Q1’21 Earnings Presentation

Banco Santander reports Q1 attributable profit of €1,608 million

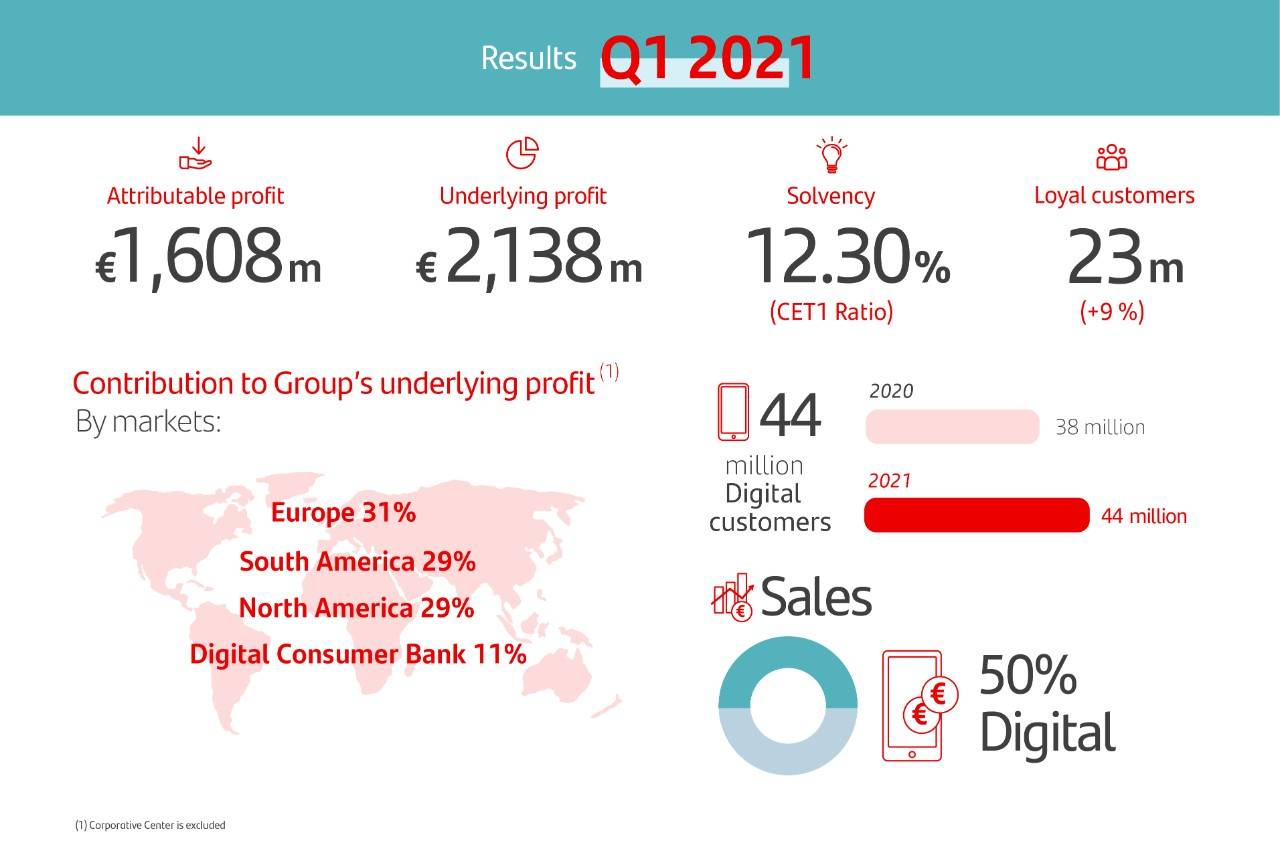

Banco Santander achieved an attributable profit of €1,608 million in the first quarter of 2021, up from €331 million in the same period last year in which it recognized an overlay provision of €1.6 billion due to the pandemic. It recorded €530 million in net charges for restructuring costs expected for the year, mainly in the UK and Portugal.

Excluding net charges, underlying attributable profit in the first quarter was €2,138 million, up 50% from the last quarter of 2020 (it had been €377 million in the same period last year). This represents the group’s highest quarterly underlying profit since the second quarter of 2010.

The bank’s strong performance was driven by good volume growth (+2% loans, +8% deposits). Businesses across the group focused on customer support, revenue growth, effective net interest income management and ongoing cost control.

The results illustrate the importance of Santander’s geographic and business diversification, with its three regions, (Europe, North America and South America), making equal contributions to underlying profit. The group saw record earnings in the US, mainly driven by a 13% increase in net operating income (+19% excluding the Puerto Rico and Bluestem portfolio disposals) and strong growth in the UK, while Santander Corporate & Investment Banking (Santander CIB) increased underlying profit by 64% to €704 million.

(Continues)

Key figures

Pictures

View and download high-resolution photos from the financial results here.