MICROFINANCE: SMALL LOANS, BIG STORIES

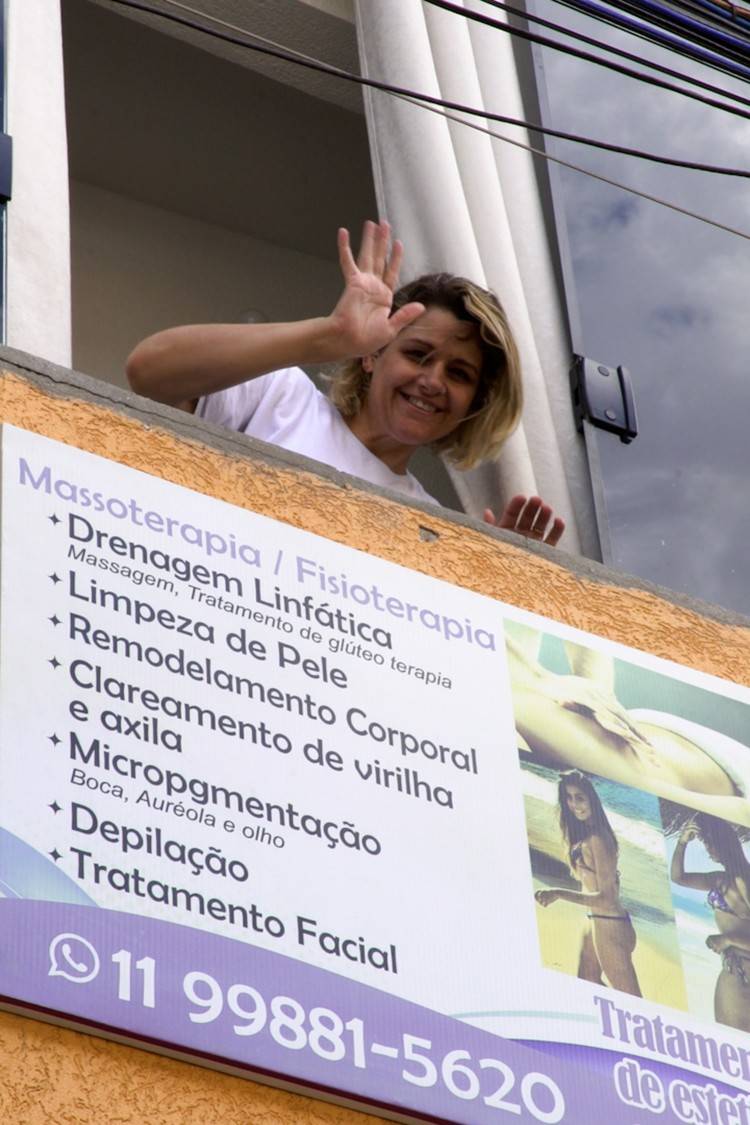

Rita de Cássia: the chance to find her way in a new setting

Here’s how a woman entrepreneur made her dream of building her own beauty salon a reality.

44-year-old Rita de Cássia, from Brazil, had a vision to turn her work as a beautician in Heliópolis, São Paulo, into a more professional set-up. After years building up her business from a small corner of her home, she set her sights on creating a space where she could serve her clients better.

“I didn’t have enough room for my clients before; they weren’t comfortable without the privacy you would usually find at a beauty salon”, said Rita.

Inspired by her self-employed grandmother, Rita built extra space on top of her house. As she explains, “I gave it an overhaul, painted and bought equipment”.

At the outbreak of the pandemic in early 2020, and under health and mobility restrictions, her clients stopped visiting the salon. Despite the plunge in household income, staunch wife and mother Rita remained undeterred, and turned the tables by going to her clients and selling her products door-to-door.

Thanks to her positive experience with the small loan Rita used to build her face and body treatment centre, she was able to borrow more money from Prospera to buy a motorbike to make home visits and deliver her products around the community. This gave her the independence and freedom her business demanded.

Santander Brasil has granted over 1.4 billion euros (9 billion reals) in micro loans in 1,500 towns over the last 17 years. Under its Prospera Microfinanças initiative, it has helped boost the business of more than one million entrepreneurs, small businesses and communities.