Dear Fellow Shareholders,

Each year I select a theme for my letter. This year it is “continuity and change”. I am going to address the things about Santander that are unchanging: the fundamentals of our business and our strategy which have made us one of the most predictable and profitable banks. And then I will look at how we are embracing change, particularly technological transformation, in order to continue to seize the new opportunities ahead of us.

This year is a particularly good moment for reflection as 2020 marks both the beginning of a new decade and the fifth anniversary of my appointment as leader of Santander. Looking back over those five years, I am struck by what has changed – the world of 2014 was very different to the world of 2019. But I am also impressed by what our Group has achieved in this time of disruption; growing, becoming even stronger and more profitable, and running our business more responsibly, all of which have enabled us to increase cash dividend per share 2.3 times since 2014, proposing to the 2020 Annual General Meeting a total dividend per share charged to 2019 results of €0.23, of which €0.20 would be paid in cash, a c.3% increase in our cash dividend per share this year. I believe the market does not yet recognise this progress.

Meanwhile, although our purpose - to help people and businesses prosper - remains unchanged, our aim now reflects the challenge of the digital era: to be the best open financial services platform by acting responsibly and earning the lasting loyalty of our people, customers, shareholders and communities. Later in the letter I will describe what building that financial services platform means in practice. First, I want to cover the fundamental strengths of our business, and how they are delivering growth and value.

Part 1: Continuity

A solid investment in an unpredictable world

2019 was another year of global volatility, with an economic slowdown, continued regulatory pressure and negative interest rates in Europe, a trade war between the US and China, and Brexit-related uncertainty. While this instability affected Europe and European banks disproportionally, we once again comfortably met our growth, profitability and strength targets thanks to the disciplined execution of our strategy.

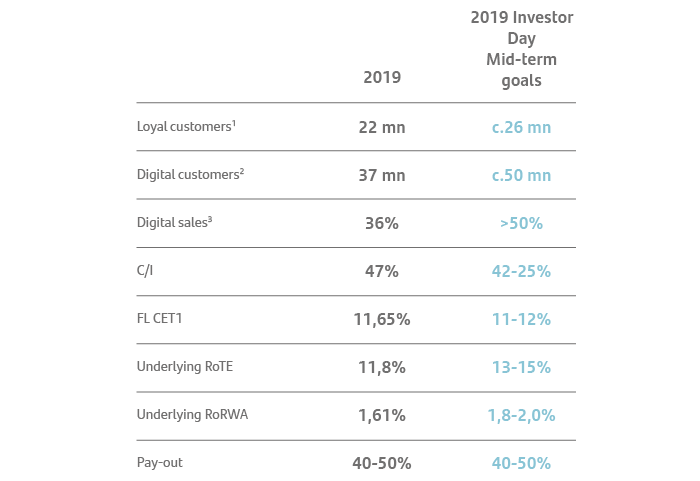

- Growth: We grew loyal1 and digital customers by 9% and 15%, respectively and, as a result, our customer revenues grew by €1.7 billion in the last year – or 4%, year-on-year in constant euros.

- Profitability: Our top-line growth, together with our unrelenting focus on efficiency and improved capital allocation, enabled us to deliver an underlying return on tangible equity (RoTE) of 11.8% at the end of 2019, on a higher capital base.

- Strength: Our growth and profitability helped us further strengthen the Bank. We delivered a fully loaded Common Equity Tier 1 (FL CET1) capital ratio of 11.65%, generating a record 97 basis points of gross capital in 2019. We are very comfortable with our capital levels and the buffers we have in excess of the regulatory requirements and are well positioned to take advantage of the significant profitable growth opportunities we see across the Group, while maintaining an attractive remuneration policy for our shareholders.

Since 2014, we have increased our FL CET1 ratio by 338 basis points while growing the business and returning €17 billion in capital to our shareholders and AT1 bondholders – a significant achievement considering the significant increase in regulatory capital requirements, including the interest rate environment which in the beginning of 2014 was 80 basis points higher than by the end of 2019.

1 Active customers who receive most of their financial services from the Group according to the commercial segment to which belong.

