Banking of Things: What is it?

Instead of going to the supermarket, imagine your refrigerator could buy groceries online and pay with its own virtual wallet or card. Here we tell you about the groundbreaking "Banking of Things" and how it can help you.

The Internet is undoubtedly one of the most powerful inventions ever. Since its inception in the 1970s, the World Wide Web has continued to evolve, enabling us to work, study, play, buy, sell and do so much more online.

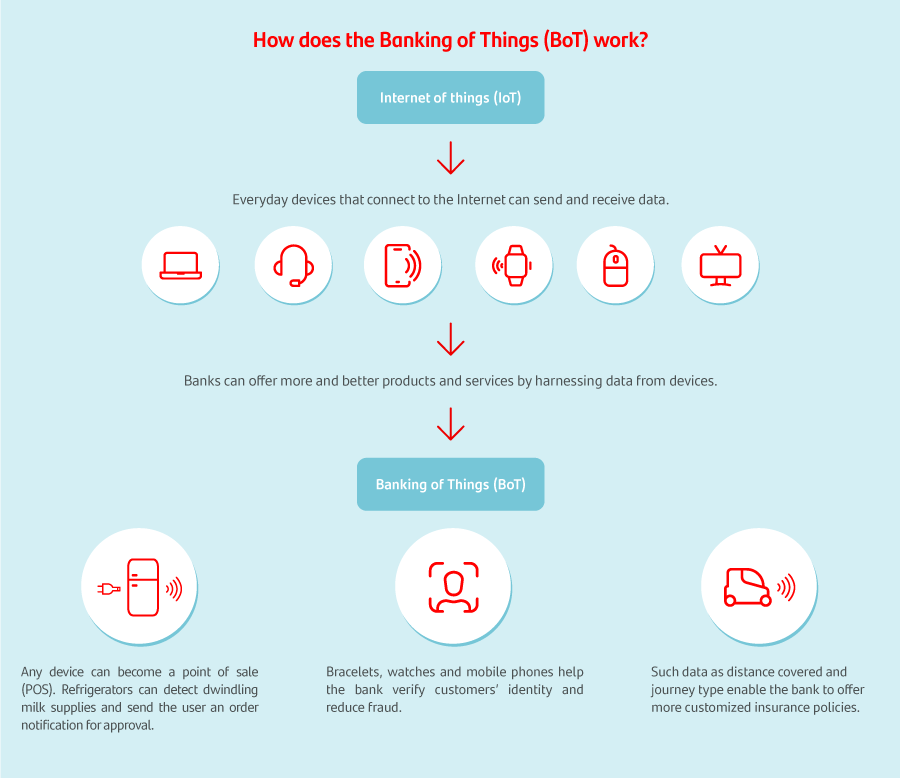

It has even evolved to allow not just people to interact but also things. Two or more connected devices can exchange data without the need for human intervention. That is what’s known as the Internet of Things (IoT).

Smart watches and bracelets usually spring to mind when we think of the IoT. Their sensors track our number of daily steps, sleep quality, calories burned during exercise and other data, and then transfer them to a smartphone or computer. But that’s not all: We can control light bulbs from a smartphone; kitchen robots let us know when food is ready; and refrigerators give us a heads up when we’ve run out of milk and eggs. The list is endless.

According to the Cisco Annual Internet Report, more than 29.3 billion devices will be connected to the Internet in 2023, and most will be at home or on transport. Since the world’s population stands at 7.9 billion, there will be over three times more connected devices than humans.

What is the Banking of Things?

In the near future, the number of devices able to connect to the Internet and channel data will continue to soar. The Banking of Things (BoT) is infrastructure that harnesses information from devices to offer more and better financial services to people and businesses.

It performs banking services through the Internet of Things. Devices can execute financial transactions automatically as part of their functionality. For instance, picture an Internet-connected washing machine that can order detergent from a supermarket or online store when it’s running low. For that, it would need a virtual wallet with sufficient funds or a registered bank card.

An electronic device that could administer its own spare parts, replenish products or notify the manufacturer of the need for a replacement at the end of its shelf life would become a point of sale.

Further developments to the Internet of Things will furnish the Banking of Things with more tools to enhance and create products and services that meet people’s needs. What if the cost of car insurance could be calculated based on travelled distance, frequency of use, destination and other information collected by the vehicle?

Security is crucial in the BoT. Smartphones, wearables and other devices enabled with geolocalization will help fight fraud. Cross-checking the device’s location data with ATM or branch information is enough to thwart identity theft and other crimes.