Santander awards solutions for restaurants, farmers and travel in the EUvsVirus hackathon

Madrid, 8 May 2020 - PRESS RELEASE

Innovators and problem-solvers from around the world put their creativity to the test, working to hack the covid-19 pandemic for three days in the EUvsVirus pan-European hackathon, which was hosted by the European Commission and EU member states with sponsorship from companies including Banco Santander.

The EUvsVirus hackathon generated 2,160 pioneering solutions aimed at fighting the challenges resulting from the coronavirus outbreak. Of these solutions, a total of 117 winners were named last week for different areas, such as health, business continuity, social & political cohesion, remote working & education, digital finance, etcetera.

Linsey Argalas, Santander’s Chief Digital & Innovation Officer, said: “The only way to face global challenges such as the covid-19 pandemic is to join forces. Santander will continue to find ways to help counteract the effects of the pandemic both within our Santander community and more widely. This hackathon presented an important way to support people and businesses worldwide during this extremely challenging time through innovation and technology.”

Santander sponsored the “New and resilient business models” challenge and awarded the following solutions:

- Hypanel, a technological solution for reopening Europe’s restaurants. The team from the Netherlands designed a transparent partitioning panel to install between restaurant tables to prevent the spread of aerosol particles, as well as a way to sterilize the air with UV light. Hypanel’s solution can allow restaurants to replace physical distancing requirements and resume profitable operations.

- sostenibl.es, which enables short marketing channels for farmers in need during the covid-19 crisis. sostenible.es is a digital network of SMEs in the organic agri-food sector designed to serve as a bridge between small farmers and end consumers. By building a digital farmers market, the team from France, Germany, and Spain is helping to create a B2B2C community around sustainable food that will continue adding value beyond the coronavirus response.

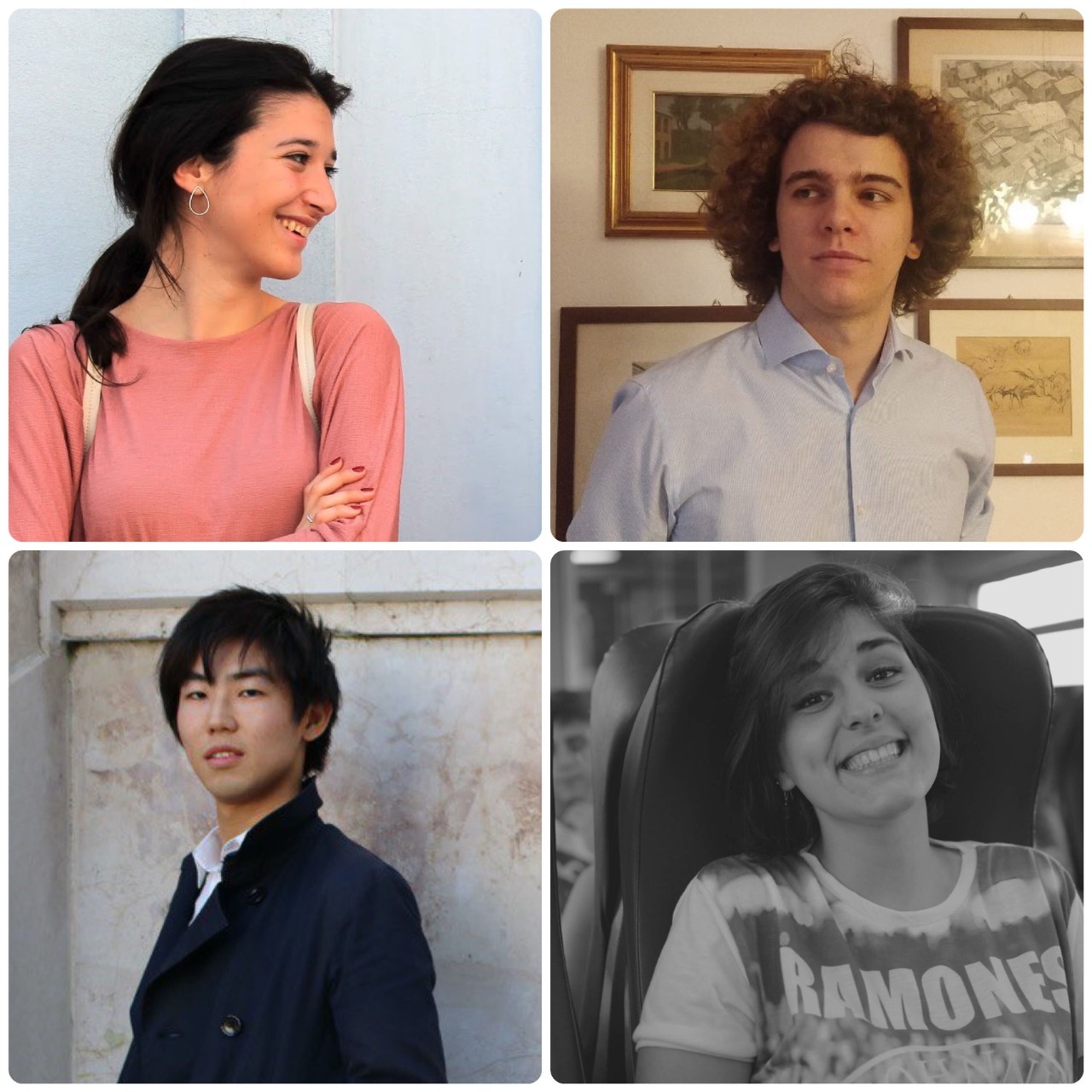

- It!, which is developing new safe ways of traveling in a post-covid-19 Europe. Recognizing that the coronavirus will likely change the way people travel, the team from Italy and Japan aims to better integrate destination management organization and destination management company efforts to raise destinations’ attractiveness while giving tourists a consistent, safe experience.

All the winners from the hackathon will be invited to a Matchathon from 22 to 25 May on the new EIC COVID platform, an online event that will facilitate match-making between winning teams and those who can use their solutions, such as hospitals. The Matchathon will also provide the winners with access to investors, corporations, foundations, and other funding opportunities from across the EU.

In addition to Argalas’ support, Santander’s participation featured several key business and technology executives from Santander Digital who served as judges and mentors for the hackathon. Those Santander partipants included Aiaz Kazi, Santander’s Chief Platform Officer; Abdenour Bezzouh, head of Technology & Operations in the division; Jose Resendiz, Chief Design Officer; Yogish Pai, Digital Transformation; Mike Almeraris, head of Developer and Content Ecosystem; Óscar Cristóbal Ruiz, Sales/Partner Engineer; and Benjamín Granados Matarranz, API Evangelist & Strategist.

Follow the Santander developers team at https://twitter.com/SantanderDevs

Banco Santander (SAN SM, STD US, BNC LN) is a leading retail and commercial bank, founded in 1857 and headquartered in Spain. It has a meaningful presence in 10 core markets in Europe and the Americas, and is one of the largest banks in the world by market capitalization. Its purpose is to help people and businesses prosper in a simple, personal and fair way. Santander is building a more responsible bank and has made a number of commitments to support this objective, including raising over €120 billion in green financing between 2019 and 2025, as well as financially empowering more than 10 million people over the same period. At the end of the first quarter of 2020, Banco Santander had a trillion euros in total funds, 146 million customers, of which 21.3 million are loyal and 38.3 million are digital, 11,900 branches and 195,000 employees. Banco Santander made underlying profit of €1,977 million in the first quarter of 2020, an increase of 1% compared to the same period of last year.