2019 Underlying profit / 2014: €5.8 bn / 2013: €4.2 bn

FL CET1 from 8,27% in 2014

EPS since 2014

Cash DPS since 2014

TNAV per share since 2014

2019 Underlying profit / 2014: €5.8 bn / 2013: €4.2 bn

FL CET1 from 8,27% in 2014

EPS since 2014

Cash DPS since 2014

TNAV per share since 2014

EPS: earnings per share

DPS: dividend per share

VTNC: net tangible book value

CET1 FL: common equity tier 1 fully loaded

A bank with strong foundations

Our success over the past five years is built on three foundations that are at the core of our strategy.

The first is our customer-centric approach, focusing relentlessly on helping people and businesses prosper. When I was appointed, we adopted values across the Group that ensure we deliver for customers, commit all our teams to a common culture, and work in a way that is Simple, Personal and Fair. Simple means giving our customers accessible products and services that they understand. Personal means designing products and services that are suited to the specific needs of our customers, treating them as people, not numbers. Fair means honouring our promises, being transparent, and treating all our stakeholders with respect. Taken together, we call this The Santander Way, and believe it is this approach that generates the most valuable asset of the company: customer loyalty.

Our customers have never had more choice in how they bank, and they will have even more options over the years ahead as new players leverage their digital positions or carve out niche offers to enter the market. We have some powerful assets we can deploy, but none is more important than the loyalty we earn from customers, not just by keeping their money and their data safe, but by offering products and services that meet their financial needs. This loyalty generates both more predictable returns and insight, enabling us to continue to improve our service.

The second foundation is our scale. Banking has always been a business where scale matters, and that is even truer in the digital world. As a Group, we have one of the largest customer bases in Europe and the Americas, serving 145 million customers. The majority (99%) of our customers and profits come from nine geographies and Santander Consumer Finance in Europe (SCF). Locally, we are the leading bank (by lending market share) in five of the countries in which we operate, and we are in the top three in four other markets. The combination of global and local scale is a competitive advantage, as it gives us the potential to profitably grow our customer base and, as a result, our volumes and revenues, with minimal additional costs.

With today´s technologies, we can now leverage our global scale to benefit our local businesses so that we can focus on being the lowest “unit cost” player in each market.

Sometimes the benefits of scale relate to our strength in specific markets, and sometimes they relate to our strength across markets. It is our scale as a Group, for instance, that enables us to build profitable global businesses, such as Corporate and Investment Banking (CIB), Wealth Management & Insurance (WM&I) and, more recently, the Santander Global Platform (SGP). By working as a group, we are able to invest in new technology at scale, developing solutions globally, using best practices across all our countries and, therefore, reducing unit costs and the time it takes to launch new services as well as being able to attract top teams to build a world-class user and customer experience.

The benefits of our scale are evident in the efficiency of our operations, yielding a best-in-class cost-toincome ratio of 47% compared to an average ratio of 56% for our global peers.

The third and final element of our success is our diversification. Our assets and profit generation are well balanced in terms of geography, customer type and product. We are present in both emerging and mature markets, offering a broad range of products and services that cater to the needs of individuals, small to medium- sized enterprises (SMEs) and large corporations. As a result, we are prepared to adapt quickly to changing market conditions. When a new opportunity emerges within one demographic or geography, we can rapidly move resources and redeploy our capital. And we can do the same when a geography or demographic is threatened, either strengthening our offer in the face of a more challenging environment or, if necessary, investing elsewhere where the returns are higher.

Our diversification means half of our profits and 78% of our loans come from mature markets that tend to produce more stable returns and cash flows. The other half comes from higher growth emerging markets, which today represent only 22% of our loans, and tend to require investing capital so we can offer more banking services to a burgeoning middle class.

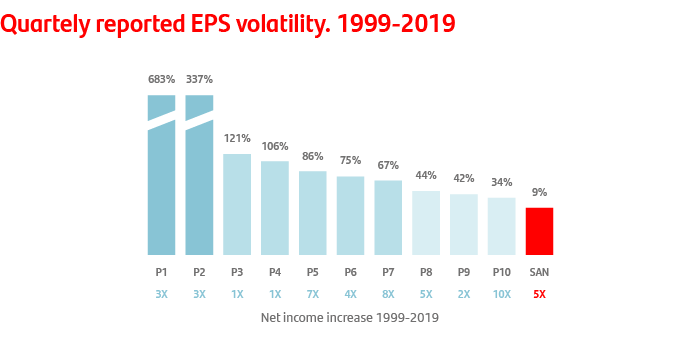

Our customer focus, scale and diversification has allowed us to deliver more predictable and profitable growth. Over the last 20 years we have increased profits by a multiple of five, while maintaining the lowest quarterly earnings volatility of our global peers. This greater predictability means we need less capital than banks with more volatile results. This was born out by the European Banking Authority’s annual stress test which, in 2019, showed once again that Santander has the most resilient balance sheet of all the banks tested.

