Shareholder remuneration

In application of the current shareholder remuneration policy, the Group carried out the following against 2025 results:

- A payment of an interim cash dividend of €11.50 cents per share, paid in November 2025, equivalent to c.25% of the Group’s underlying profit in H1 2025, 15% higher than its 2024 equivalent. Including the €11.00 cent dividend per share paid in May 2025, the cash dividend per share paid during 2025 was also 15% higher than that paid in 2024.

- The first share buyback programme of €1.7 billion, carried out between 31 July 2025 and 23 December 2025.

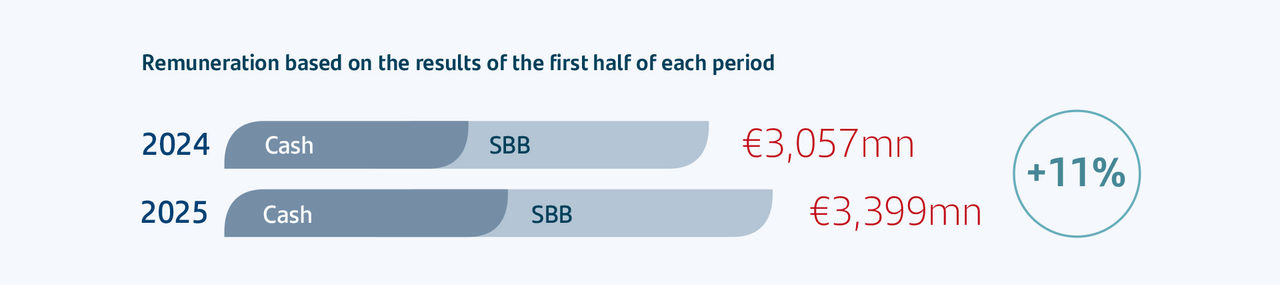

- Total shareholder remuneration charged against H1 2025 results was €3,399 million, 11% higher than the remuneration charged against H1 2024 results. The amount is approximately 50% of H1 2025 attributable profit (around 25% through cash dividend payments and around 25% through share buybacks).

- Additionally, the Board of Directors has approved on 4 February 2026 the implementation of a share buy-back programme for an approximate amount of €5,030 million, for which the Bank has already obtained the necessary regulatory authorization and is currently underway. In line with the Bank’s current shareholder remuneration policy* , €1,830 million corresponds to an amount equivalent to approximately 25% of the Group’s underlying profit for the second half of 2025. The remainder of the programme relates to an extraordinary share buy-back of €3,200 million, representing approximately 50% of the CET1 capital generated following the completion of the sale of 49% of Santander Bank Polska to Erste Group. You can find all the information about the share buyback program here.

- The board of directors is expected to submit the approval of a final cash dividend, in accordance with the current shareholder remuneration policy, at the next general shareholders’meeting. As a result, the total cash dividend per share charged against 2025 results is estimated to be approximately 15% higher than that charged against 2024 results.

*The Bank’s current shareholder remuneration policy consists of a total remuneration target of c.50% of the Group’s underlying profit, split approximately in equal parts in cash dividend payments and share buybacks.

As previously announced, Santander intends to allocate at least €10 billion to shareholders through share buybacks charged against 2025 and 2026 results and against the expected capital excess. This share buyback target includes i) buybacks that are part of the existing shareholder remuneration policy; and ii) additional buybacks following the publication of annual results to distribute year-end excesses of CET1 capital. The implementation of the shareholder remuneration policy and additional buybacks is subject to future corporate and regulatory decisions and approvals.

Further information on shareholder remuneration can be found in the following sections of this website:

- Dividends

- Share buybacks and why they’re important to shareholders

- Prices of latest reinvestments (PDF 160 Kb) (Only available in Spanish)

- The most recent and historical dividend payments are shown in the table below.

| Date | 03-11-2025 |

|---|---|

| Gross | 0.1150 |

| Net | 0.0932 |

| Class | Ordinary |

| Type | Interim |

| Exercise | 2025 |

| Dividend Yield | 2.57% |

| Ex-dividend Date | 30-10-2025 |

| Date | 03-11-2025 |

|---|---|

| Gross | 0.1150 |

| Net | 0.0932 |

| Class | Ordinary |

| Type | Interim |

| Exercise | 2025 |

| Dividend Yield | 2.57% |

| Ex-dividend Date | 30-10-2025 |