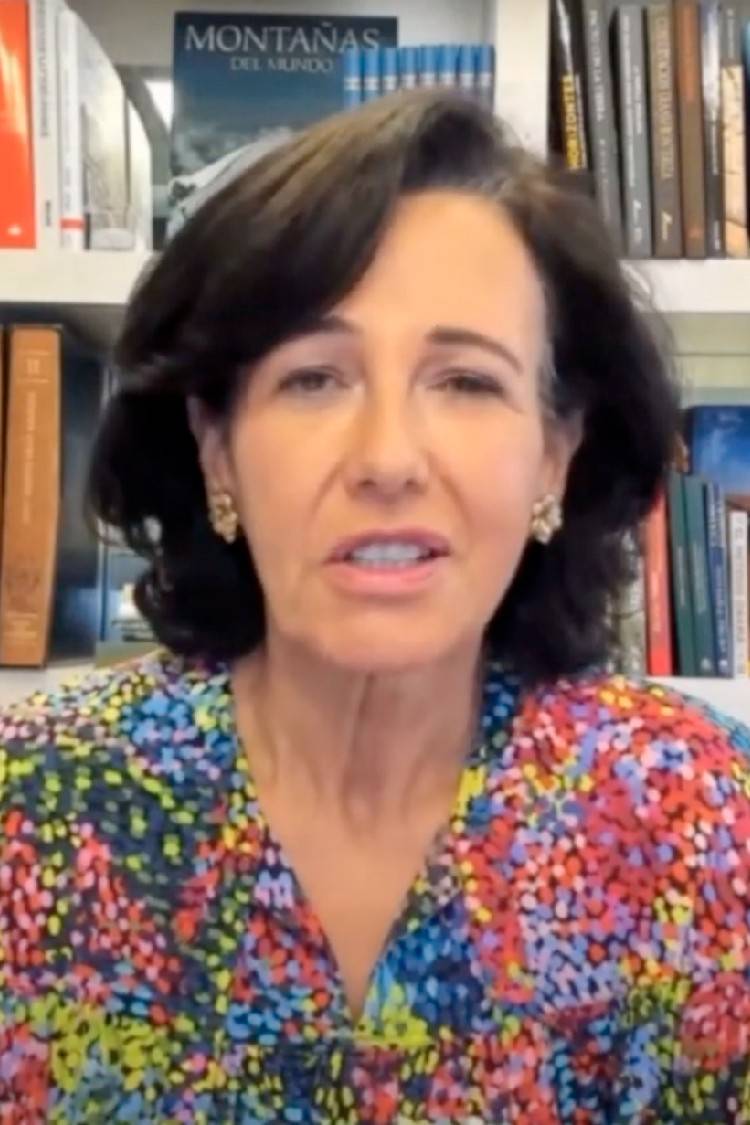

Ana Botín in Fortune: “Combining digital and personal advice and service, a key component to boost financial inclusion in society”

Ana Botín and Mastercard CEO Michael Miebach took part in a digital encounter on the banking sector, digital payments and financial inclusion organised by Fortune magazine. The Group executive chairman touched on the importance of facilitating access to the financial system for one and all, through a combination of digital platforms and customised advisory and services, offering fair, affordable products and services to boost financial empowerment within society.

During the meeting Ana Botín explained that customers want better and faster payment systems at a great price, and so offering the best digital payment service is essential to increase and reinforce transactionality and the loyalty of our customers, a strategy Santander is rolling out through PagoNxt , one of the cornerstones of Santander's growing.

granted per day in 2020

people helped in 2020

granted per day in 2020

people helped in 2020

Our approach

people empowering in 2025

people empowering in 2025

Ana Botín also described the way in which Santander is facilitating access to the financial system for one and all through Superdigital, a digital platform where we help consumers gain a better understanding of how to benefit from financial services to carry out their professional projects and cover their personal and family needs.

She also dwelt on the need to offer fair, affordable financial products and services to consumers in order to boost financial empowerment within society. In this regard, Ana Botín cited the example of the "Prospera" programme of microcredits for small entrepreneurs set up in Brazil by Santander fifteen years ago, which is now also up and running in Argentina, Colombia and Chile, and the "Tuiio" programme in Mexico, which seeks to empower people financially and generate a measurable social impact.

In 2020, Santander approved 4,500 microcredits a day in South America, and helped a total of 2.9 million people. Santander has undertaken to financially empower 10 million people by 2025.