Investing named as the most sought-after financial skill amongst young adults, yet nearly eight in ten have never created a basic budget

New research by Santander1 reveals that 44% of young people say investing is the financial skill they would most like to learn about, despite nearly 8 in 10 (79%) having never created a basic budget.

This comes as many lack access to the right tools and guidance to take control of their finances; last year, Santander found that only one in four (26%) young adults (18-21) are leaving school having received a financial education.

The survey of 2,000 18- to 21-year-olds also looked at young people’s financial ambitions. It found financial stability — defined as feeling secure and not worrying about money—is the most common goal, with over half (51%) stating it as their top ambition for the next decade. Despite this clear desire for financial stability, 45% of young people admit they are unsure where to start to improve their financial situation, with this increasing to 49% for women.

Investing in the future

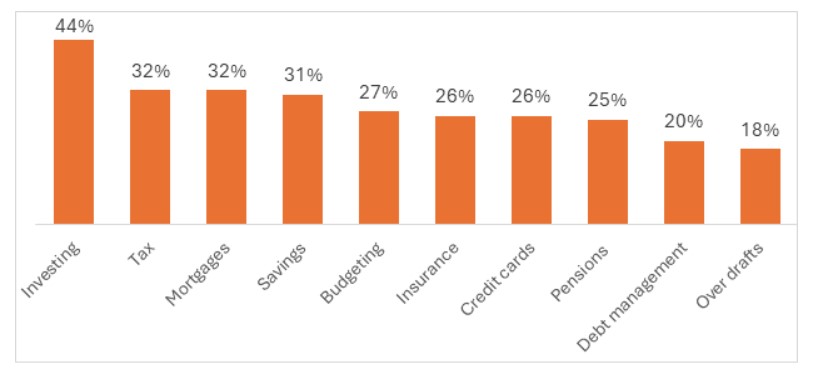

While only a quarter (24%) of young people recall learning about investing in school, the topic appears to be the most sought-after financial skill – with 44% naming it as a topic they’d like to learn more about. This is significantly higher than the next most popular topics which include tax (32%), mortgages (32%), and savings (31%), and more than double that of managing debt (20%) or overdrafts (18%).

Among the 18–21-year-olds who completed the study, 18-year-olds expressed the highest interest in learning the skills to invest - while women show a stronger preference for learning about savings and budgeting than men.

Lack of budgeting skills highlights need for greater financial education

Despite a thirst for investment knowledge, many young people lack the more fundamental skills needed to manage their money effectively. For example, budgeting, a crucial aspect of financial stability, is still not widely practiced. Only one in five (21%) young people have created a budget independently, with just 23% having saved for a rainy day, and two in five (40%) saving for a high-cost purchase.

It's interesting to see that while financial stability is the number one goal for young people, they're most keen to learn about investing. Investing is a great tool for long-term planning, but it can be risky, so we'd recommend it for those who may be standing on more solid financial ground. The desire for investment knowledge could well be associated with the large volume of investment content on social media - coupled with a lack of education on the topic from the school system, including on the associated risks. “In order to achieve financial stability, it is important we give young people the tools to nail the basics such as budgeting before moving on to more complicated methods of financial planning. A good place to start is a budgeting tool, like Santander’s online Budget Calculator which allows customers to see their incomings and outgoings in one place.

Mark Weston, Director of Financial Support at Santander UK

To access Santander’s online Budget Calculator, a simple and easy-to-use tool to help you get a clear view of your incomings and outgoings, visit our website: Budget planning | Santander UK.

Top 10 most sought-after financial skills amongst young people:

1 Research was conducted by Savanta between 22nd October and 5th November amongst 2,000 18–21-year-olds.

READ MORE NEWS FROM SANTANDER UK IN ITS PRESS ROOM