To build a more responsible bank and strengthen the customer experience we are leveraging our global and in-market scale, network and technology capabilities.

We continue supporting our customers in the energy transition through different initiatives.

in NPS in 7 of our core markets

in green finance raised and facilitated

financially included through our access and finance initiatives

Socially responsible investment (AuM)

invested in community support

support for education, employability and entrepreneurship (accumulated)

in NPS in 7 of our core markets

in green finance raised and facilitated

financially included through our access and finance initiatives

Socially responsible investment (AuM)

invested in community support

support for education, employability and entrepreneurship (accumulated)

Our culture

“The Santander Way” is our global culture. It aligns with our corporate strategy and includes our purpose, our aim, and how we do business.

Promoting inclusive and sustainable growth

We attend the needs of society by helping businesses generate jobs and grow, we encourage people’s financial inclusion, we provide access to well-rounded education and resources to improve professional skills, and we support the transition to a low-carbon economy.

Reports on sustainability

The presentations below give an overview of Santander’s sustainability strategy and corporate governance.

Group Annual Report

Santander reports annually to stakeholders (employees, customers, shareholders and broader society) on its culture, actions and commitment regarding sustainability and responsible banking.

Sustainability presentations for investors

Reporting for investors and analysts on environmental, social and governance topics.

Education, Employability, and Entrepreneurship

Access to reports on how Santander promote the progress of people and businesses through the support to education, employability, and entrepreneurship.

Other reports

Other reports that help guide our strategy.

Key policies supporting the sustainability agenda’s progress

They provide the fundamental guidelines that should guide the organisation's actions and decision-making.

General code of conduct

Brings together the ethical principles our employees must follow and is central to our compliance function.

Corporate culture policy

Establishes the guidelines and standards to ensure a consistent group culture.

Responsible Banking and Sustainability policy

Outlines our Responsible Banking and Sustainability principles, objectives and strategy with regard to our stakeholders including human rights protection.

Environmental, Social and Climate Change Risk Management policy

Details how we identify and manage risks from activities that require special attention and prohibited activities: oil and gas, energy, mining and metals, and soft commodities.

Initiatives

Santander is an active member in the main local and international initiatives and working groups that promote sustainable development.

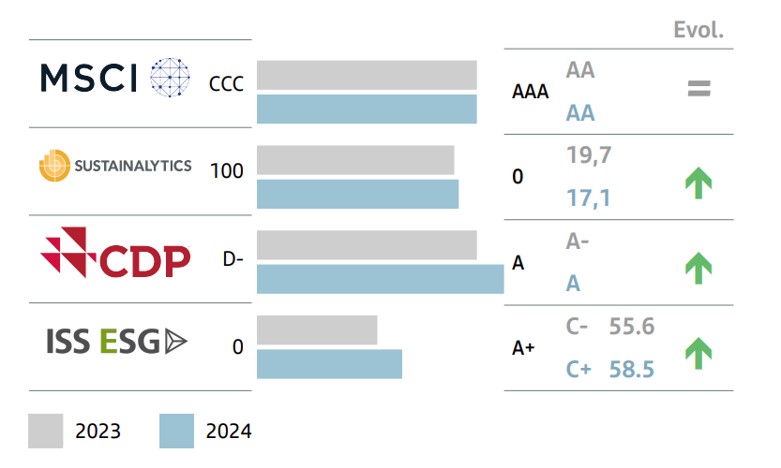

ESG ratings