Part 2: Change

Reinforcing our foundations

As a result of the decisions we have made over the past five years we are in a stronger position to continue succeeding in the years to come. To do this we need to change, so that we can re-enforce our strong foundations.

Our strategy has been -and remains- focused on three pillars:

- Improving operational performance by leveraging our diversification and scale across all our markets;

- Continuing to redeploy capital to our most profitable businesses; and

- Accelerating the digitalisation of our business and services to improve customer experience through Santander Global Platform.

By focusing on these three priorities, we aim to grow earnings and improve our profitability from where we are today - among the most profitable European banks - to levels normally associated with banks in the US, which means achieving a RoTE of 13-15% and an efficiency ratio between 42-45% in the medium-term.

To achieve these targets, in 2019 we simplified our management structure, which has resulted in greater agility; more effective collaboration within and across geographies; and strong executive team succession planning. Throughout the year, we took additional steps to further improve our organisation, including further training of our team members, with a special focus on digital skills, and the deployment of tools designed specifically to enhance collaboration.

Let me now take each of these three pillars in turn and discuss them in the context of our performance in 2019.

Improving operational performance

In 2019, we made significant progress leveraging the scale and talent of our Group to improve our overall operational performance in Europe, North America and South America, as well as in our global businesses.

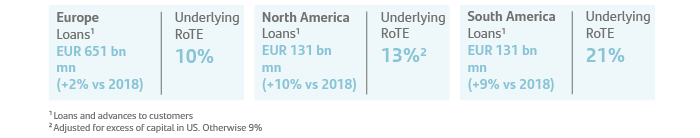

In Europe, we have a common vision for Individual and SME banking, which is successfully delivering a transformation programme that generated approximately €200 million of net savings in 2019, achieving 20% of our €1 billion net cost savings target. Except for the UK, which has been affected by Brexit uncertainties and the impact of ring-fencing regulation, all of our markets produced underlying profit growth. Europe as a region, including UK, maintained an underlying RoTE of 10%.

In North America, we are producing strong profitable growth. Mexico has made outstanding progress in its transformation, having completed a 3-year investment programme, which strengthened our retail franchise with loyal and digital customers growing by 26% and 45%, respectively, while maintaining the highest satisfaction metrics among all our subsidiaries. This progress is reflected in its profitability, with Mexico contributing to 9% of Group’s profits in 2019. We are confident in its continued growth in the medium- term, with a current approximate 21% RoTE, which led us to increase our stake in Santander Mexico up to 91.65% in 2019.

U.S. financial performance improved for the third straight year with ordinary attributable profit up 24% in 2019 and RoTE (adjusted for excess capital) improving to c.9% from 3% in 2016.

Santander Consumer USA (SC USA), the #5 retail auto finance origination business in the US, continues to deliver solid profitability with over $30 billion in annual auto originations in 2019, a stable and attractive adjusted RoTE of 20%, and a scalable servicing platform that we are leveraging to grow our 3rd party servicing portfolio.

Santander Bank National Association (SBNA), our retail and commercial banking business, increased its number of loyal customers and improved customer experience. While the current interest rate and competitive environment are headwinds to overall profitability, we continue to be focused on becoming more efficient, optimising the branch network, and leveraging the Group to deliver enhanced digital capabilities to our US customers.

In South America, the number of loyal and digital customers grew by 7% and 15% respectively in 2019, and we now have 54 million customers. Profits increased from €3.5 billion to €3.9 billion in the same period (37% of total Group) with total loans of only €131 billion (15% of the Group). Our growth in this region has been led by Brazil, which delivered its best results ever in 2019.

