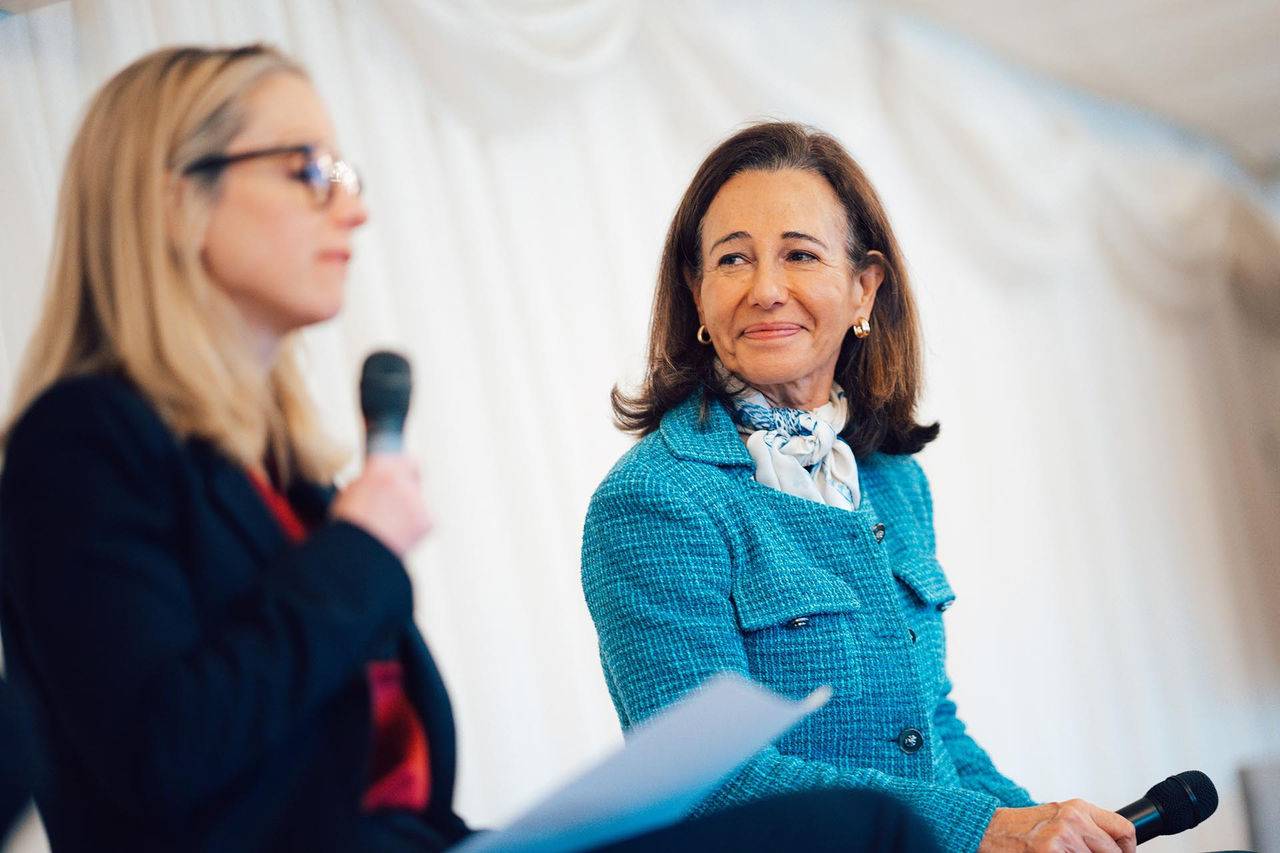

Santander releases the report ‘The Currency of Learning: Global Perspectives on Financial Education’

Ana Botín presented “The Currency of Learning: Global Perspectives on Financial Education” at the House of Commons in London.

This report, based on a survey of 20,000 people in 10 countries, reveals how the gap between perception and actual knowledge of financial matters is a widespread problem.

The report highlights several significant findings:

- Financial education ranks as the second most important subject that people would like to see taught in schools, ahead of traditional subjects such as history or science.

- However, this type of instruction is still not common: 84% of those who do not recall having received financial education at school said they would have liked to.

- People tend to believe they know more about finance than they actually do. While 61% of respondents claimed to have financial knowledge, only 32% answered correctly.

- Social media is increasingly perceived as a source of information on financial education: one in five respondents would turn to it for financial guidance, a figure that rises to one in three among young people aged 16 to 24.

- The topics people most want to learn about are investing (63%), saving (61%), and taxes (51%), areas many wish they had studied in school.

Financial education at Santander

This study reinforces Santander's commitment to financial education as a key element of its approach to promoting financial wellbeing and inclusion. Our bank runs programmes to help people manage their finances, understand risks such as fraud, and build financial resilience. These initiatives, which we adapt to local needs across all our core markets and align with OECD/INFE principles, primarily target young people, entrepreneurs, senior citizens, and vulnerable groups. Last year alone, more than four million people worldwide took part in Santander’s financial education activities and content.

FINANCIAL EDUCATION

We provide people with the skills they need to manage their finances