Q1’25 Earnings

Santander increases profit by 19% to €3,402 million and earnings per share by 26% in Q1, reaffirms 2025 targets

- Return on tangible equity (RoTE) increased to 15.8% post-AT1 from 14.1%

- TNAV plus dividend per share, up 14.5%[1]

Don't miss these key takeways

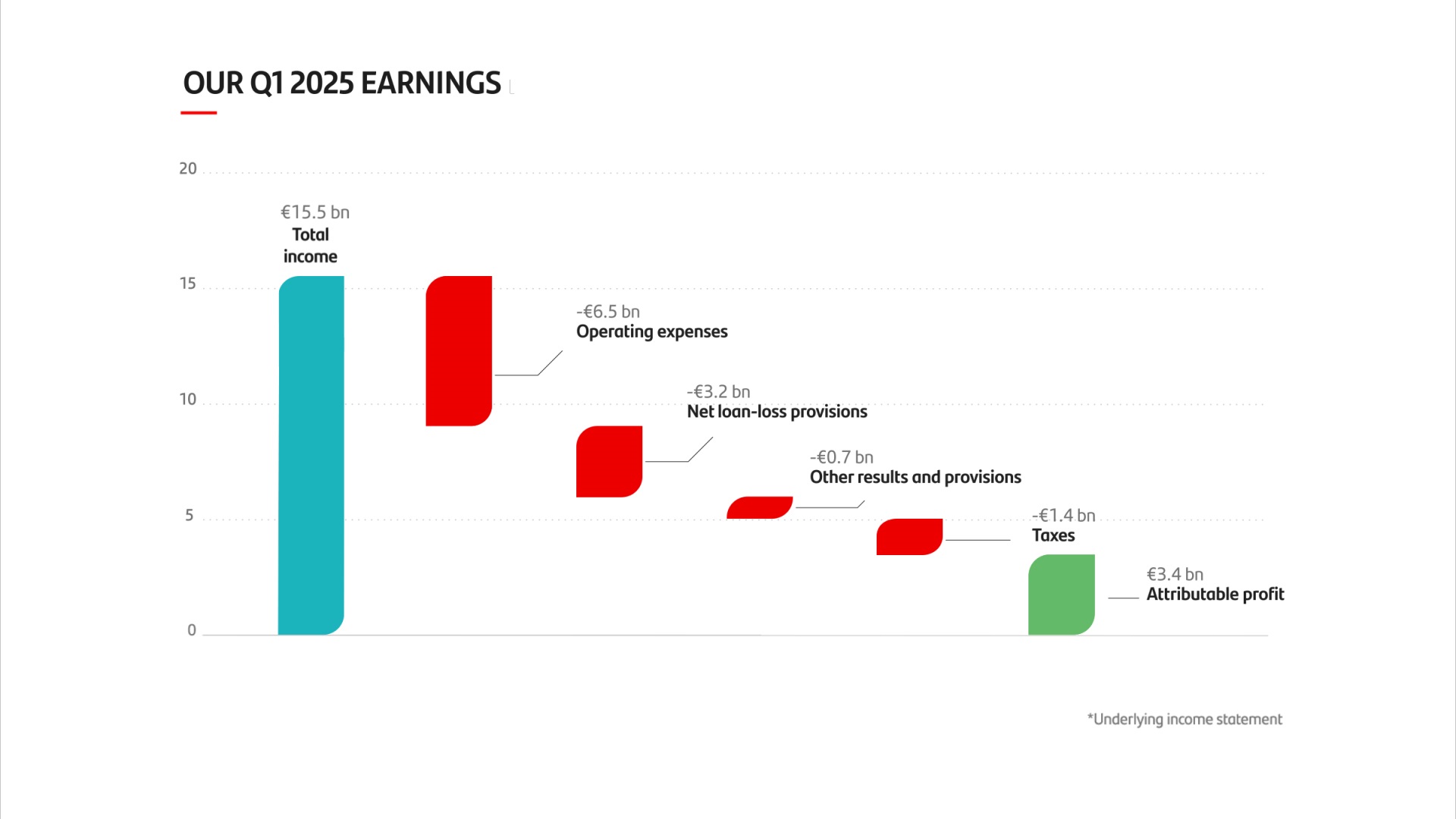

- Revenue rose 1% to €15.5 billion buoyed by record net fee income, as Santander added nine million customers, bringing the total to 175 million.

- Operating expenses decreased by 1%, reflecting the bank’s transformation towards a simpler, more digital and integrated model. As a result, the efficiency ratio improved by 0.8 percentage points to 41.8%.

- Credit quality remained strong, with cost of risk at 1.14% (-6 basis points), reflecting the strength of the group’s diversified balance sheet, while the non-performing loan (NPL) ratio fell below 3% (2.99%) for the first time in over 15 years.

- CET1 capital ratio reached 12.9%, up 0.1 percentage points versus last December thanks to strong organic generation.

- In May, the bank will pay a final cash dividend of 11 euro cents per share against 2024 earnings, resulting in a total cash dividend per share charged against 2024 of 21 euro cents, an increase of 19%.

- Santander is on track to meet its 2025 targets: c.€62 billion revenue; mid-high single digit growth net fee income in constant euros; lower costs; cost of risk of c.1.15%; RoTE of c.16.5% post-AT1; and CET1 of 13%.

Santander achieved a record attributable profit of €3,402 million in the first quarter of 2025, a 19% increase versus the same period last year thanks to record net fee income (+4%) and lower costs. In addition, the bank added nine million new customers with the total number of customers the group serves reaching 175 million customers.

That 19% growth is favoured by the temporary levy on revenue earned in Spain (€335 million) which was fully recorded in the first quarter of 2024. This figure contrasts with €87 million recorded in the first quarter of 2025, representing the quarterly accrual of the tax on revenue expected in Spain for the year. Had the bank accrued the 2024 temporary levy by distributing the charge evenly across the four quarters, consistent with the 2025 tax treatment, the profit for the first quarter would have increased by 10%.

The group continued to increase profitability and shareholder value creation, with a return on tangible equity (RoTE) of 15.8% post-AT1; earnings per share (EPS) of €0.21, up 26%, and tangible net asset value (TNAV) per share of €5.46 at the end of the first quarter of 2025. Including the interim cash dividend from 2024 results paid last November, total value creation (TNAV plus cash dividend per share) increased 14.5%.

In the first quarter of 2025, customer funds (deposits and mutual funds) grew 5% in constant euros, with deposits up by 3% in constant euros, driven by the growth in the Retail and Consumer businesses and the number of customers served.

Loans rose 1% in constant euros to €1.02 trillion, as growth in lending within Consumer, CIB, Wealth and Payments offset a slight fall in Retail due to early amortizations and the bank’s focus on profitable growth and capital optimization.

Total income increased 1% (+5% in constant euros) to €15,537 million, as the group achieved record net fee income, backed by higher activity and customer growth. Net interest income was flat (+4% in constant euros) excluding Argentina.

1 Variations are year-on-year unless otherwise stated.

We’ve had a strong start to 2025, growing the number of customers we serve, increasing RoTE to 15.8% and generating a 26% uplift in earnings per share. Our global businesses are all performing well, underlining the impact of our transformation and ability to further improve operating efficiency.

Ana Botín, Banco Santander executive chair

2024 Annual Review

Results, strategy and messages to shareholders from the Executive Chair and CEO