1 Loans and advances to customers

2 Adjusted for excess of capital in the US. Otherwise 9%

Supporting our three regions are our global businesses: Corporate and Investment Banking (CIB), Wealth Management & Insurance (WM&I), that together contributed 26% of the Group’s profits, and Santander Global Platform (SGP), which increasingly enables us to offer a “One Santander” proposition to customers worldwide. Together, they drive network effects and enhance the competitiveness of our local offerings.

#1 renewable energy Project Finance in 2019

CIB continues to demonstrate strong growth, leveraging its customer- centric approach and capital-light model. Underlying attributable profit was 10% higher year-on-year, driven by strong growth in revenues and lower loan-loss provisions, while the return on risk-weighted assets (RoRWA) improved to 1.8% - one of the best amongst our competitors in this business. Today 42% of global CIB clients’ revenues come from cross-border transactions. We have been recognized as leaders in renewables financing per number of deals on Dealogic league tables. In 2019 CIB issued the first ever end-to-end Blockchain bond, opening the door to a new technology with endless possibilities.

WM&I continues to steadily close the gap with our retail market share. Total assets under management grew 13% to €395 billion in 2019, and underlying attributable profit grew 11% in constant euros to €1.0 billion, while total contribution to profit after tax reached €2.5 billion (including profit after tax and net fee income generated by this business). In Private Banking we launched a global value proposition so clients can access a global platform of products and services that cover their worldwide needs, and we were recognised as the best Private Bank by Euromoney in Spain, Portugal, Chile, Mexico and Argentina. In Asset Management, we gained market share with c.€6 billion in net positive sales, and in Insurance Gross Written Premiums exceeded €8 billion, up 13%. As part of our responsible banking initiatives, we launched our Wealth Management environmental, social and governance (ESG) sustainable value proposition, and we already have c.€7 billion in this category.

Reweighting capital to our most profitable businesses

We deployed more capital in North and South America, where we see our highest return-on-equity and profitable growth potential, especially in countries with young populations and low banking penetration, such as Mexico and Brazil.

At the same time, we have been investing more capital in high growth, high return businesses (such as insurance and asset management), and we divested capital where we saw less opportunities. We also combined low growth businesses with partners to make them even more competitive and improve returns on capital, such as the strategic agreement to combine our securities services business with CACEIS. As a result, more than 70% of our capital delivered double-digit returns in 2019, with more than 30% delivering an underlying RoTE above 20%.

The improvement in our operating performance, combined with a continuation in optimising capital allocation, enabled us to enhance profitability from a segment and portfolio perspective. In 2019, 73% of the Group’s risk-weighted assets generated returns above a reference RoRWA of 1.20% which is well above our cost of equity, and our Group underlying RoRWA increased to 1.61% from 1.59%.

Accelerating digitalisation

Brazil:

-99%

Cost of money transfer

Poland:

-72%

Cost of opening an account

Underpinning our profitability and growth in 2019 is the progress we have made to digitalise our banks. We have a clear strategy to transform how we interact with our customers by rethinking the way we use information to power our customer insights. This is enabling us to personalise and customise our service, enhance the way we manage risk, and protect customers’ data even more securely. As a result, we are able to deliver the best customer experience in every product and service, creating loyalty amongst customers who are better served by us, and reducing the costs of our operations as we can deliver products more efficiently while improving quality of service. I am particularly pleased that we have achieved the top 3 Net Promoter Score (NPS) in 6 out of 9 geographies.

Our digital performance in 2019 improved across the board. The number of digital customers has increased dramatically, both in absolute terms and as a share of our overall customer base. We now have 37 million digital customers, a 15% year-on-year increase, representing 51.7% of our active customers.

Mobile is again fuelling this growth with mobile customers growing at 40% year-on-year.

Digital customer engagement, including the number of transactions made, is increasing as well. Digital customers engage online 5 times per week, resulting in approximately 700 million digital “touchpoints” per month. In addition, mobile sales have grown at twice the rate of 2018. As a result, 36% of new products sold in 2019 were through digital channels, growing steadily and reaching 39% in December 2019, a 7 percentage points increase compared to the same month in 2019.

This level of engagement gives us more data and therefore greater insight into our customers, enabling us to better answer to their needs, and improve our underwriting and enhance returns as a result.

