In the last 100 years both tennis and banking have evolved. New technologies have made tennis rackets lighter, umpires can now verify their calls using replay cameras; while in banking mobile payments are on the rise and we can use our fingerprint to verify transactions.

Santander is committed to innovation and offers you the tools to enjoy your digital life with confidence. Make sure you are familiar with our 5 cybersecurity tips and be prepared for every step of the journey.

Our ambassador Rafael Nadal shares how to ace your digital life, with Santander’s online security tips. Watch the video.

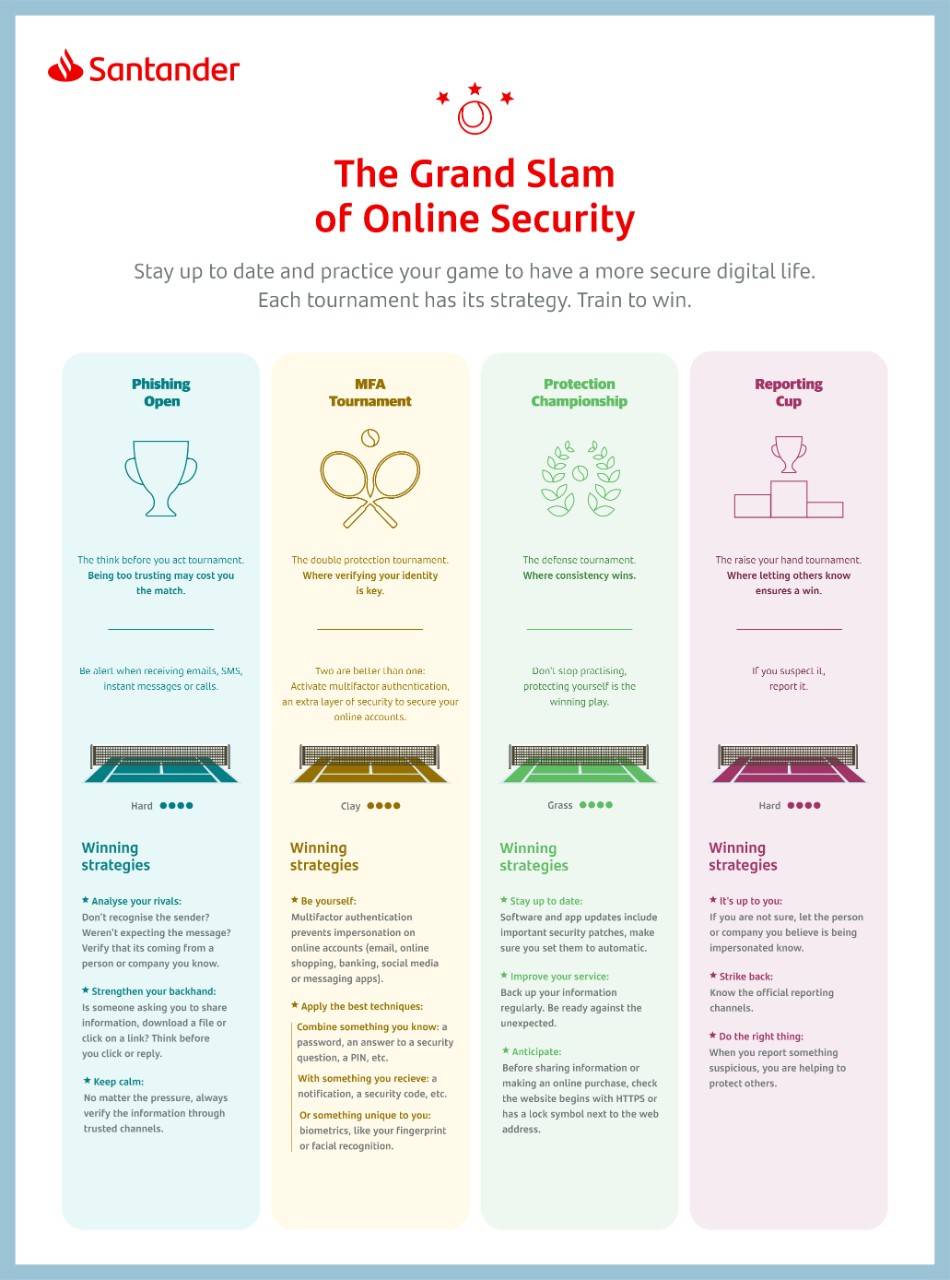

#01

Protect your information and equipment

Tennis enthusiasts upgrade their equipment regularly. Apply the same principle to your software and apps, keep them up to date and benefit from the latest security updates.

Set your Santander apps to update automatically and review the in-app security settings to help you manage cards and transactions.

#02

Be discreet online and in public

In tennis and in life, you should never give away all your plays. Enter the court knowing that there are things that only you should be aware of. In your digital life, share only with those you trust and take control of the match.

When posting online, ensure your pictures never reveal your card, bank details or passwords.

#03

Think before you click or reply

Before you serve the ball, there are always a few seconds to think of the play. Do the same in your digital life and think before you act. Don't let phishing score the point.

If you’ve been asked to login to your banking account from a link in an email or SMS, don´t click. Always access your account through Santander’s official website or app.

#04

Keep your passwords safe

The racket that will give you advantage is secured in a locker before the match starts. Protect your information by locking your accounts and devices with strong passwords and multifactor authentication (MFA).

Santander’s online banking and apps offer additional ways to authenticate such as MFA or biometrics.

#05

If you suspect it, report it

Each sport has its rules. If in your digital life you ever see anything suspicious, call out the foul shots and let the experts know.

Santander will never call you to ask for your security details or one time passcodes, neither will ask you by email or SMS. If you do receive this type of phishing, you should inform us.

Santander provides a service that allows anybody to register on a computer, mobile phone or tablet in just five simple steps

What are Bizum, Todo Pago, CoDi and Paym? Find out about the methods used around the world to send money

Santander Mexico has launched a numberless credit card for its customers that reduces the risk of fraud by 90%.

The bank customises its offer for individuals and companies with free essential services for loyal customers and offers the possibility to subscribe to special plans for a fixed monthly fee.

What are QR payments? How can I pay with my mobile? Find out everything about digital payments here

Discover why these payment methods are gaining popularity and the main advantages of using them