Robo-advisor: what is it and how do I use it?

The technological revolution is paving the way for a new scenario: Robo-advisors we can hire to manage our investments. But just how do they work?

What’s a robo-advisor?

Though it sounds like a robot that gives advice on investments, a ‘robo-advisor’ mainly manages them by automatically investing online according to investor preferences and profiles.

How do robo-advisors work?

Robo-advisors rely on automation and algorithms to manage investments. They aim to tailor portfolios to clients’ preferences, conditions, assets and goals (i.e., their investor profile, as explained by Openbank). They have a range of portfolios for each kind of investor.

The two investment types robo-advisors generally offer are investment funds (to earn returns on money) and pension plans (for long-term savings). In general, robo-advisors’ management is passive; but it can include active investing. Thus, they can charge better fees than personal advisors.

How do I use a robo-advisor?

Robo-advisor clients sign a discretionary management agreement authorizing the robo-advisor to allocate initial capital and adjust their investment to market trends.

To start using a robo-advisor, we must follow these steps:

- First, we answer a suitability questionnaire about our finances, investment goals and risk tolerance to determine our investor profile.

- Next, from a selection of portfolios that match our investor profile, we choose the one we think suits us the most.

- Then, we must open an account with the bank we choose to deposit the money we’re going to invest.

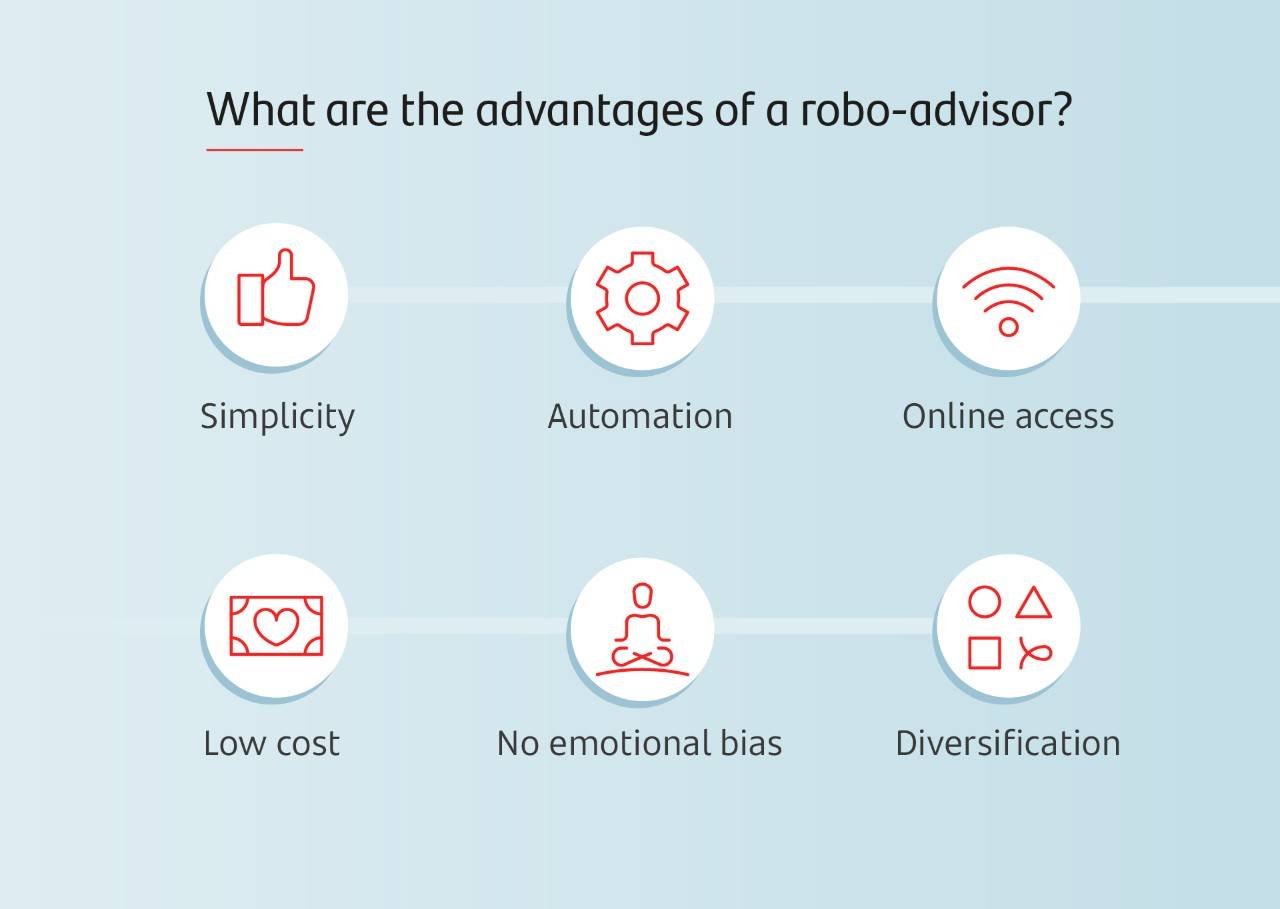

What are the pros and cons of robo-advisors?

Robo-advisors have a number of advantages. First, the simple system they give us to start investing in financial products is based solely on algorithms (and not personal instincts), thus minimizing market uncertainty. Second, their automated services lowers the cost of investing considerably. And, third, since they’re online, we can access them anytime and anywhere and get information in real time (for more details, visit Openbank).

Still, while robo-advisors are highly innovative for tailored investing, they don’t fully personalize investments because they base portfolio offers on investor profiles and not on users.

What’s an index fund and what’s it got to do with robo-advisors?

Robo-advisors’ portfolios typically invest in index funds, which aim to match a particular stock market benchmark instead of outperforming it. Since robo-advisors can make these funds standard investment options, they will often offer them to subscribing investors as high-quality, low-cost products.

Investing carries risk, including no returns and/or loss of principal. The capital value of units can fluctuate with the market. Past returns do not guarantee future returns.