Everything you need to

know about bank fees

Last update: 03/11/2025

A bank fee is a very simple concept: it’s the money we pay banks for the services they provide us. Why do we pay them? For new credit cards, ATM withdrawals, bank account maintenance and other services. Here’s all you need to know about the many kinds of bank fees, how and when to pay them, and how to avoid overcharges.

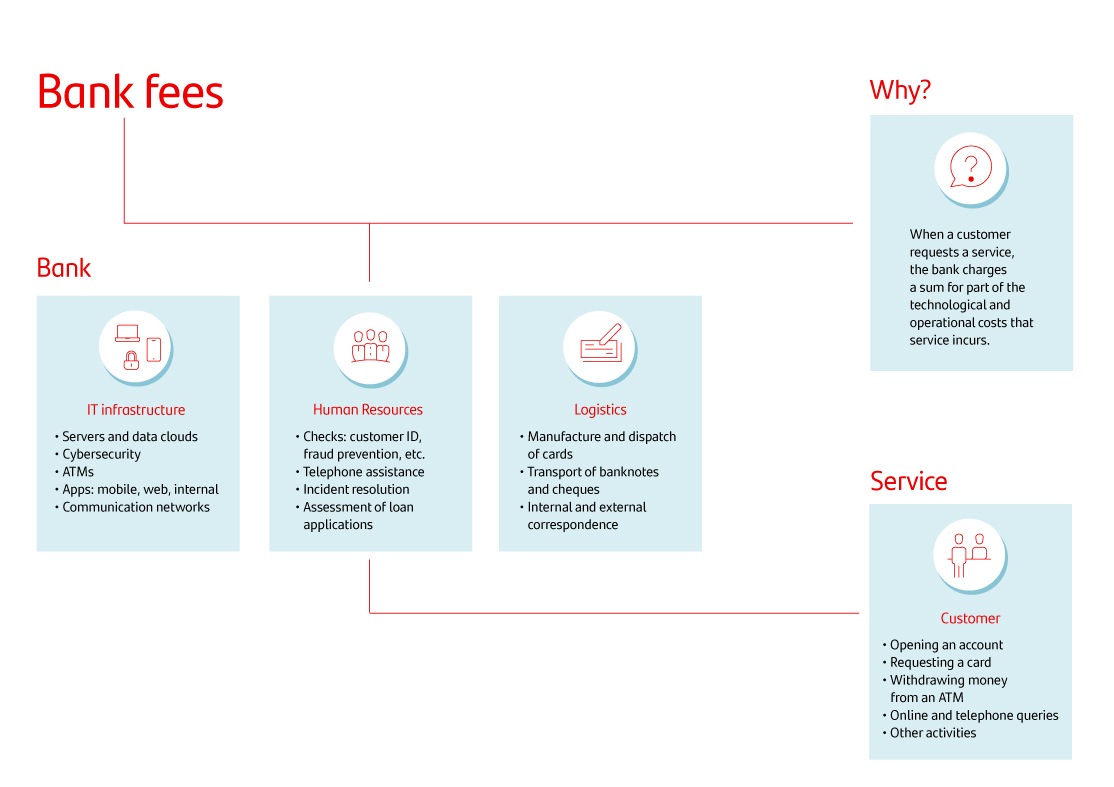

What’s a bank fee?

It’s money we pay a bank for providing or arranging services like issuing a credit card, sending a transfer or exchanging foreign currency, due to transaction expenses.

How are bank fees paid and how often?

The fees customers pay can depend on the bank, the service, terms and conditions and local legislation. Fees can be charged for a one-off service, such as an international transfer (a transaction you can learn a lot more about with these tips from Santander Consumer Spain). Transfer fees can be either fixed or a percentage to pay the bank for moving money from one country to another and converting currency. There are also flat-rate fees, in which all bank fees are charged at once.

As users of banking services and products, we should know that banks set most fees freely. National laws and authorities only restrict some fees. Rules on termination and repayment fees for consumer credit and mortgages exist in several countries and can be regulated by law. Bank fees are usually supervised by competent national authorities.

By law, financial institutions can change fees unilaterally within the terms of the product agreement. Still, they must notify customers in advance in a period that can vary by country.

Banks must also provide users with detailed fee information for each service they provide at branch offices, online and at pertinent government agencies. Users should also understand their products’ terms and conditions, which is essential to their day-to-day financial wellness.

Types of bank fees

Common fees are :

- Card maintenance fees. However, we may only start paying these fees after a special period, which is why it’s important to understand all the terms of the credit card agreement.

- Cash withdrawal fees at an ATM that does not belong to our bank. Finanzas para Mortales talks more about ATM fees here.

- Fees for transferring money to another bank or cashing a cheque.

- Overdraft fees. This amount can vary according to the bank and usually has fixed and variable values based on the amount of money overdrawn.

- Currency conversion fees (even when paying with a credit card).

Tips to avoid overcharges

To avoid paying more bank fees than necessary, you should:

- combine your accounts into one to avoid paying several maintenance fees. Check out these tips by Finanzas para Mortales.

- negotiate better account conditions with your bank if you have a high account balance.

- bank online.

- avoid withdrawing from ATMs that do not belong to your bank.

- direct debit your bills or salary, which could improve your banking conditions as a loyal customer.

- stay current and read all your bank’s communications often.

How are a bank fee and a bank expense different?

On the one hand, a bank fee is the price banks charge for the services they offer. On the other hand, a bank expense is the cost banks must pay third parties for transactions required to provide such services (e.g., delivery charges and valuation fees).