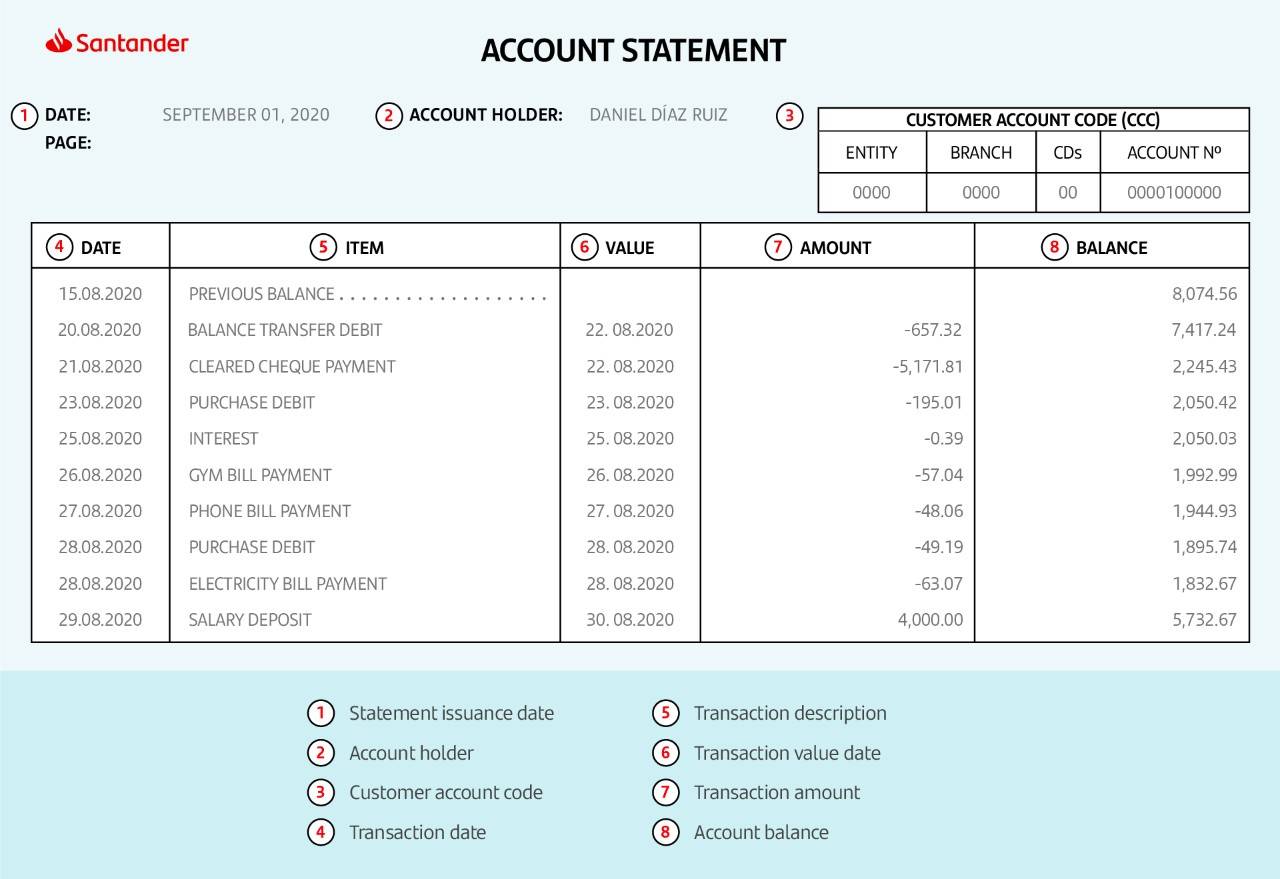

Anatomy of a bank statement: what’s in it?

A bank statement is said to be a personal document that shows our banking transactions and account balance through a series of numbers, letters, sections and cryptic abbreviations. Here we will show you otherwise.

Though we may have heard a lot about bank statements, what are they exactly? They are documents that provides a detailed summary of a person’s account activity for a specific time period, including cash withdrawals, deposits or payments during that period from that account.

We need this information to understand our finances and how much we deposit, spend or save each month. But how do we read this document? It’s true styles and formats can vary from bank to bank, but generally:

At the top, we find an issue date and the details of the person issued the statement, (i.e., the account holder’s name and the account number.

The first step is to go to the Transactions section, which lists all completed transactions, including cash withdrawals, salary payments and bill and card fee payments. We need to check everything is correct.

The dates are a very important part of any bank statement. We have to distinguish between two types: transaction date, or when the transaction is executed, and value date, or when the transaction becomes effective.

The third and most important step is looking at our overall balance. This section shows the total amount of an investment and any interest earned on it, or the next instalment you must pay on a loan or credit card, and the due date to avoid interest charges.

You should review your account from time to time to check your finances. Remember to inform your bank if you detect any irregular activity.