This in turn creates greater loyalty and better profitability: our digital customers are already more loyal than our branch-only customers and are also 2-3 times more profitable.

Santander Global Platform

I have already briefly mentioned our newest global business, Santander Global Platform (SGP), but I would like to explain it in greater detail, as it will transform the Group, driving our growth in the medium and long- term. Our vision for SGP is to be a single, open platform that provides payment and other services, in a software as a service (SaaS) model across our global footprint, first to customers and our banks, and over time to third parties and external developers. By collaborating across our regions and leveraging our scale and expertise in payments and financial services, we can quickly and efficiently build our own digital assets and fintech solutions that can be scaled across the Group. This will enable us to build a global leader in payments and digital banking solutions, which are key drivers of customer loyalty both for individuals and SMEs.

Today, SGP’s value proposition for SMEs and individuals is based on high-growth, large addressable markets in which we are already delivering results:

Accumulated investment in Getnet

EUR 535 mn

ROI to date

52%

Global Merchant Services (GMS) is our global acquiring solution built on the back of Brazil’s Getnet.

Our single platform will allow us to integrate multiple markets and third parties in a multi-tenant structure with a single competitive catalogue of payment products and value- added services.

Our plans aim to reduce our average cost per transaction by c.30% by 2022, to increase our competitiveness in our local markets as well as in the regional and global e-commerce space, where specialisation and scale are key to compete.

Getnet’s proven success in Brazil, coupled with our global scale (€150 billion equivalent acquiring turnover annually) and market presence (12% market share in Brazil, 16% in Mexico, 15% in Spain4 and 20% in Portugal), should enable us to successfully execute our expansion strategy to 8 countries in Latin America and Europe by 2021.

Global Trade Services is our single global platform to serve SMEs that trade internationally and require international payments and FX; trade finance; and multi-country accounts. This is a large, high growth market in which we already have 200,000 SME customers.

To accelerate our plans, last November we announced the acquisition of a 50.1% stake in Ebury, a best-in-class trade and foreign exchange facilitator for small and medium-sized companies. We expect the transaction to close in the next few months, once we receive regulatory approvals.

Ebury brings best-in-class technology, a top-notch team who shares our values and vision and a high growth track record, with customers increasingly transacting with them (+20% transactions per customer in the last 2 years) resulting in signifi nt top-line growth (+45% revenue year-on-year).

By combining the strengths and customers of Santander with those of Ebury, we aim to become the leading proposition for international SMEs in Europe and the Americas. After GTS’s initial service launch in 2020, we plan to extend GTS to 20 markets in the medium-term.

In terms of SGP’s offer for individuals, we have two complementary digital banking solutions that allow us to serve the full spectrum of individual customers.

For individuals who require a simple, flexible “pre-banking” service, SGP offers Superdigital, our financial inclusion platform that enables us to meet the fiancial needs of the underserved in a cost-effective way, providing them with basic fiancial products and a path to access credit, and thus serving them responsibly and profiably.

Superdigital also integrates with GMS for small merchants - just one example of the power of SGP, where our solutions work together for more seamless, personalised experiences and deeper customer relationships.

With a special focus on Latin America, where there are around 300 million unbanked and underbanked consumers, Superdigital is one of the best examples of responsible banking as it delivers profit with purpose.

As of today, Superdigital operates in Brazil, Mexico, and Chile and is growing active customers at c.60% annually and transactions almost 2 times faster. Our goal for Superdigital is to scale the business across 7 markets in Latin America in the medium-term.

High-single digit EPS

3Y-CAGR1

c.12%

FL CET1 in 2020

1 2019-22 underlying EPS CAGR

Finally, we have Openbank, our global, full-service digital bank that covers most of the usual fi ncial needs of both the mass and affluent markets. Openbank offers a superior experience compared to neobanks due to its full suite of products that go beyond the traditional digital current account and simple card.

Openbank customers are more loyal and engaged, 42% of total active customers are loyal, and these customers on average use 4.4 products versus one to two products in the case of neobanks. Meanwhile, payroll accounts are growing at 16% year-on-year. We are seeing very strong growth trends both in assets and deposits, with mortgage sales growing at 134%, and revenues growing 12% over the last 12 months.

