How can we reinvent world trade shaken up by new geopolitics and climate change?

An urgent challenge where the financial sector plays a major role in finding innovative solutions for businesses.

You order online and the package arrives a few days later, or a few weeks later. Or it never arrives because there is no stock of the item you wish to purchase. These inconveniences we often put up with conceal a rather more serious problem.

We are constantly hearing about "supply chain" problems, in a bid to simplify a concept that has a much more complex dimension than it would appear. Despite its name, a supply chain is not just a number of links which breaks down if it falls apart. The profile is more like a tree in which a number of branches lead into a common trunk.

This poses a problem because the chains operated by large corporates, such as mobile phone manufacturers, are so complicated and non-transparent to make all components take, for example, the same measures for climate change or keep ahead of possible local problems, that this becomes a colossal challenge. Each hub is a point of vulnerability, which could break up and send out damaging waves in all directions along the chain.

Economic globalisation has led to the relocation of many production processes by a large number of companies trading all around the world. The most common format, “just in time”, which attempts to reduce costs by moving goods at exact times to avoid storing up excess amounts of components, worked well while demand could still be predicted. Warnings had already been issued long ago to the effect that this format was not sustainable, and it has fallen apart.

The advent of the pandemic accelerated and exacerbated the supply chain's structural problems and its underlying imbalances. This, in addition to political tension and rising world energy prices, has now set up a "perfect storm" scenario which is compelled to address times of radical changes to demand: demand has soared for some products within a short space of time, and for others it has plunged just as dramatically.

The change in trade flows implies that traditional supply chain models are now inefficient in taking the impact of this kind of situation on board. This was further exacerbated in 2022 following Russia's invasion of Ukraine, which gave rise to major economic sanctions against Russia and has greatly affected the world supply chain, especially in the wake of rising oil and gas prices.

Will we ever get back to a situation "like it was before"?

Forecasts by experts point out that we will not be returning to a pre-pandemic scenario, because another risk has emerged worldwide, an underlying permanent risk, which is kicking at the supply chain. In addition to the disruption of the pandemic and the troublesome geopolitical situation, we also have the systemic effect brought about in the supply chain by climate change before and after 2020.

