Santander's Financial Crime Compliance team recognised by the United Nations for supporting Ukrainian refugees

The Finance Against Slavery and Trafficking (FAST) initiative, based at the United Nations University Centre for Policy Research (UNU-CPR), which works to mobilize the financial sector against modern slavery and human trafficking, recently highlighted case studies from Openbank, Santander Bank Polska and Santander España for their successes in facilitating financial inclusion during the crisis

June, 2023.

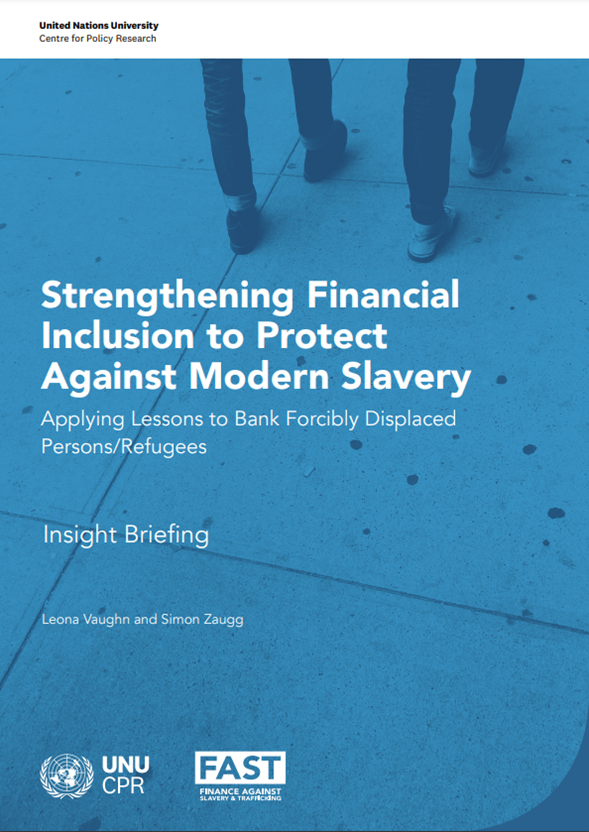

The United Nations University’s Centre for Policy Research has published a report, Strengthening Financial Inclusion to Protect Modern Slavery: Applying Lessons to Bank Forcibly Displaced Persons/Refugees, which emphasizes how financial crime compliance programmes, when designed effectively, can facilitate vulnerable population access to financial services while still meeting local regulatory requirements. The insight briefing from the UN includes cases studies from five banks focused on the provision of financial access to refugees from Ukraine, with three of those banks from within Santander: Openbank, Santander Bank Polska, and Santander España.

The case studies from Santander provide three distinct perspectives on the challenges faced and overcome by the respective local Financial Crime Compliance teams during the initial wave of refugees. For example, Santander Bank Polska on the frontlines providing access to opening accounts and facilitating relief payments, or Openbank, as Europe’s largest digital bank, redesigning remote and highly automated onboarding workflows, or Santander España evaluating how to document responsibly the source of funds and wealth coming from individuals’ fleeing their home country with their life’s savings.

“The ways in which financial institutions as well as public regulatory/supervisory authorities have innovated specific products and processes for displaced people in this context,” the report reads, “offers important lessons to others in the sector on how to meet the needs of vulnerable people in current and future crises around the world.” Within a week of the refugee crisis in February 2022, the Santander Financial Crime Compliance team at the Group’s corporate headquarters had released a memorandum to all subsidiaries providing specific guidance on how to facilitate the onboarding of Ukrainian refugees in the country in which they sought asylum. It was aligned with the bank’s existing policies and in line with previous opinions issued by the European Banking Authority. The local Financial Crime Compliance teams, in parallel, remained plugged into their local industry groups and in constant contact with regulatory authorities to ensure everyone was working toward the same aim: prevent bad actors from exploiting the millions of vulnerable individuals seeking refuge in the EU. All the cases from Santander highlighted the importance of cooperation amongst the bank’s staff, often operating under a task force approach. Business representatives, technology & operations, compliance, risk and legal all came together to find effective and efficient ways forward.

The Santander Financial Crime Compliance team continues to work with the FAST initiative on a series of projects across the world, including pilot work on supporting victim-related financial inclusion in Mexico. The team also provides advisory support to a new self-assessment tool built by the UN that allows financial institutions to evaluate the strength of their own policy framework against human trafficking and modern-day slavery.

Staff from the FAST initiative have also participated in Santander’s Financial Crime Compliance Summit now for the last two years, raising awareness on victims and discussing synergies between financial crime compliance and responsible banking initiatives on areas like the bank’s commitment to UN Sustainable Development Goal #8 – “Decent Work and Economic Growth” – which includes ending modern slavery, trafficking and child labour.

More information on the FAST Initiative can be found here.