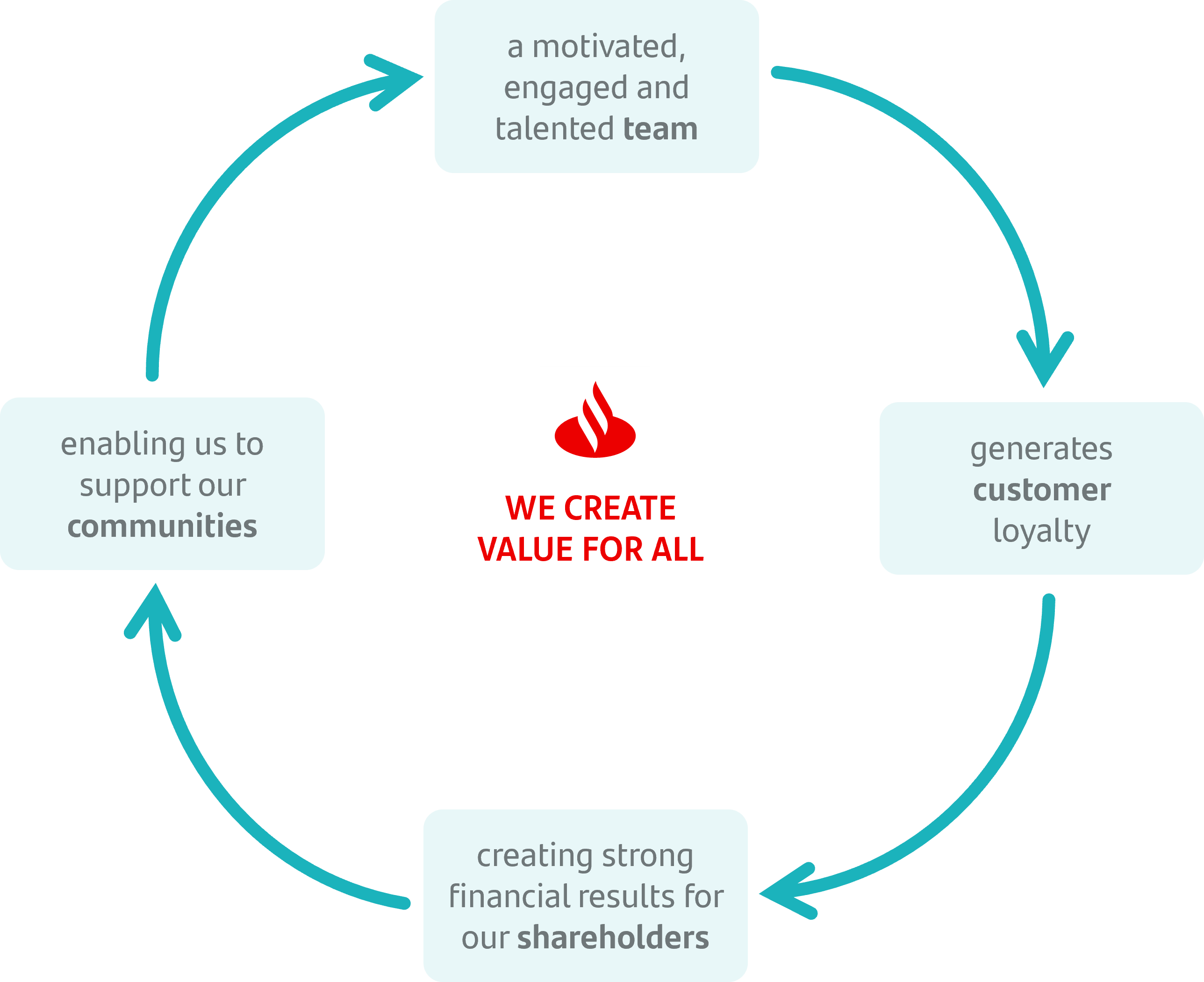

Our strategy aims to create value for all our stakeholders. Our talented and engaged team generates customer loyalty, leading to strong financial results for our shareholders, so we deliver support for our communities, which motivates our team.

Our business model is based on three pillars:

01. Customer focus:

Building a digital bank with branches

New operating model to build a digital bank with branches, with a multichannel offer to fulfil all our customers' financial needs.

total customers

total customers

02. Our scale:

Local and global scale

- Our global and in-market scale helps us to improve our local banks' profitability, adding value and network benefits.

- Our activities are organized under five global businesses: Retail & Commercial Banking (Retail), Digital Consumer Bank (Consumer), Corporate & Investment Banking (CIB), Wealth Management & Insurance (Wealth) and Payments.

- Our five global businesses and our presence in Europe and the Americas support value creation based on the profitable growth and operational leverage that ONE Santander provides.

03. Diversification:

Business, geographical and balance sheet

Well-balanced diversification between businesses and markets with a solid and simple balance sheet that gives us recurrent net operating income with low volatility and more predictable results.

Our strong model is reflected in the resilience of our business. It is a competitive strength that continues to differentiate us.

Our corporate culture

The Santander Way remains unchanged to continue to deliver for all our stakeholders

![]()

Our aim

To be the best open financial services platform, by acting responsibly and earning the lasting loyalty of our people, customers, shareholders and communities.

![]()

Our purpose

To help people and businesses prosper.

![]()

Our how

Everything we do should be Simple, Personal and Fair.