Openbank is already operating in Spain, Germany, the Netherlands and Portugal and we plan to scale it to 10 markets in the medium-term, including in the Americas.

4 Excluding Popular EVO

1 Active customer who receive most of their financial services from the Group according to the commercial segment that they belong to.

2 Every physical or legal person, that, being part of a commercial bank, has logged in its personal area of internet banking or mobile phone or both in the last 30 days.

3 The percentage of new business carried out through digital channels in the period.

Part 3: Looking Ahead

We will continue to change as we strengthen our core foundations -customer focus, scale, and diversifi- to ensure sustained success. We need to change the way we work, even what we do, and fully embed a more collaborative culture to achieve our medium-term goals, including delivering a high single digit EPS CAGR over the next 3 years.

To achieve these targets, our approach is simple: we will continue to execute against the three pillars that have served us well in 2019.

In Europe we are building towards our 2025 vision of banking for individuals and SMEs based on a simplified product structure and an even greater customer-based approach leveraging both our digital and physical capabilities.

We expect profitable and efficient growth as we launch Openbank in new markets in Europe and leverage the Openbank platform across Santander Consumer Finance business franchises to deliver full banking services to its customers while running our consumer business on a modern, efficient and state-of-the-art tech platform. These initiatives, together with the execution of the second phase of our common European banking platform, as well as the expansion of CIB and WM&I across the continent, make us confident of achieving our 12-14% underlying RoTE mid-term target in Europe.

In North America, we will continue to deploy capital to Mexico in 2020 to capture the expected high market growth, and in our U.S. business, we expect to continue growing profit at double digits in 2020. We are optimistic about our U.S. business with one of our highest priorities being transforming SBNA. We are also focused on growing our CIB and Wealth Management businesses in the U.S. We are on track to meet our Investor Day targets by leveraging our competitive strengths and collaborating as a Group on Digital transformation and on our global value proposition for clients.

As in previous years, we expect to continue to redeploy capital to South America given high long-term RoTE expectations as a result of high credit demand in the region that will be supported by the progressive development of the middle classes. One case in point is Brazil where, in a stable macro environment, its low banking penetration means that banking is a leveraged play to the economy.

We have been successfully implementing a payment strategy in South America with the roll-out of a regional credit card positioning, the launch of Superdigital and Getnet in Chile, and in the years to come in the whole region. We are also focusing on rolling out our successful long-standing consumer finance model in Brazil operating successfully for decades, to all countries in which we are present in South America, exporting similar digital experience and risk models.

In our global businesses, our goal for 2020 is to continue transforming CIB by becoming strategic advisors to our global clients; accelerating the originate to distribute model; and reinforcing our commitment to the responsible banking agenda, achieving double-digit growth in profits and maintaining profitability.

We expect Wealth Management & Insurance to deliver double-digit growth in profits in 2020 as we expand our global platform for Private Banking. In Asset Management, we will grow by offering new products, and by combining our physical distribution with our digital platforms in the UK, Spain, Brazil and Openbank. We expect our Insurance business to grow across all sectors but especially in our non-credit related products, with digitalisation playing a key role, especially in South America.

On the digital front, we will continue to progress in 2020 with the aim of building out common technology platforms across the Group as our top priority, to drive greater efficiency and agility while deepening our customer relationships and strengthening loyalty. This will be driven in large part by the development of SGP and the digital transformation teams across the Group working with our Group T&O to ensure convergence both amongst our regions, as well as between SGP and other banks in the medium-term. As set out in the previous section, we are already seeing that SGP is positioning Santander to access new markets and sources of value creation. But this is only the beginning. More global solutions for both businesses and individuals are in various stages of development, all with an eye towards providing Simple, Personal and Fair products and services that help us deliver for our clients the Santander Way.

As a result of continued execution on our strategy and considering our 2019 FL CET1 of 11.65% as well as our historical 5-year track record of generating on average 40 basis points of capital per annum, we would expect to be close to a FL CET1 of 12% by the end of 2020. This would place us at the top end of our 11-12% medium-term goal. We expect some quarterly volatility in 2020 associated with the closure of several transactions. Reaching the top end of our capital goal would mean that we no longer need to accumulate capital, thus providing additional strategic flexibility in terms of deploying capital toward organic profitable growth across our footprint or returning capital to shareholders.

