9M 2021 financial earnings

Banco Santander reports attributable profit of €5,849 million for the first nine months of 2021

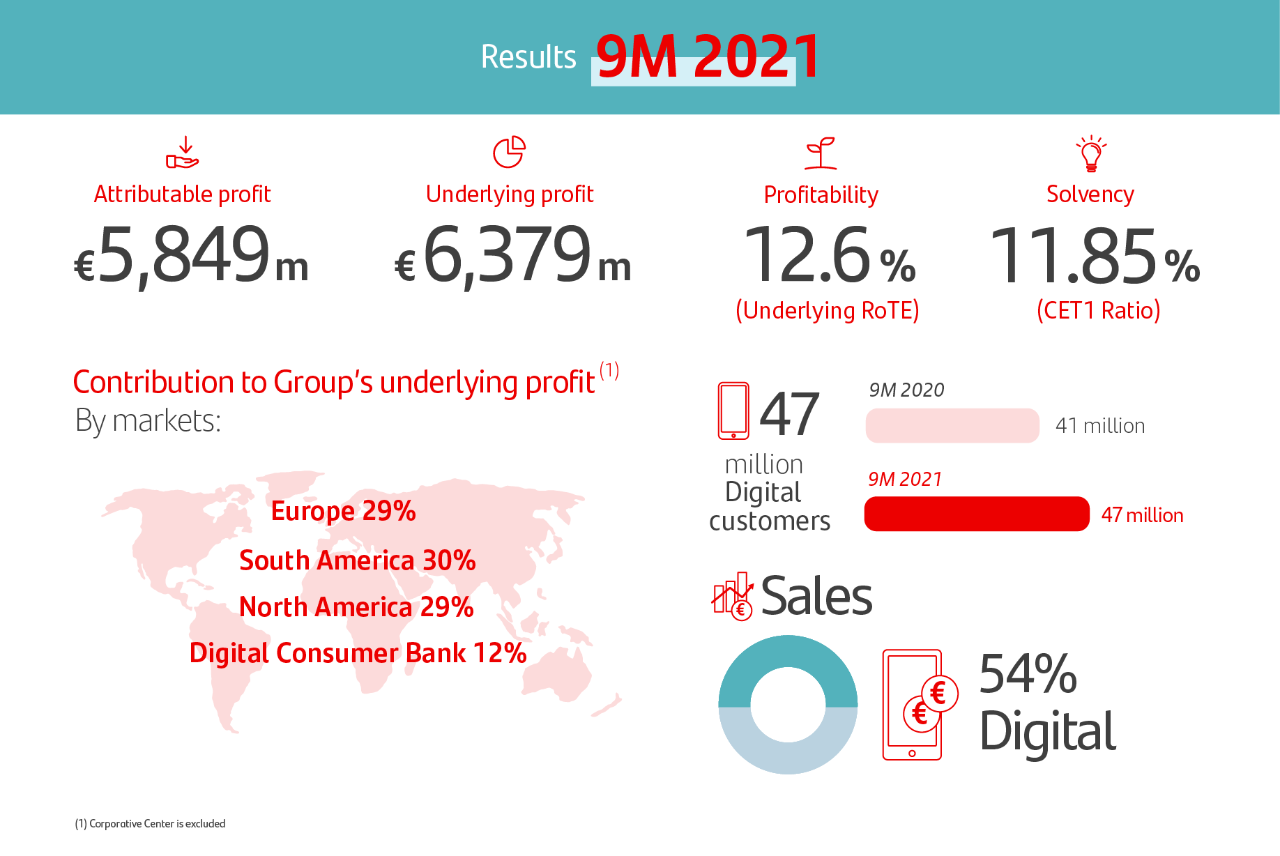

Banco Santander achieved an attributable profit of €5,849 million in the first nine months of 2021. This compares to a loss of €9 billion in the same period last year, when the bank made a non-cash adjustment to the valuation of goodwill and deferred tax assets (DTAs). Excluding net charges of €530 million for restructuring costs already announced in Q1 2021, underlying profit for the first nine months was €6,379 million, up 87% versus the same period of last year. This is Santander’s highest underlying profit in the first nine months since 2009. In the third quarter alone, the bank achieved an attributable profit of €2,174 million, an increase of 25% versus the same period of last year.

The bank’s strong performance was driven by good volume growth, with loans increasing 4% and deposits 6% year-on-year. Across the group, businesses continued to focus on supporting customers, driving revenue growth, effective net interest income management and cost control.

The results illustrate the benefits of Santander’s geographic and business diversification, with its three regions (Europe, North America and South America), making similar contributions to the group’s overall profit. Underlying profit in the first nine months nearly doubled in Europe to €2,293 million (+98%) and more than doubled in North America to €2,288 million (+122%), while it grew 31% in South America to €2,471 million. The Digital Consumer Bank also grew strongly (+17%) to €935 million.

Underlying profit before tax was €11.4 billion in the first nine months of the year, up 74%, while tax on profit in the period was €3.9 billion, resulting in an effective tax rate of 34%.

Video | José Antonio Álvarez

Key figures

Media Gallery: Financial Results

View and download high-resolution photos from the financial results here.