Biometrics, the future of security in digital banking?

Today, it is possible to verify our identity using a selfie, our voice or by placing our finger on the fingerprint reader of our mobile phone. Using those features that make us unique is a simple, secure way to access online banking services.

Human beings have physical characteristics that make each of us unique and serve to differentiate us. We are talking of unrepeatable features such as our facial features, fingerprints and voice. These types of features are called biometric data and they are becoming increasingly important when it comes to security in digital banking.

Just as we can identify our family and friends by simply seeing or hearing them, technology has managed to endow devices such as mobile phones, computers, tablets or video door phones with the same ability. This protects private data and physical and virtual facilities from access by third parties.

As we have said, biometrics uses those unique, non-transferable features of the human being, so the authentication of security systems consists in creating and saving a model or data map that represents the user exclusively and serves to confirm their identity when they request access, whether to physical or virtual spaces.

Examples of biometric authentication in digital banking

In the banking sector, the use of these biometric authentication systems represents a step forward in the protection of user data, for example by replacing or strengthening traditional alphanumeric passwords. They also serve as a reliable, fast and convenient method of verification when using or purchasing products and services. Here are some examples:

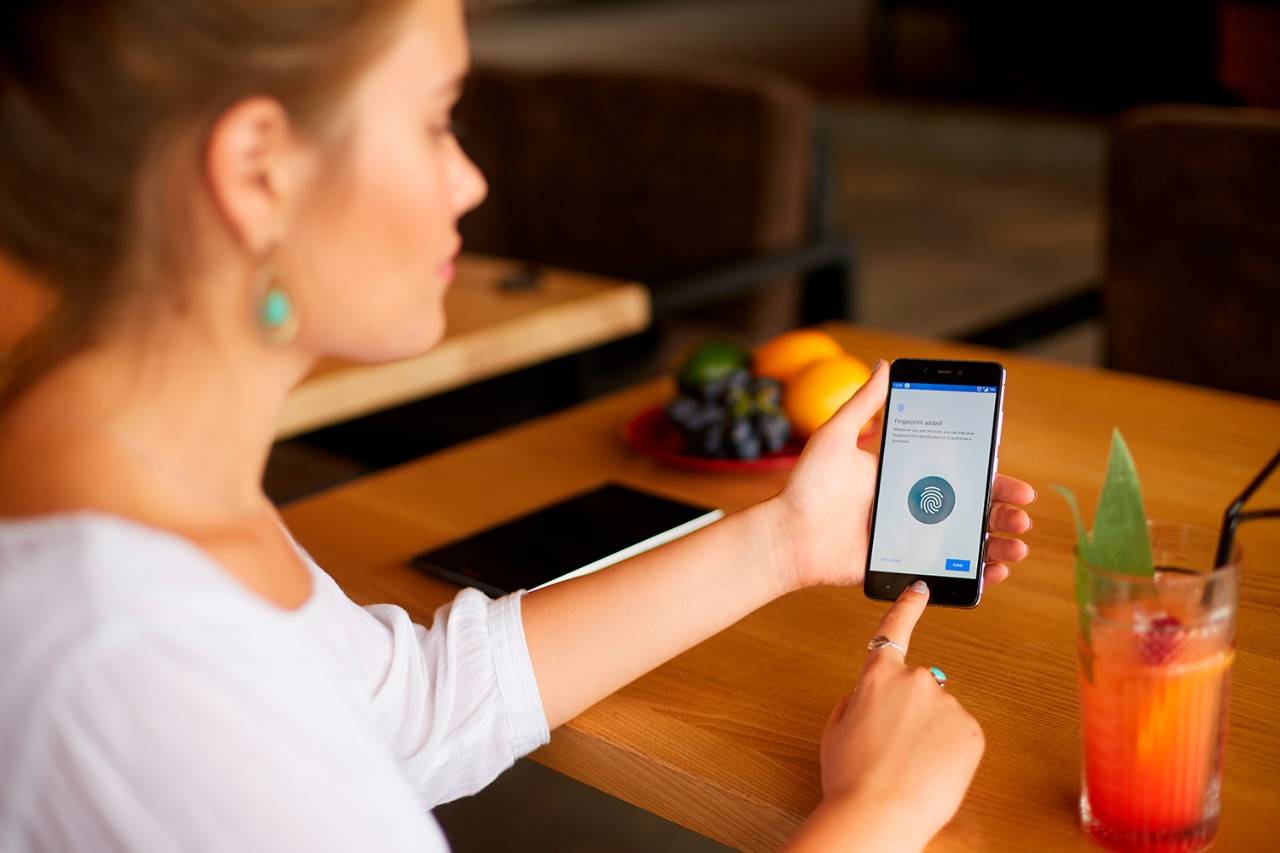

Fingerprint

It is undoubtedly the most well-known and traditional biometric method. These are the shapes we have on our fingertips, which form a unique pattern that serves to identify us. Most smartphones currently have a fingerprint reader, so it is possible to use it to perform day-to-day operations such as activating your mobile phone to make a payment or accessing digital banking.

Facial recognition

This works the same as our eyes when they identify a particular person: through the features of the face. Using the device’s camera (such as mobile phone, computer or tablet), the image is captured and a mathematical pattern is created to associate it with an identity, taking into account aspects such as distance between the eyes, position of the nose, size of forehead, etc.

In digital banking, for example, it is possible to open a bank account with a smartphone, using the camera to send a photo of ourselves and our identity card in order to compare the two images and verify the data.

Voice recognition

This method of biometric verification works the same as the fingerprint or facial recognition. The difference is that the data taken into account for identity verification are those related to voice, such as frequency, speed, cadence and other characteristics. In the banking sector there are examples of its application in telephone customer services, where individuals can prove their identity in order to access information about their products or, in the case of users who cannot visit their bank branch, to carry out one-off transactions.

Advantages of biometric authentication

Biometric identification in the digital banking sector has several advantages. Convenience and simplicity of use is undoubtedly one of them. Whether it’s placing our finger on a reader, taking a photograph or simply speaking over the phone, none of these actions involves any great difficulty, as could happen with passwords or codes, which need to be remembered.

As no two fingerprints, faces or voices are identical, the security of this type of identification is greater. It is also a method that significantly reduces the chances of suffering crimes such as phishing, a fraudulent practice with which cybercriminals seek to access our personal data by sending e-mails.

Lastly, one of the advantages of biometric security is its continuous innovation: as technology advances, so do authentication methods. For example, one of the most recent steps in this direction is behavioural biometrics, which takes into account a combination of factors to identify the legitimacy of banking customers’ operations, such as how they type on the keyboard, the locations from which they frequently perform operations or their purchasing habits.