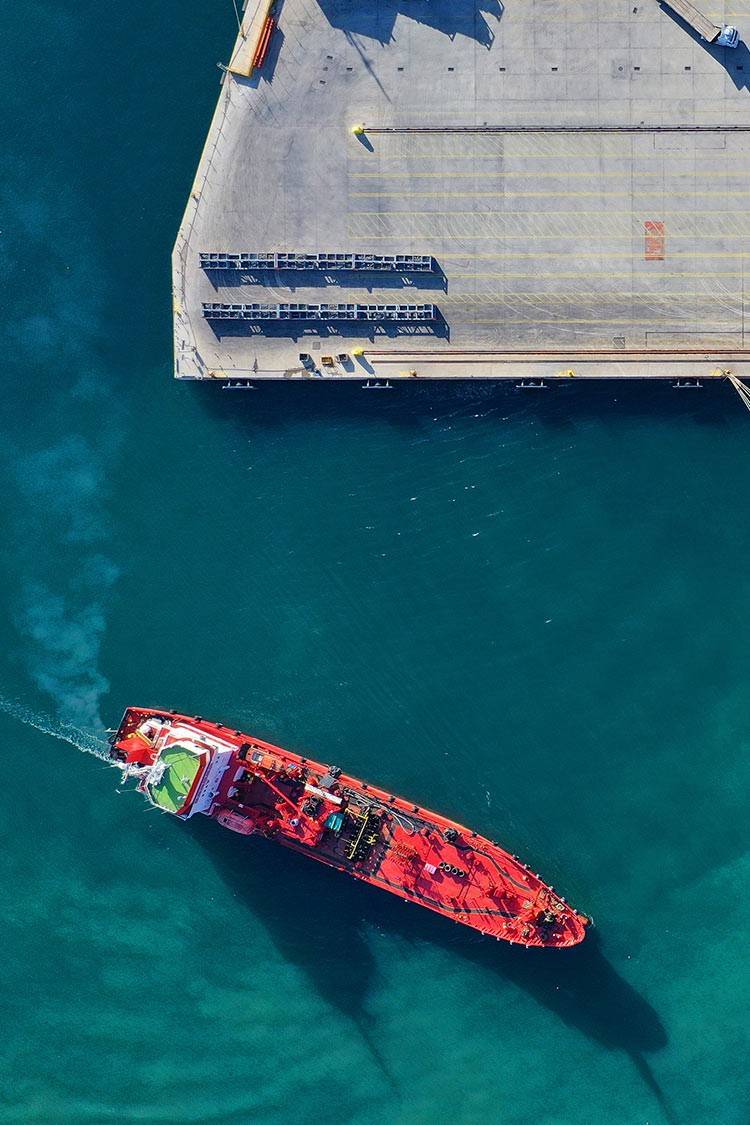

Extreme phenomena such as hurricanes, flooding, forest fires etc. are shaking up the world economy, and are increasingly noticeable in ports, on roads and in factories. And there are no indications that it will get any better. Academics and experts claim that the impact of climate change on the supply chain is being given the least publicity, even though it is posing a much more serious threat with persistent effects in the face of temporary factors such as the pandemic or the war in Ukraine.

The big problem, as pointed out by Dale Rogers, business professor at Arizona State University, in an article in Wired magazine, is that "logisticians are always trying to execute the strategy but not necessarily develop it. They're trying to figure out how to make something happen now, and climate change is a long-term problem". Of all the threats, the most pernicious is the rising sea level caused by the increase in the global temperature, and ports, railway lines, roads and other transport and supply infrastructures will be affected by sea levels rising between 50 cm and 2 metres.

Far from being a problem that merely affects infrastructures or transport, the supply chain is actually interconnected to many other factors, which can bring about a domino effect in that disruptions can intensify and propagate within the world economy, with impacts such as higher prices and shortages of all kinds of goods, from basic agricultural products to the latest electronic goods. By way of an example, the cost of transporting a container in the Pacific Ocean rose from USD 2,000 to USD 15,000 before and after the pandemic.

Path to be taken and solutions

This means we are facing a post-pandemic "new normality", potentially extremely volatile, with an urgent need to be prepared. Tools are required to manage commercial operations with greater flexibility and at the lowest possible cost, in a context of energy transition for corporates.

Some of the solutions being implemented ahead of possible interruptions of supply chains, are larger inventories or dual supply chains - with two paths or routes to bring in the same product. This, however, only prevents shortages, and boosts production and stocking costs.

The challenge, therefore, lies in generating a total change of suppliers and concentrators at all levels. In this panorama, large finance corporates such as Banco Santander have a particularly important role to play, and they also have the responsibility of helping businesses overcome challenges and find innovative solutions.

Securing supply and the need to accumulate large amounts of inventory under the new "just in case" model has been perhaps the most common logistical problem today and with the greatest impact on companies' balance sheets and cash flows. From a financing perspective, Santander Corporate & Investment Banking (SCIB) has developed solutions to help our clients manage these problems without impacting their leverage and helping to improve working capital management. This is helping companies to develop greater capacity and flexibility in transport infrastructure, strengthen safety stocks and inventories, make logistics operations more agile and digitised, offshore critical components and find alternative supply arrangements to reduce dependence on their current networks, all with a positive impact on their financial statements.

Simultaneously, we must not lose sight of the transition towards a greener economy. Not only does it help decarbonise the atmosphere - Santander is carbon-neutral and is striving to be Net Zero by 2050 - and is therefore helping fight climate change and higher global temperatures on an individual basis. This spirit must also be passed on in all relations with suppliers and products, to set criteria and an example for customers. The use of green energy, 100% elimination of exposure to coal-mining by 2030 and facilitating the mobilisation of EUR 220 million in green funding are just some of the bank's initiatives and targets for a more resilient, greener future on all levels.