What is amortization and why is it important?

Knowing the real value and useful life of our assets, and the amount we owe on, and the term of, our loans, are key to managing our finances better. Amortization is a way of finding out that information whenever we want. Here we tell you what it means and what you can get out of it.

Though you’ll have heard the word “amortization” at home and at work, you might have questions over its meaning. If we take the sentences “the car is now amortized” and “the loan amortization schedule will be five years”, they appear to point to different ideas.

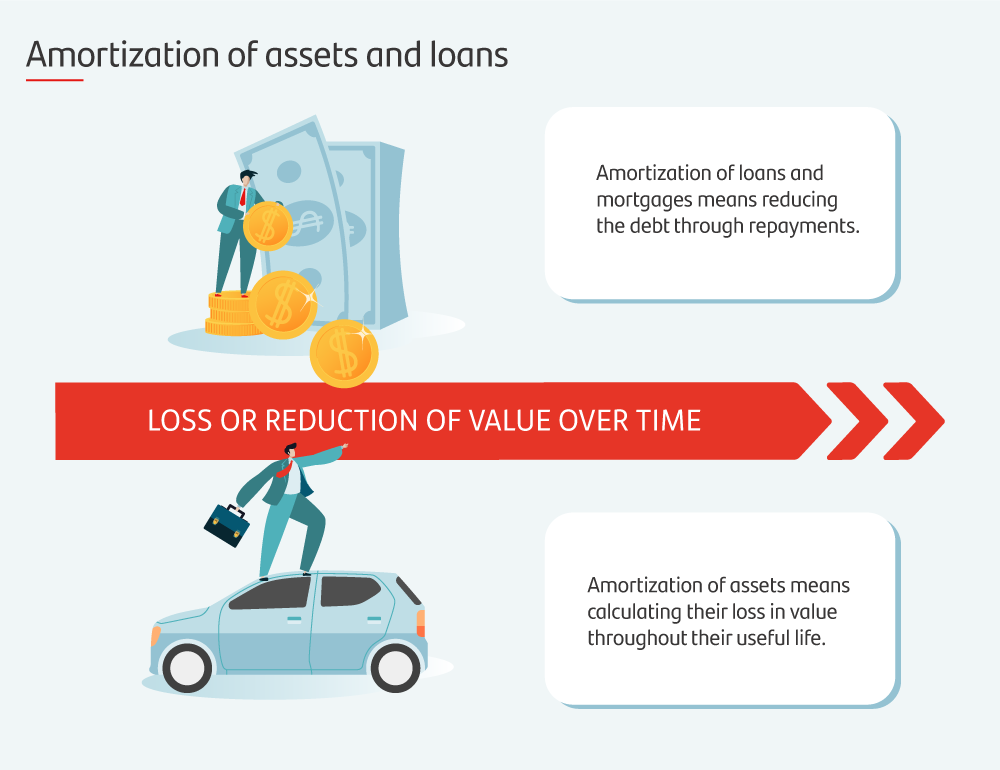

First, we should know that amortization refers to a reduction in value over time. While a car, computer or other asset will drop in worth as the years go by, the amount we owe on a loan, mortgage or other debt will fall as we make repayments. To understand what amortization means, we need to know whether we’re talking about an asset or a loan.

What is amortization of an asset?

Assets are items of property and resources we own that we expect will provide a benefit or return over a set period. A mobile phone, computer we use to study or work and the trainers we wear to go running are all assets we pay money for to fulfil a purpose.

All assets will lose their usefulness or benefit (i.e. their value) over their designated useful life. For instance, if we buy a EUR 1,000 television with a useful life of 10 years, we can say it will amortize after a decade, having served its purpose for its designated period. Its initial value will gradually drop while we enjoy using it.

We can easily work out the amortization of the television along its 10-year useful life. One of the most common calculations is annual amortization, where we divide the initial cost of the asset by its estimated useful life (EUR 1,000/10 years). The outcome is EUR 100 per year. In the first year, it’ll have amortized EUR 100; in the second, EUR 200; and in the third, EUR 300, and so on until we reach the amount we paid. If the television continues to work after the end of its useful life, it will take on a residual value.

What is amortization of a loan?

Loans can include consumer credit, a bank loan and a mortgage. Amortization in this case is the gradual reduction of the debt through the repayments we agree with the lender. Broadly speaking, loan amortization only considers the principal and doesn’t include interest.

These are the most common ways to calculate loan amortization:

- The French method. Also known as the progressive (quota) method, it consists of paying back the same amount each month until the debt is fully settled. Though instalments are equal, interest is usually owed in the beginning before the borrower pays off the principal.

- Increasing balance. As the name suggests, instalments begin lower but increase over time. People in financial difficulty at the beginning of the loan term but who envisage having greater repayment capacity in the future usually turn to this method.

- Declining balance. The borrower pays off some of the debt at the start in order to lower the interest and, therefore, reduce instalments further down the line.

When it comes to buying a house, the words “mortgage” and “amortization” usually go hand in hand. The borrower and lender agree a term by which the loan will be repaid. Check out this article by Openbank (in Spanish) on how to pay off a mortgage to make it more cost effective.

Why is it useful to understand amortization?

Now we know what amortization is, we should learn of its importance in our daily life. In addition to using amortization to calculate the real value of our assets and loans, it also helps us make decisions that contribute to better financial health.

When we buy and sell items on collaborative economy apps, we can find out the real value of those items thanks to annual amortization, which considers the original cost and the time they’ve been in use. It’s also handy to calculate the amortization of technology devices so we know when they’ll need replacing. That way, we can set aside a sum in our budget to avoid a sudden blow to our wallet.

When we need a loan to buy an asset, it helps to know the amortization schedule to avoid taking on debt for something that could lose its value before we fully settle the borrowed amount.