A country's economic stability depends on things like the goods and services it can produce, armed conflicts, health crises, market trends and consumer confidence.

Several economic recessions have occurred throughout history, harming the finances of people and businesses across society. Governments at all levels around the world usually take action to avoid economic downturn; however, they’re not always successful. But if recessions have happened many times before, why is there the constant risk that they will happen again? What causes them? What is their effect?

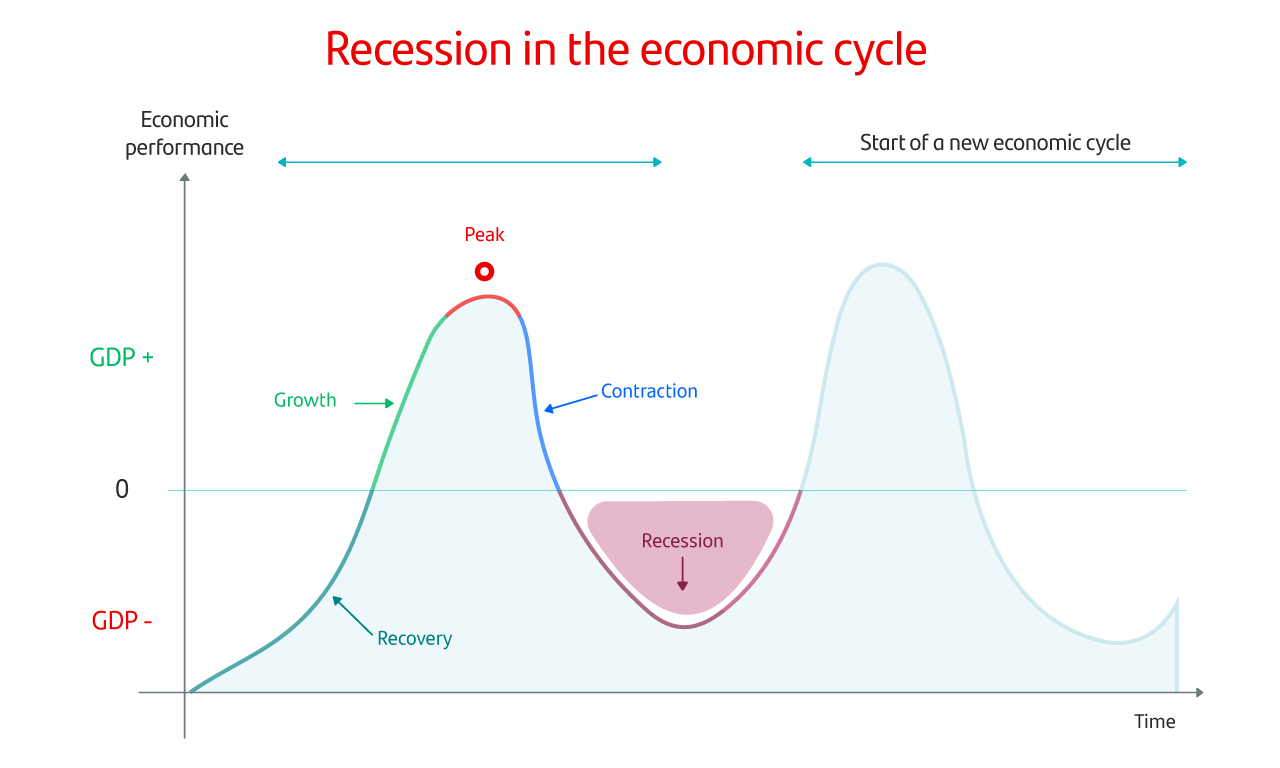

The economy goes through cycles of highs and lows, much like a wave in the ocean: when it grows, its crest comes to a peak, declines and then starts to rise again. When the economy goes up, it's called “economic growth”; but when it goes down, it's called “economic contraction” (or “downturn”).

If the economy shrinks for two consecutive quarters, it is said to have gone into recession. In general, this is determined by an indicator called the “gross domestic product” (or “GDP”). People commonly confuse “recession” and “slowdown”; however, growth indicators in a recession are negative (i.e. the wave is falling) but positive in a slowdown (i.e. the wave is rising) albeit at a slower rate than in the previous quarter.

What causes economic recession?

All recessions have different causes and effects. Economies experiencing growth are likelier to fall into recession as part of the economic cycles. However, other factors can cause recession, many of which cannot be anticipated or prevented. Here are three common causes of recession.

- Oversupply. In an economic boom, companies tend to increase production to meet consumer demand. When demand peaks and starts to decline, the excessive supply of goods and services that aren’t consumed can lead to a recession, with companies producing less and downsizing while people lose purchasing power and consumption continues to fall.

- Uncertainty. Not knowing how the economy will change makes business decision-making riskier. Wars and pandemics are two situations that can make consumer trends unpredictable in the short, medium and long term, thus generating economic uncertainty. Because businesses and people hold off on spending and investment decisions, economic activity declines.

- Speculation. In general, economic bubbles form when the price of something suddenly rises due to speculation, market trends or consumer confidence. Investors buy it up, hoping to earn a return from the price increase. However, when they start to sell it off, supply exceeds demand (i.e. there are fewer new buyers) and drives prices down, causing the bubble to burst. This happened with tulips in the 17th century and the housing market in 2008.

The longer the economic recession, the harder it is to reverse its effects, like low consumption, low investment, fewer goods and services, and unemployment. It also heightens the risk of an economic depression, the next rough patch the economy can go through.