One of the 25 best companies to work for at global level

Most sustainable bank in the world

Part 4: Profit with Purpose

The expectations of banks and large companies are changing – our commitment to our communities, the economies we serve and the environment we all depend on is now permanently at the centre of social and political expectations of us. As a large business we have unique ability to make a positive contribution to big social and economic challenges. I want Santander to be a leader in this area -and I am convinced that we will return value to you by doing so.

Ensuring that we run our business responsibly, and that we deliver profit with purpose, has been core to Santander’s approach to banking for generations. Although there is always more to do, we have received global recognition for our efforts. Last year we were named one of Forbes’s “2000 best regarded companies”, and we were the most sustainable bank in the Dow Jones Sustainability Index. As well as this, we were named one of the top 5 most trustworthy banks in the Financial Times’ Annual Bank Image Survey, and one of the world’s 25 best workplaces by Fortune and Great Place to Work.

This final accolade is worth flagging. A great place to work is a business where the team shares a sense of purpose, which motivates them to go the extra mile for customers, earning their loyalty. To do that, we must do the basics of banking brilliantly. We also need to show that we are doing what we can, as part of our day to day operations, to tackle today’s global challenges and improve local communities.

This is about much more than just words. It is about the actions we take. For many years we have supported universities, making us the largest corporate sponsor to higher education in the world. Our support is focused on 3 Es: Education, Entrepreneurship and Employability. In 2019 alone, we supported nearly 70,000 university students through scholarships, entrepreneurship programmes and internships and access to jobs - proof of how we are fulfilling our purpose of helping people and businesses prosper.

Now we want to go further and do more to help address the big global challenges we face. Many of these present commercial opportunities, such as climate change or financial inclusion. For example, last year we raised and facilitated €18.6bn in green finance; issued our first green bond (of €1bn); financially empowered 2.0 million people; and supported micro - entrepreneurs with €277 million of lending balance by the end of the year. These activities deliver profit with purpose.

In 2019, we published our pledge on responsible banking, in which we made a number of commitments to which we expect to be held accountable. By 2025, for example, we aim to financially empower 10 million people through programmes to deliver banking services to those who were previously unbanked. Tackling climate change is a responsibility for each of us, and for every company. It poses an existential challenge to our communities and economies. This is an emergency, and we need to act as if it is one. We are doing our part, helping our clients in the transition to a low carbon economy, stepping up plans to contribute to the Paris Agreement goal to keep the increase in global average temperature well below 2°C above pre-industrial levels pursuing efforts to limit the temperature increase to 1.5 °C, as well as increasing transparency and disclosure in line with the recommendations of the Taskforce for Climate Related Financial Disclosures.

We have committed to be “net 0” in carbon emissions as a Bank in 2020, both by reducing our own emissions and compensating the balance.

Conclusion

Santander has generated profits and paid dividends to its shareholders for more than 50 consecutive years. This is a company - and an investment - that benefits from a combination of strength, profitability and more predictable and sustainable growth than its peers. In this year’s letter, I have shown why. First, the unchanging foundations that underpin that performance: our customer focus, our scale and our diversification measured both geographically and by our range of customer segments and products. And second, a culture which drives our ability to embrace change, to build, to grow and, in some cases reinvent, the foundations with each passing year. Only by seizing change will we be able to maintain the strong foundations on which the success of our business is built.

I am immensely proud of what the team has achieved over the past five years. But I am also convinced that, for all the dramatic change we have seen in the last decade, the next decade will bring even more. Our business model, our competitors and the global economy are all evolving. The basics of banking may not change, but almost everything else about banking is changing, or will change. Our customers will continue to look to us to be a source of stability, just as you will continue to look to us to deliver value. I am committed to delivering both.

Let me end by saying thank you to each and every member of the Santander team: you make the bank what it is - and our success is powered by your dedication, energy and commitment. Thanks to the Board of Directors for your insights and guidance – and especially to Guillermo de la Dehesa, Ignacio Benjumea and Carlos Fernández who are standing down from the Board after many years’ service. And, finally, thanks to you our shareholders, for your loyalty to Santander.

Ana Botín

Executive Chairman