UK CAREERS | WHERE DO YOU WANT TO MAKE AN IMPACT | DATA SCIENCE & ANALYTICS

Santander Data Centre of Excellence

Careers in Santander Data Centre of Excellence

- UK Careers

- Where do you want to make an impact?

- Data Science & Analytics

Not ready to make a move but would like to hear more about our roles?

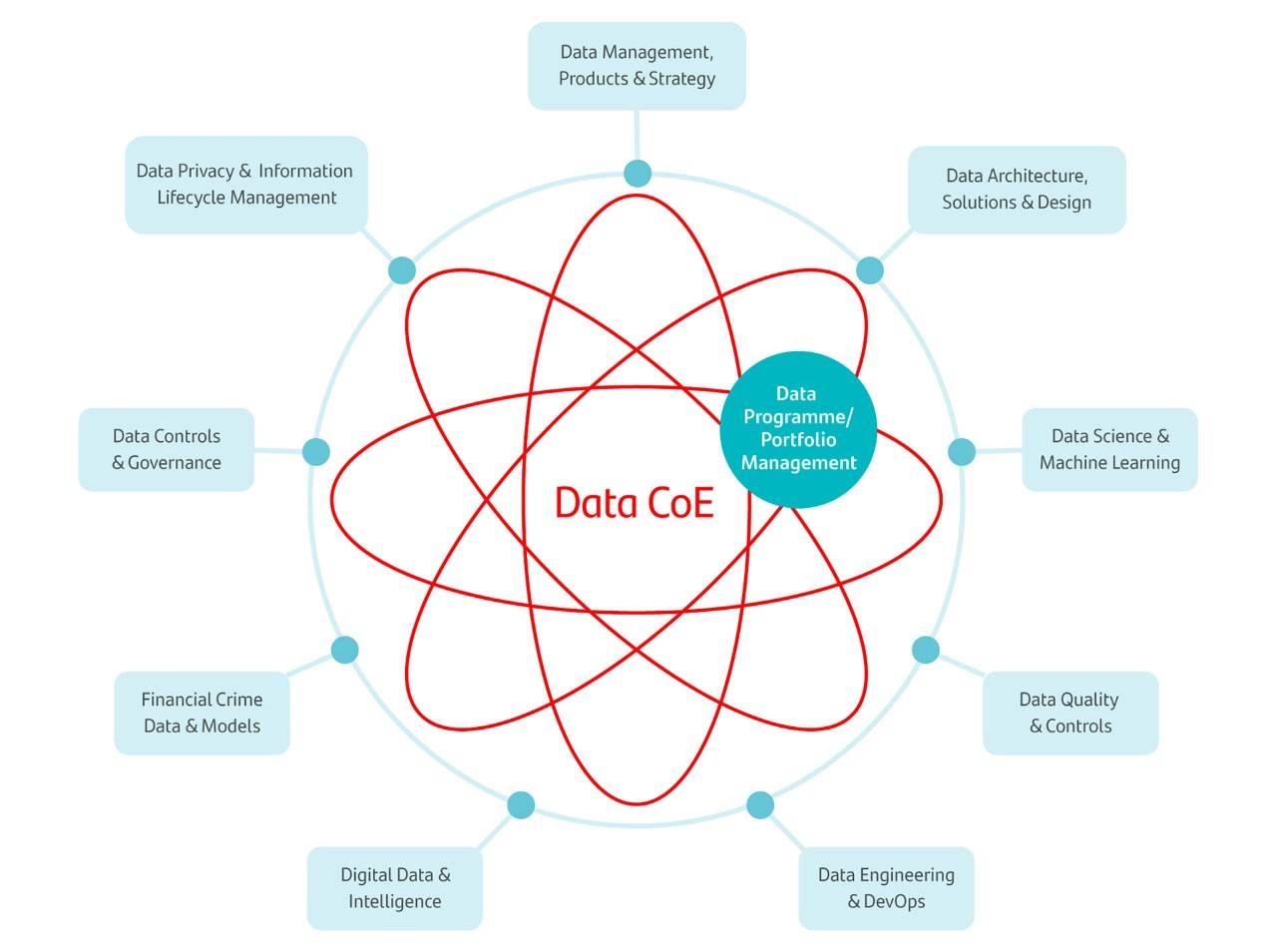

Aligned to the Bank’s Data & Analytics ambitions, Santander’s Data Centre of Excellence (CoE) consists of a variety of different subject areas, initiatives and challenges, ranging from ensuring that our data is protected and under control, to ensuring we are adhering to regulatory expectations, along with creating and developing innovative solutions to help manage our data. We believe in building a caring, collaborative, transparent and datadriven culture to help us succeed towards a better future.

Joining the Data CoE, you’ll be part of a team where anyone and everyone can grow, learn, and be part of a Bank-wide Data Transformation targeted towards making a real difference across our core ambitions:

- Derive Value from our Data – Drive customer value and revenue growth by maximizing the value of data

- Build Trust in our Data – Mitigate risks and establish controls to build complete trust with our data

- Democratize Data – Simplify existing Data architecture to provide frictionless access to data

- Digital banking with a human touch – Drive inclusive digitalisation and use technology in a way that creates value for all our customers and stakeholders

Data Management, Products & Strategy

Embedding data ownership across Santander UK, focusing on delivering pragmatic data management solutions to solve for a range of business insight, productivity, and regulatory use cases.

Data Portfolio & Programme Management

Driving change and transformation across the Data Centre of Excellence through providing portfolio level oversight, implementing reporting and governance standards & best practices, and delivering change across the strategic pillars.

Data Privacy & Information Lifecycle Management

Building bank-wide Privacy and ILM related capabilities. Providing subject matter expertise to enable the Bank to manage information from creation to destruction. Doing so in a way that helps build trust in how we handle personal data, reduces privacy risk, and encourages operational efficiencies.

Data Controls & Governance

Design, implementation, and ongoing governance of Data related controls to address the risk that our strategic objectives, important business services or regulatory obligations are negatively impacted by poor management of data.

Data Quality & Controls

A team of subject matter experts supporting data quality management, control execution at customer, account and product level, derived data control services and master data management.

Financial Crime Data & Models

Designs the optimum data model and architecture, engineers the data provision and APIs, controls the data flows, calibrates Financial Crime data models, provides MI and analytics and works with the business data owners to ensure continuous improvements to data quality.

Digital Data & Intelligence

To implement a Cloud Data Framework and Platform to enable the end-to-end transition to the cloud which will contribute to the acceleration of the digital transformation towards the bank’s strategy: Growing customer loyalty, simplifying and digitizing the business, embedding sustainability across the business and ensuring the right skills and knowledge are in place.

Data Engineering & DevOps

Responsible for the creation and maintenance of reusable data products, that facilitate the organisations use of data. The team use a number of tools and techniques to make this possible and explore future data technology.

Data Science & Machine Learning

Lead the Data Science strategy and manage and develop the Bank’s Data Science & analytics platforms.

Data Architecture, Solutions & Design

Aligning all transformation and change to the banks Data Strategy and Architecture, enabling the progression to a modern technology platform. Centred around data, technology, and ways of working, we challenge, guide and support initiatives with their choices, providing quality assurance through governance.

DO YOU WANT TO WORK WITH US?

Discover our current vacancies in Data Science & Analytics